- Ethereum staking rates may exceed 50%, prompting potential adjustments in its monetary policy by developers.

- DeFi protocols are projected to see a significant increase in BTC locked, nearly doubling by 2025.

On December 27, 2024, Galaxy Research (@glxyresearch) released its cryptocurrency market predictions for 2025, outlining key developments for Bitcoin (BTC), Ethereum (ETH), and the broader blockchain industry. The report emphasizes price movements, institutional adoption, and technological advancements expected to shape the crypto market.

Bitcoin’s Market Trajectory and Institutional Integration

Galaxy Research forecasts that Bitcoin will exceed $150,000 during the first half of 2025, potentially reaching $185,000 by the fourth quarter. This projection is based on increasing adoption by institutional investors, corporations, and sovereign entities.

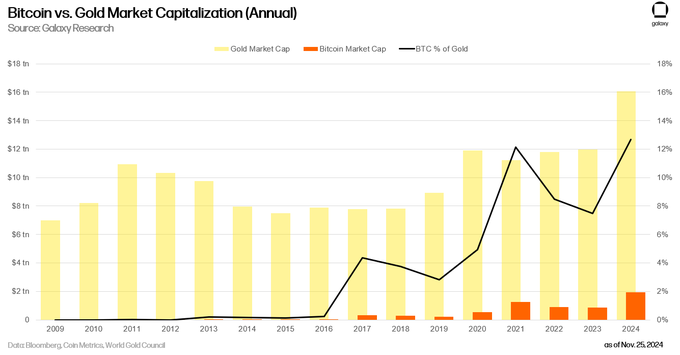

Bitcoin’s market share is expected to grow further, capturing up to 20% of gold’s market capitalization, which positions it as a robust digital asset for long-term holding.

