CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

On the monthly timeframe, Dogecoin is developing recurring unite patterns near past cycles’ maximum values.

Price movements during the previous 2017 breakout followed a matching pattern as it formed rounded bases before it surpassed resistance levels.

The same pattern has formed in present times as price created multiple rounded bottoms and a resistance rejection.

An explosion could break through resistance levels in line with its 2017 historical structure.

During the previous breakout phase, DOGE saw both a period of consolidation and quick price growth.

Price discovery could begin when confirmation occurs for a breakout above the red resistance line through which it could reach previous highs.

The pattern indicated that Dogecoin could likely see extended sideways movement or face resistance unless past events recreate similar conditions.

The resistance area stands as a powerful barrier that may force a new round of support testing followed by another effort to break out.

The pattern indicated accumulation behavior just before resistance became unreachable which may prove the invalidation of the breakout prediction.

The market will confirm the rally when trading breaks decisively with strong momentum but will continue in extended sideways patterns in case of failure.

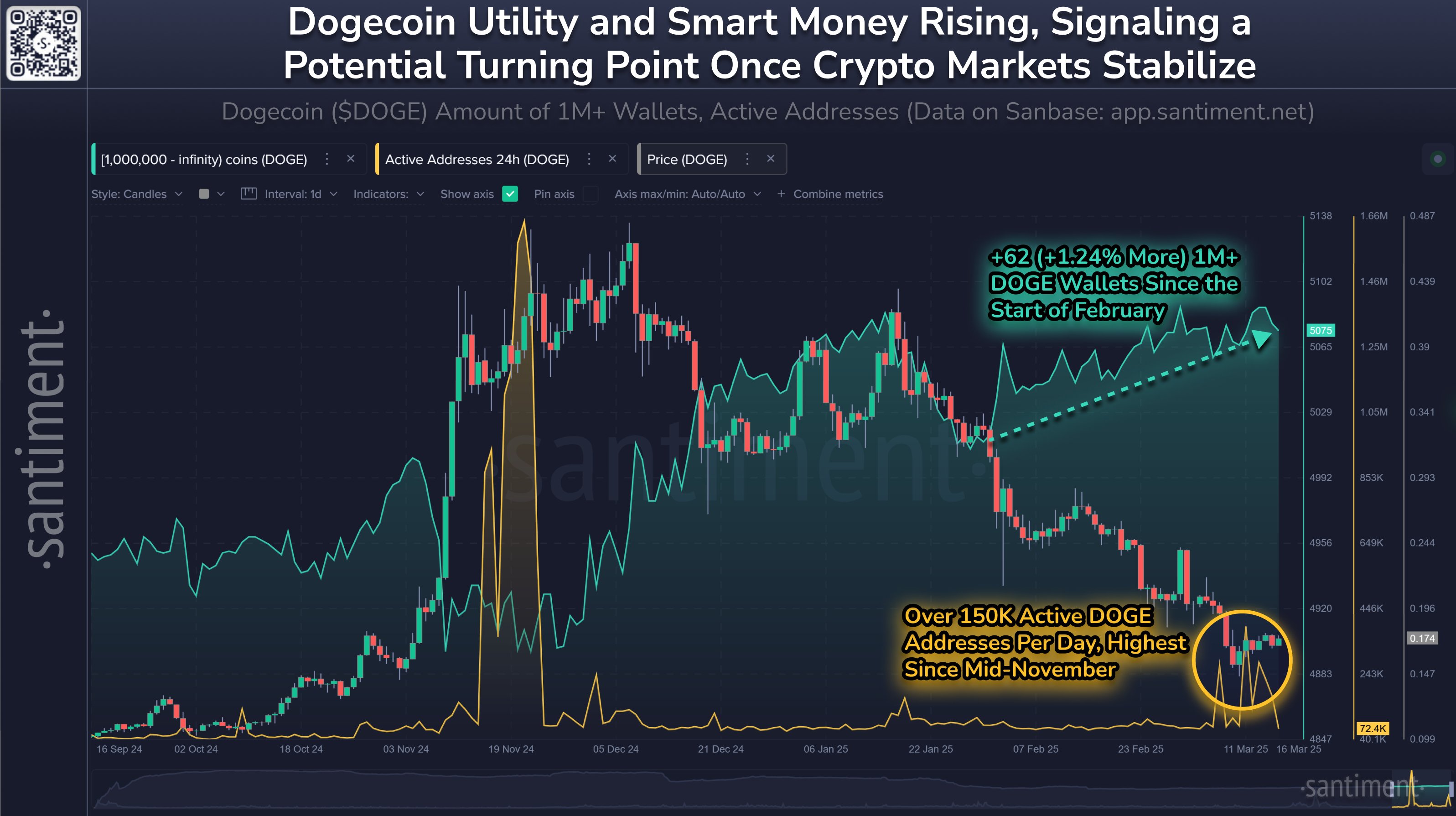

DOGE’s On-Chain Activity Thriving Amid Dropping Prices

Profit losses from Dogecoin exceeded substantial numbers following two months of cryptocurrency market depreciation. However, DOGE saw rising rates of development.

Recent data indicated that after early February, Dogecoin wallets with tokens exceeding 1 million in their balances rose.

This rise since the beginning of February represented about 1.24%. The large financial institutions also showed dual interest in Dogecoin as they continued to increase their holdings.

Since mid-November, active addresses per day also achieved the biggest mark in four months at 150,000 daily addresses. This happened against the backdrop of declining prices.

High-level activity continues to rise from the increased operational status of the network.

The price of Dogecoin peaked in late 2024 before starting the decline that extended across the ending period of analysis.

A slight uptrend in recent times indicated that stability conditions might be stabilizing.

A fundamental change could become apparent as the crypto markets build stability in their operations.

The potential price increase could happen since there is a significant surge in smart money ownership and utility signal intensification.

Dogecoin Market Sentiment

Lastly, sentiment analysis of Dogecoin appeared in that retail investors pointed towards negative feelings about the meme coin as the crowd sentiment meter read -0.66.

This was bearish from the Crowd as Market Prophit noted on X, formerly Twitter. Investors with authority measured as bullish with a value of 0.33.

The difference in readings indicated difference in perspectives between these investor groups.

Retail investors maintain a negative outlook due to the decline in Dogecoin prices. These investors tend to follow the current market trends, unlike ‘Smart Money,’ as these investors tend to take advantage of discounted prices.

The sophisticated investors detect value opportunities in the market because they foresee upcoming recovery patterns. These readings suggest an imminent shift for Dogecoin.