CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

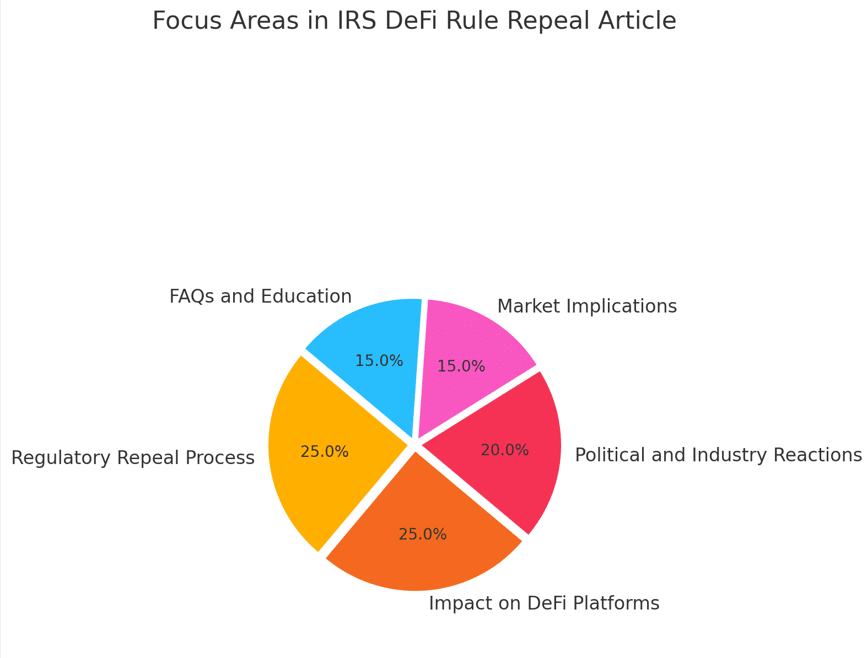

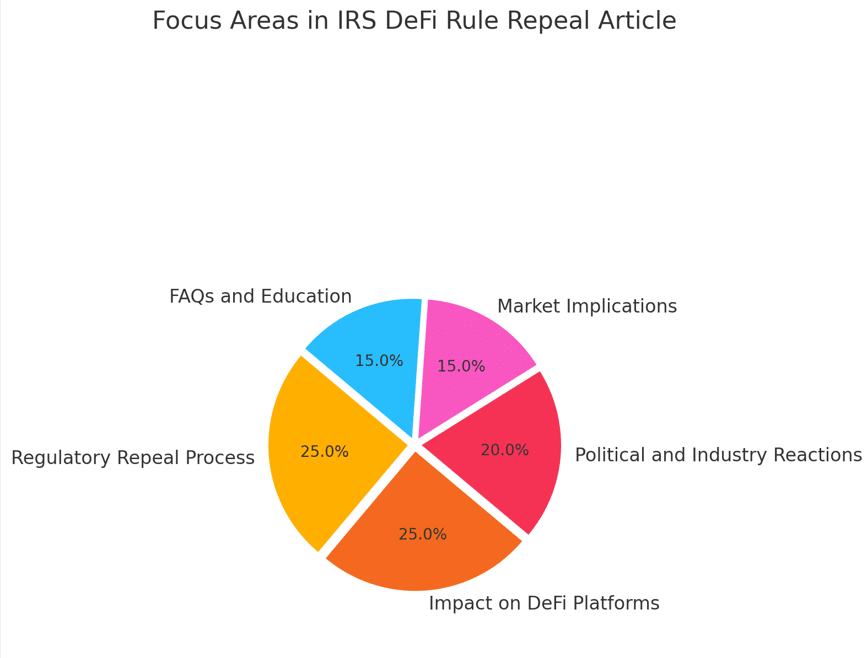

As per the source, the U.S. Congress is poised to repeal an Internal Revenue Service (IRS) rule that broadened the definition of “broker” to capture decentralized finance (DeFi) platforms. Finalized in December 2024, this rule placed onerous reporting requirements on DeFi platforms, requiring them to gather and report extensive data on user transactions to the IRS. Such requirements were impractical for DeFi, which for the most part do not have centralized authority or the capabilities to obtain the necessary information, critics said.