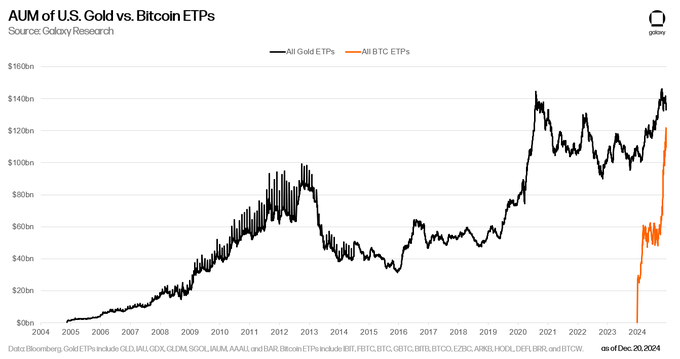

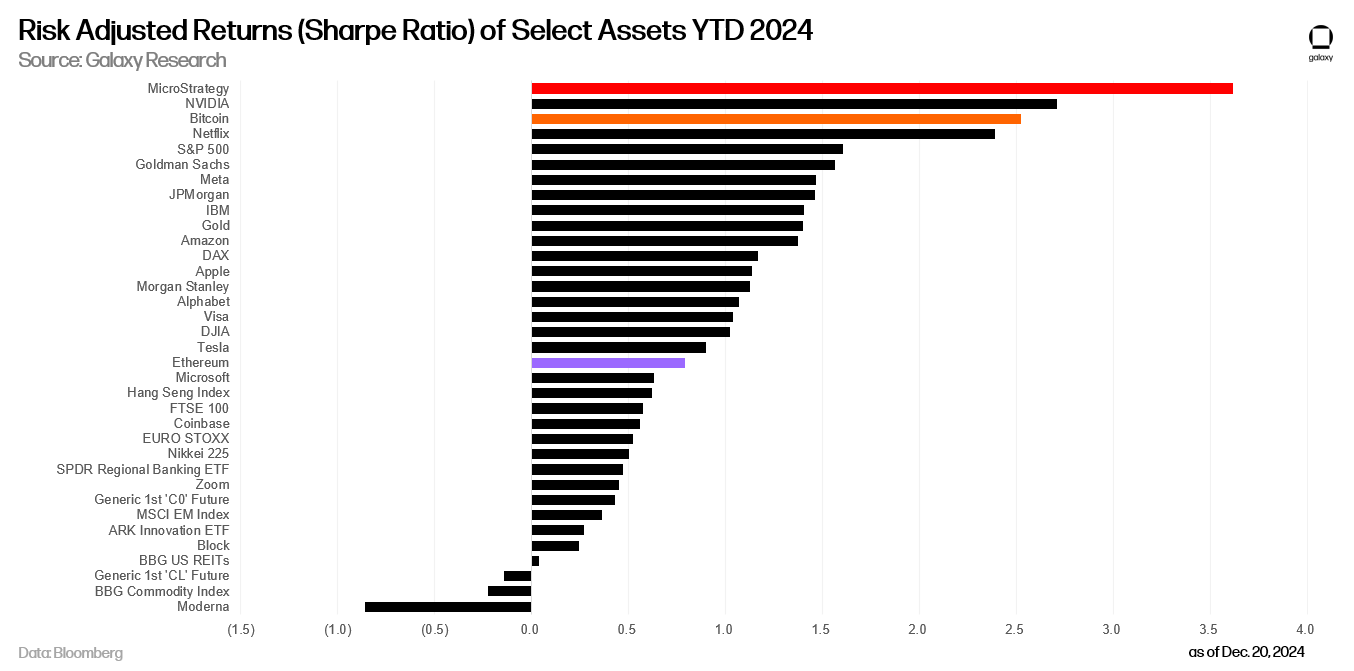

In the U.S., Bitcoin Exchange-Traded Products (ETPs) are anticipated to manage over $250 billion in assets by the end of 2025. These products, which attracted $36 billion in net inflows in 2024, are gaining momentum among hedge funds and public institutions.

Their rapid growth highlights Bitcoin’s transition from speculative investment to a widely accepted financial tool.

Bitcoin in Corporate and Government Portfolios

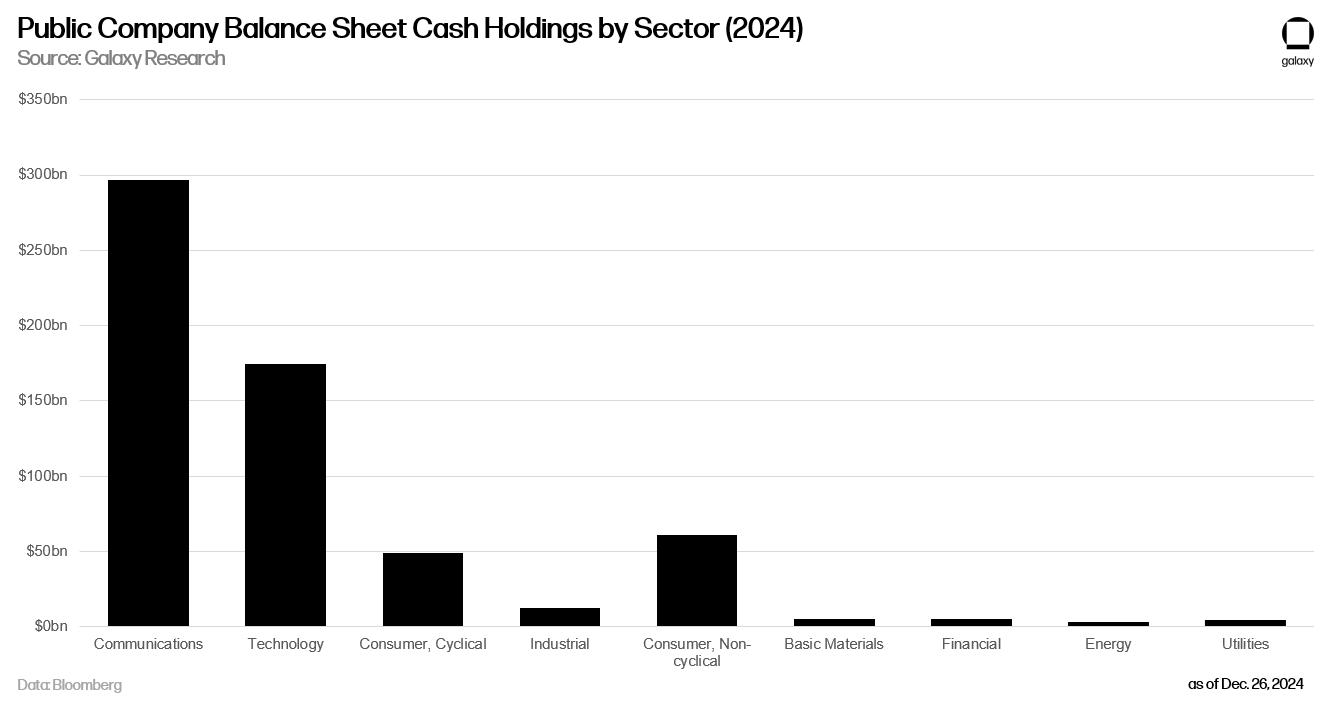

Galaxy Research predicts that at least five Nasdaq 100 companies and five sovereign nations will add Bitcoin to their financial reserves by 2025.

These allocations will serve strategic purposes such as portfolio diversification and cross-border transaction settlements.

Additionally, wealth management platforms may begin recommending Bitcoin allocations of 2% or more in client portfolios, reflecting growing confidence in its stability.

Ethereum’s Expansion and DeFi Adoption

Ethereum is expected to reach $5,500 in 2025, driven by easing regulatory pressures on decentralized finance (DeFi) and staking protocols. The proportion of staked ETH is forecasted to surpass 50%, potentially leading developers to reconsider the network’s monetary supply mechanisms.

