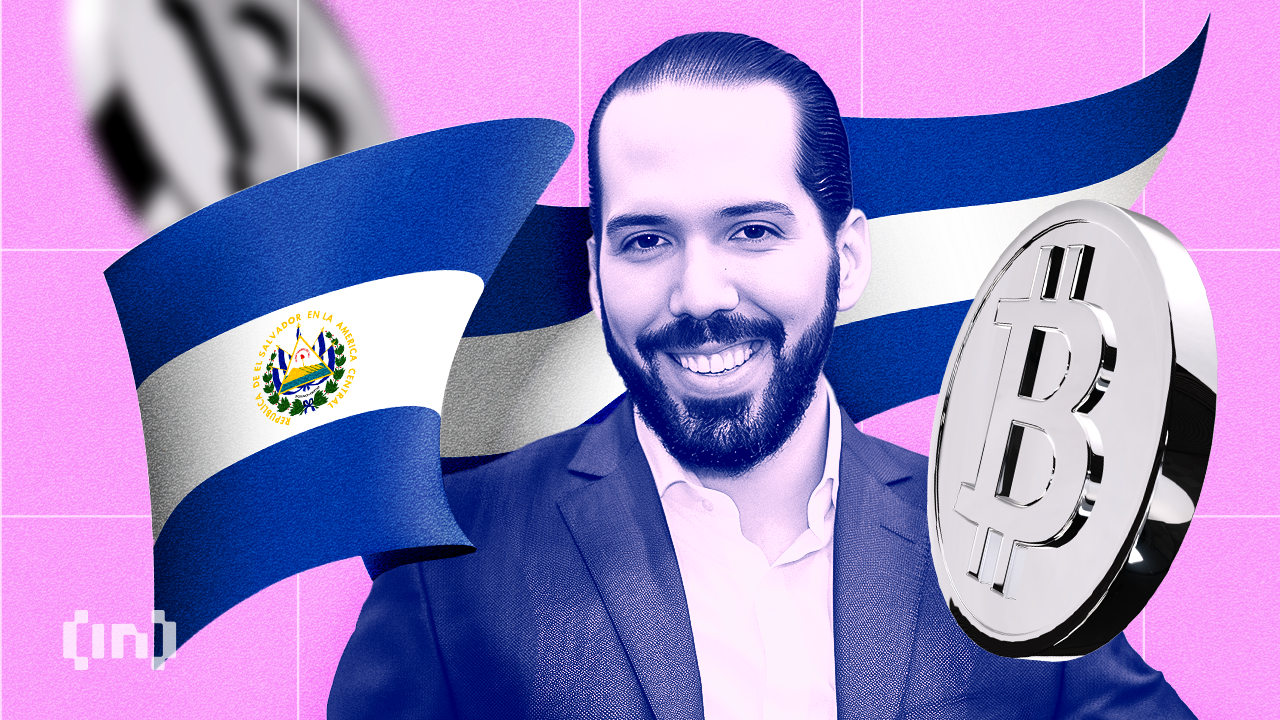

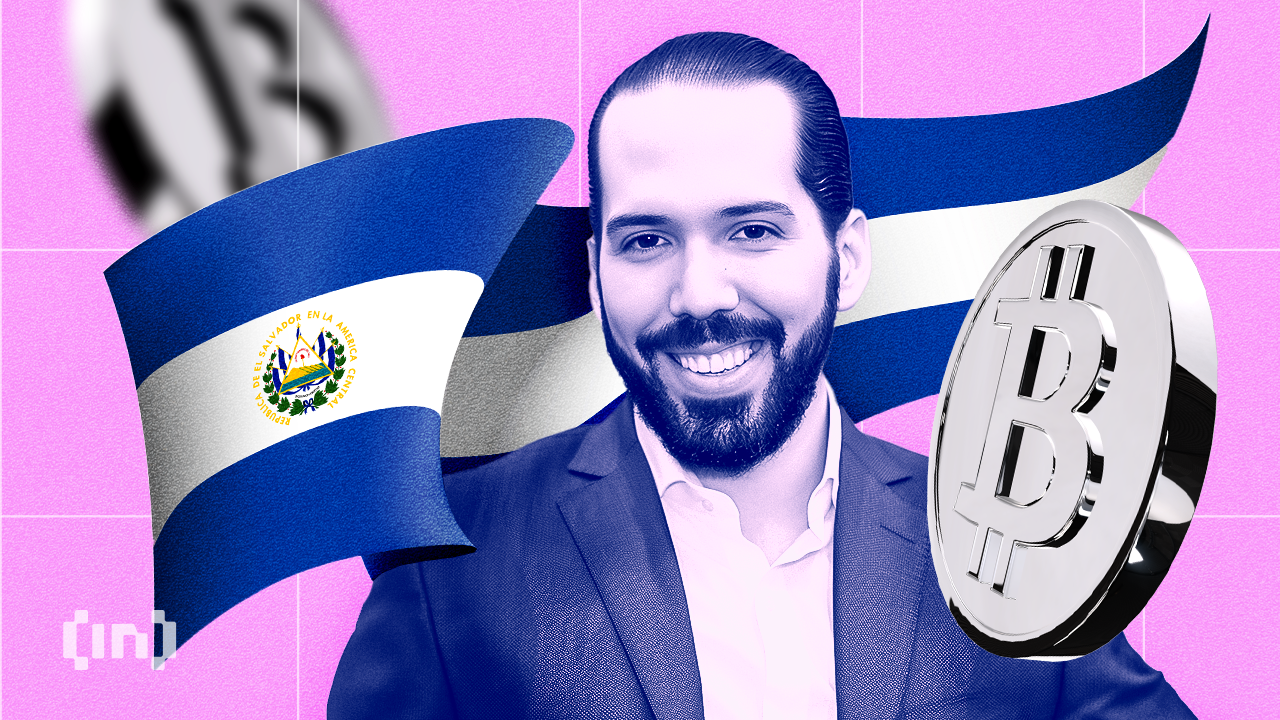

El Salvador has reached a staff-level agreement with the International Monetary Fund (IMF) for a $1.4 billion Extended Fund Facility (EFF) arrangement.

The 40-month deal aims to address the country’s fiscal challenges while supporting economic reforms and long-term growth.

El Salvador’s IMF Deal Includes Bitcoin, Tax, and Fiscal Reforms

As part of the agreement, El Salvador will amend its Bitcoin Law to make Bitcoin acceptance voluntary rather than mandatory for merchants. Taxes will be payable exclusively in US dollars, and the government plans to reduce its involvement with the state wallet, Chivo.

“The IMF basically went from, “remove the Bitcoin Law or else,” to “make the use of your already optional currency officially optional and wind down your app that nobody likes anyway.” El Salvador made the IMF surrender to its Bitcoin Law,” commented one user.

These adjustments reflect efforts to address IMF concerns about Bitcoin’s volatility and risks.

The country also committed to significant fiscal reforms. It plans to reduce the fiscal deficit by 3.5% points of GDP over three years through spending cuts and tax increases. Additionally, El Salvador aims to increase foreign reserves from $11 billion to $15 billion, ensuring greater financial stability.

The IMF acknowledged the country’s steady economic growth, driven by strong remittances and a boost in tourism. The agreement seeks to enhance public finances, promote sustainable development, and maintain financial stability.

“Bitcoin use in El Salvador was always voluntary and its usage has never been higher and continues to grow. The IMF’s point is dead on arrival. Chivo is one of dozens of wallets used in El Salvador. Its presence or non-presence is meaningless. Again, pay taxes in USD? Yea, whatever dude. Saving rates in Bitcoin and using Bitcoin as collateral to buy property is exploding higher in ES. El Salvador’s success is due to Bitcoin, not the failed policies of the IMF,” added Max Keiser.

In securing this arrangement, El Salvador law opens the door to additional loans from other international financial institutions, potentially increasing total financing to over $3.5 billion.

This deal concludes four years of negotiations with the IMF, during which Bitcoin’s role in the economy was a key concern. The IMF’s Executive Board is expected to review and approve the agreement in the coming weeks. This development represents a critical step for El Salvador as it balances economic modernization with financial stability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.