Legislative Journey Toward Repeal

The legislative process to overturn this rule has seen bipartisan support. On March 4, 2025, the Senate passed a resolution to repeal the IRS rule with a decisive 70-27 vote. Subsequently, the House of Representatives approved a similar resolution on March 11, 2025, with a 292-132 vote, including support from 76 Democrats. Due to procedural requirements, the Senate is scheduled to hold a final vote on March 27, 2025, to confirm the repeal. If approved, the resolution could be presented to President Donald Trump for signing as early as March 28, 2025.

Implications for the DeFi Sector

The IRS rule was designed to expand tax compliance by increasing the number of entities that needed to report digital asset transactions. However, industry stakeholders argued that imposing such requirements on DeFi platforms was impracticable and would suffocate innovation in the crypto industry. Due to their decentralized nature, DeFi platforms allow for peer-to-peer transactions without intermediaries, making it difficult to gather user data like traditional financial institutions. This rule’s repeal is described as a victory for DeFi, a sector that had expressed concerns over a possible regulatory burden impeding its growth.

Political Perspectives and Industry Reactions

The move to repeal the IRS rule has garnered support from various political figures and industry representatives. Senator Ted Cruz (R-TX), a leading advocate for the repeal, stated,

“This rule would have been devastating to the industry.” Similarly, Representative Mike Carey (R-OH) emphasized the importance of fostering innovation, noting that the rule “would stifle American innovation and raise privacy concerns.”

Industry leaders have also expressed relief and optimism. Kristin Smith, CEO of the Blockchain Association, remarked that the Senate’s vote is “a hopeful sign” and “bodes well for the efforts to design and pass stablecoin and market structure legislation.”

Conclusion

This expected reversal of the IRS broker rule is a landmark moment for the DeFi industry and the cryptocurrency ecosystem at large. Along with going towards more incremental, bipartisan reforms, eliminating burdensome reporting requirements shows that Congress is committed to innovation and ensuring that the U.S. retains its position as the leader in the digital asset arena. Organization International (ISO) marketers play a crucial role in balancing regulation with technology advancement as the legislative process ends.

FAQs

What was the IRS broker rule targeting DeFi platforms?

The IRS rule, which was finalized in December 2024, broadened the definition of “broker” to encompass decentralized finance (DeFi) platforms, mandating them to gather and relay comprehensive user transaction information to the IRS.

Why was the IRS rule problematic for DeFi platforms?

DeFi platforms function in a way that exists without centralized oversight, making gathering the information that the IRS rule requires difficult. Critics said the rule was unrealistic and might stifle innovation in the crypto industry.

What did Congress do to repeal the IRS rule?

The Senate approved a resolution to repeal the rule on March 4, 2025 and the House followed suit on March 11, 2025. The resolution could then be sent to President Trump for signature, following a final Senate vote on March 27, 2025.

What are the implications of repealing the IRS rule for the DeFi industry?

By repealing the rule, DeFi platforms will no longer be required to collect and report detailed user information, thus, the market will be able to thrive innovation.

Glossary

Decentralized Finance (DeFi): A sector of the cryptocurrency industry that offers financial services through decentralized networks and smart contracts, eliminating the need for traditional intermediaries.

Broker: An individual or entity that facilitates transactions between buyers and sellers, traditionally required to report such transactions to regulatory authorities.

Congressional Review Act (CRA): A U.S. congress law that allows Congress to review and potentially repeal federal regulations issued by government agencies.

Form 1099-DA: A tax form introduced for reporting digital asset transactions to the IRS.

Smart Contracts: Self-executing contracts with the terms directly written into code, enabling automated and trustless transactions on blockchain networks.