CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- XRP tests $2.30-$2.35 support; breakout above $2.60 resistance eyes $3.20. Neutral RSI/MACD suggests consolidation precedes next directional move.

- SEC case closure boosts institutional adoption, but short-term price hinges on FOMC decisions and BTC correlation (-0.32).

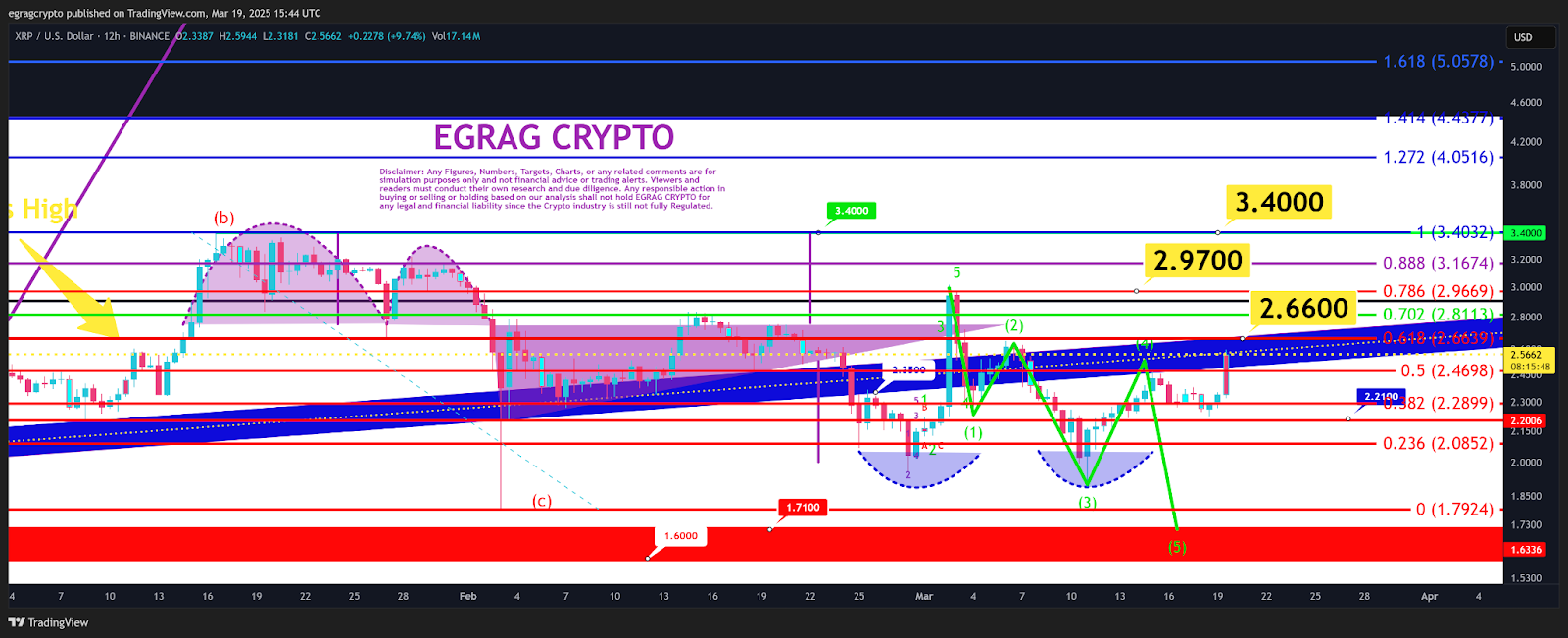

Crypto analyst EGRAG CRYPTO has reignited debate over XRP’s price trajectory, outlining two potential scenarios: a bullish reversal via a “Double Bottom” pattern or a bearish continuation into a “Wave 5” decline. As of March 19, 2025, XRP trades at $2.3672, down 0.58% in 24 hours but up 269.5% year-over-year.

EGRAG’s analysis, first shared on March 13, identifies $2.65–$2.70 as a critical resistance zone. A daily close above $2.66 would invalidate the bearish Wave 5 scenario, which targets $1.71–$1.60.

Conversely, a confirmed Double Bottom requires XRP to breach $2.97, with $3.40 acting as a decisive bullish trigger. Achieving this could propel prices toward $5–$8, aligning with forecasts from analysts like Dark Defender.

#XRP – Double Bottom or Wave 5 Downward? ?(Update)

As the Aussies like to call it, the “Double Boob” chart!

If #XRP fails to close above the $2.65-$2.70 range, it won’t negate wave 4 and will likely lead us down to the 5th wave.

