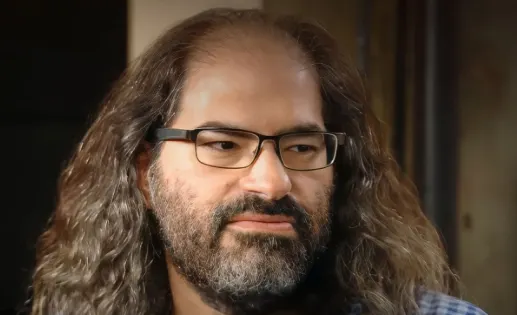

Ripple’s Chief Technology Officer, David Schwartz, has ignited speculation within the XRP community with a cryptic tweet referencing a “10x increase,” coinciding with a significant price rally for the cryptocurrency. As XRP surged nearly 13% over the weekend, discussions among enthusiasts intensified, pondering the implications of Schwartz’s message. Meanwhile, Ripple executed substantial XRP transfers, totaling 90 million tokens, further fueling curiosity about the company’s strategic moves. As XRP hovers around the critical $2.20 mark, analysts are closely monitoring its potential for recovery amid a volatile market landscape.

Ripple Chief Technology Officer (CTO) David Schwartz has stirred a buzz within the XRP community following a thought-provoking tweet. The post, which cryptically highlighted a “10x increase,” arrived shortly after XRP, the fourth-largest cryptocurrency by market capitalization, rallied nearly 13% over the weekend. The interplay between Schwartz’s tweet and recent market dynamics has fueled debates over the potential trajectory of XRP’s price.

On Saturday, Schwartz tweeted a photo of a “Pre-Mix Bubble Solution” can, which boasted of “10x times the bubbles.” The Ripple CTO humorously called attention to the tautology in the phrase, suggesting that either “10x” or “10 times” would suffice. While seemingly innocuous, the post sparked a lively discussion in the XRP community, with some speculating whether the tweet hinted at a potential 10x price increase for XRP.

Enthusiasts took to the comments, exploring the possibility of XRP reaching $10 or more in the near future. While Schwartz did not explicitly link the post to XRP’s price action, the timing of the tweet amidst XRP’s recent performance heightened the community’s curiosity.

Adding to the intrigue, Ripple made significant XRP transfers over the weekend. Blockchain tracker Whale Alert flagged two substantial transactions totaling 90 million XRP, worth approximately $200 million. The first transfer, containing 50 million XRP valued at $111.7 million, and the second, with 40 million XRP worth $89.6 million, were both sent to anonymous wallets within a single minute.

These transfers follow another weekend flurry of XRP activity, with Whale Alert identifying 182 million XRP moved in chunks of 99.9 million, 52.7 million, and 30 million XRP. The cumulative fiat value of these transfers is estimated at a staggering $411 million. The purpose behind these transactions remains unclear, sparking speculation about Ripple’s strategic intentions.

Key Price Levels for XRP: Analyst Insights

XRP’s recent market activity has drawn the attention of cryptocurrency analysts. Ali Martinez, a prominent crypto trader, highlighted $2.20 as a crucial price level for XRP. Martinez believes that the token must consolidate at this point before attempting to break through the $2.70 resistance level. Conversely, if XRP fails to maintain support at $2.20, Martinez warns that a decline to $1.96 could ensue.

As of this writing, XRP is trading at $2.26, marking a period of sideways movement following a tumultuous week. The token experienced a sharp decline of 28% last week, falling from $2.71 to $1.96 before partially recovering over the weekend.

The juxtaposition of Schwartz’s cryptic tweet, Ripple’s significant XRP transfers, and the token’s volatile price action has created a swirl of speculation among XRP investors. Some interpret the CTO’s “10x times” tweet as an optimistic hint, while others remain cautious, focusing instead on the technical analysis that outlines potential support and resistance levels.

Ripple’s large-scale movements also add to the narrative, with many wondering if the transfers signify preparations for institutional partnerships, market-making activities, or other strategic initiatives.

As XRP hovers at the critical $2.26 mark, its next moves could set the tone for the coming weeks. A successful consolidation at this level might open the door to a rally toward $2.70, while failure to hold support could spell further declines. In the meantime, the XRP community remains watchful, dissecting every tweet, transfer, and chart for clues about the token’s future.

Whether David Schwartz’s “10x times” tweet was a clever observation or a subtle hint of what’s to come, one thing is clear: XRP continues to captivate the cryptocurrency world with its unpredictable moves and vibrant community discussions.

XRP Emerges as the Most Traded Altcoin on Binance Amid Market Volatility

Meanwhile, XRP has solidified its position as a standout performer on Binance this December, emerging as the most traded alternative cryptocurrency on the platform. According to data shared by CryptoQuant analyst JA Maartunn, the Ripple-linked token has generated a remarkable $116.6 million in trading volume on Binance Futures, outpacing other altcoins even amid widespread market declines.

Despite a challenging trading environment characterized by substantial price drops for Bitcoin and other altcoins, XRP has managed to maintain a strong presence in the market. Earlier today, the cryptocurrency fell to an intraday low of $2.13, marking a decline of more than 4%, according to CoinGecko. This drop further extends XRP’s descent, as the token is now down over 25% from its multi-year high of $2.85, achieved on Dec. 3.

The earlier rally was largely driven by activity from Coinbase whales, who significantly boosted the token’s trading momentum. However, in the wake of this surge, XRP has faced downward pressure, underperforming relative to other major cryptocurrencies.

XRP’s open interest stands at around $1.9 billion, showcasing the token’s robust activity in the derivatives market. Binance accounts for nearly half of this open interest, with $812 million, while Bitget and OKX hold the second and third spots. Recently, XRP generated an impressive $9.6 billion in trading volume, positioning it as the fifth most-traded cryptocurrency globally. It trailed only Bitcoin, Tether’s USDT, Ethereum, and USDC in terms of trading activity.

Notably, during the peak of its December rally, XRP briefly flipped Bitcoin in trading volume on South Korean exchanges, underscoring its immense popularity in the region. This surge in activity was accompanied by a record high in Google search volume for XRP, although the heightened interest proved to be short-lived.

Analysts Remain Optimistic About XRP’s Recovery

JA Maartunn, the CryptoQuant analyst who highlighted XRP’s trading dominance, expressed confidence in the token’s ability to recover “relatively quickly” from its current downturn. Despite recent losses, XRP’s strong presence in the futures market and its position as a leading altcoin suggest a resilient investor base.

The token’s recovery may also be supported by broader market trends and potential bullish catalysts in the coming years. In 2025, for example, XRP could benefit from the growing buzz around cryptocurrency ETFs in the United States. These developments are expected to bolster institutional adoption and liquidity for digital assets, potentially creating tailwinds for XRP.

As 2024 draws to a close, XRP’s performance underscores both its potential and the challenges it faces in a highly volatile market. The token’s ability to dominate Binance’s trading volume reflects strong investor interest, but its recent price declines highlight the broader market’s fragility.

Moving forward, XRP’s trajectory will likely depend on several factors, including market sentiment, regulatory developments, and its ability to capitalize on growing institutional interest in cryptocurrency. For now, the Ripple-linked token remains a focal point for traders and analysts alike, as it continues to navigate the highs and lows of the digital asset market.