Ethereum will remain the most utilized blockchain for experiments integrating traditional and decentralized finance.

Broader Developments in Blockchain Technology

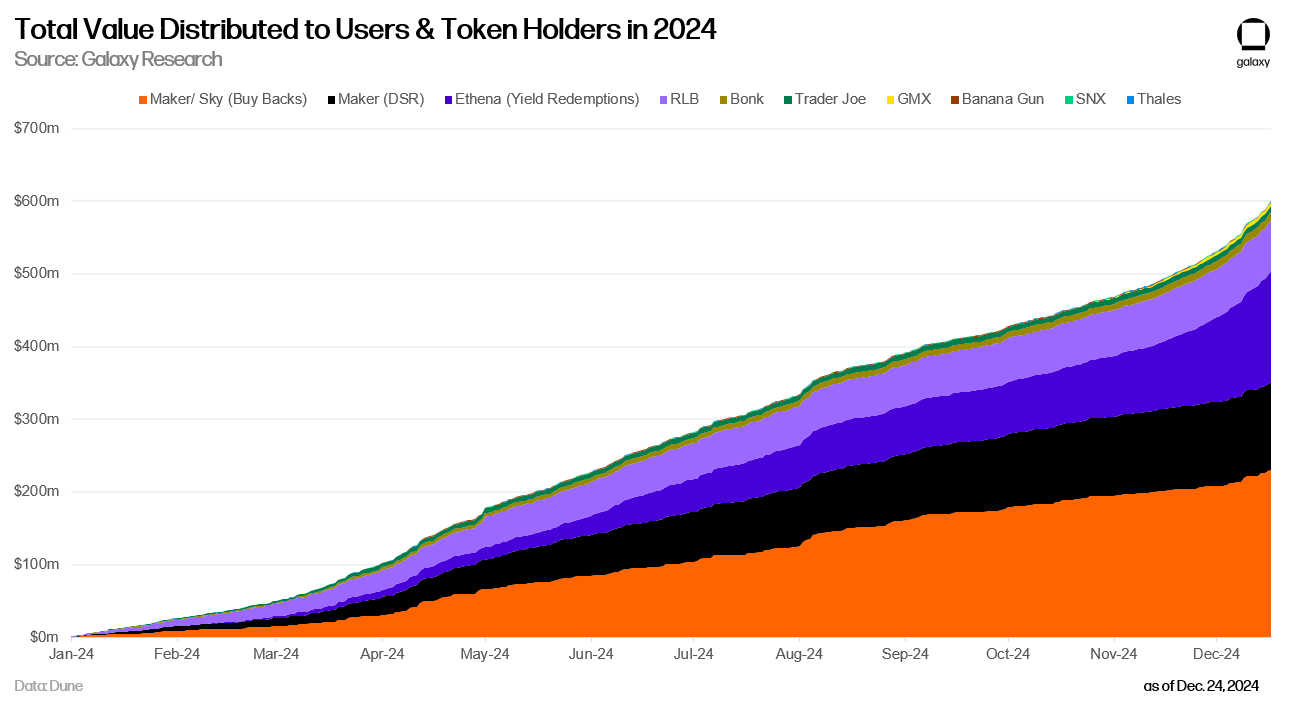

The ETH/BTC ratio is projected to dip below 0.03 before rebounding to over 0.06 by the year’s end, indicating Ethereum’s resilience in the market. Meanwhile, the value of BTC locked in DeFi protocols is set to double, showcasing a surge in decentralized applications.

Additionally, more than half of the top Bitcoin mining firms are expected to venture into high-performance computing, including artificial intelligence.

These predictions underscore the ongoing integration of cryptocurrencies into global financial systems and their growing role in institutional portfolios.

For full details about the analysis and research by Galaxy Research, you can find all the information in the following tweet:

🚨 Crypto Predictions for 2025 from @glxyresearch

Featuring… bitcoin and ether price, ETHBTC, both Dogecoin and D.O.G.E., stablecoins, defi, L2s, policy, VC, and more…

Here are the predictions we just sent to @galaxyhq clients and counterparties 👇

— Galaxy Research (@glxyresearch) December 27, 2024

Ethereum (ETH) is currently trading at $3,324.12 USD, with a slight decrease of 0.26% over the past 24 hours. The 24-hour trading range has been between $3,299.88 USD and $3,429.70 USD, indicating a relatively stable performance. Its market capitalization stands at $400,514,738,341 USD, positioning it as the second-largest cryptocurrency globally.

Key Metrics:

- Market Cap: $400.5 Billion USD.

- Trading Volume: $23.26 Billion USD in the past 24 hours, reflecting a 5.40% increase, showing increased market activity.

- Circulating Supply: 120 million ETH tokens.

Technical Insights:

Ethereum’s price behavior indicates a consolidation phase, with resistance at $3,430 USD and support around $3,300 USD. A breakout above the resistance level could signal an upward movement, especially given the increased trading volume.