BUT #EGRAGCRYPTO , the #SEC dropping the… https://t.co/WDA5TeqZJU pic.twitter.com/uOKaZuW2hX

— EGRAG CRYPTO (@egragcrypto) March 19, 2025

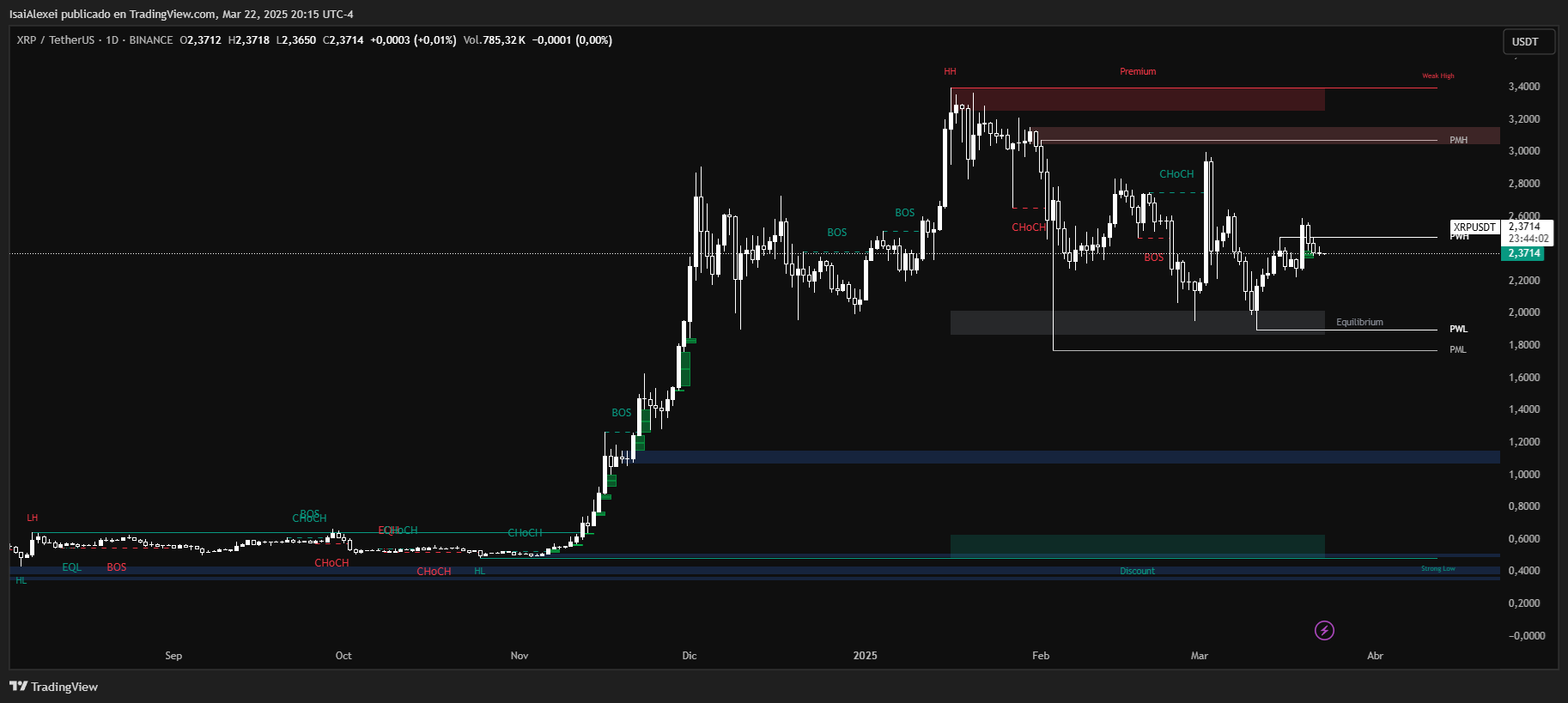

The SEC’s recent decision to drop its case against Ripple removes a longstanding legal overhang, bolstering XRP’s adoption prospects. However, short-term price action remains tethered to technical factors. EGRAG stresses reliance on “math, numbers, and charts” over speculative hype, urging traders to monitor key levels.

Technical Overview

- Short-Term (1–2 weeks): XRP tests support at $2.30–$2.35. A hold here could spark a rebound toward resistance at $2.45–$2.60. Failure risks a drop to $2.10–$2.00.

- Mid-Term (1–3 months): A breakout above $2.60 may fuel a rally to $3.00–$3.20. Sustained bullish momentum could challenge January’s peak of $3.40.

- Long-Term (6–12 months): With legal clarity and institutional interest, analysts project targets of $4.00–$5.00, contingent on broader crypto market trends.

Community reactions highlight mixed sentiment. Some traders, like @WilliamRoutled9, endorse EGRAG’s bullish targets, while others, including @Dig_Asset_Tour, caution that macroeconomic factors like Federal Reserve policy could sway prices.

XRP’s 302.98% six-month gain underscores its long-term strength, but volatility persists. The asset’s ability to convert technical signals into sustained momentum will depend on market participation and adoption milestones. For now, the $2.30–$2.70 range remains a battleground for bulls and bears.

EGRAG’s framework offers a roadmap: breach $2.70 to fuel optimism, or falter and risk revisiting lower supports. With XRP’s macro targets intact, patience and discipline may determine investor outcomes in this high-stakes technical duel.