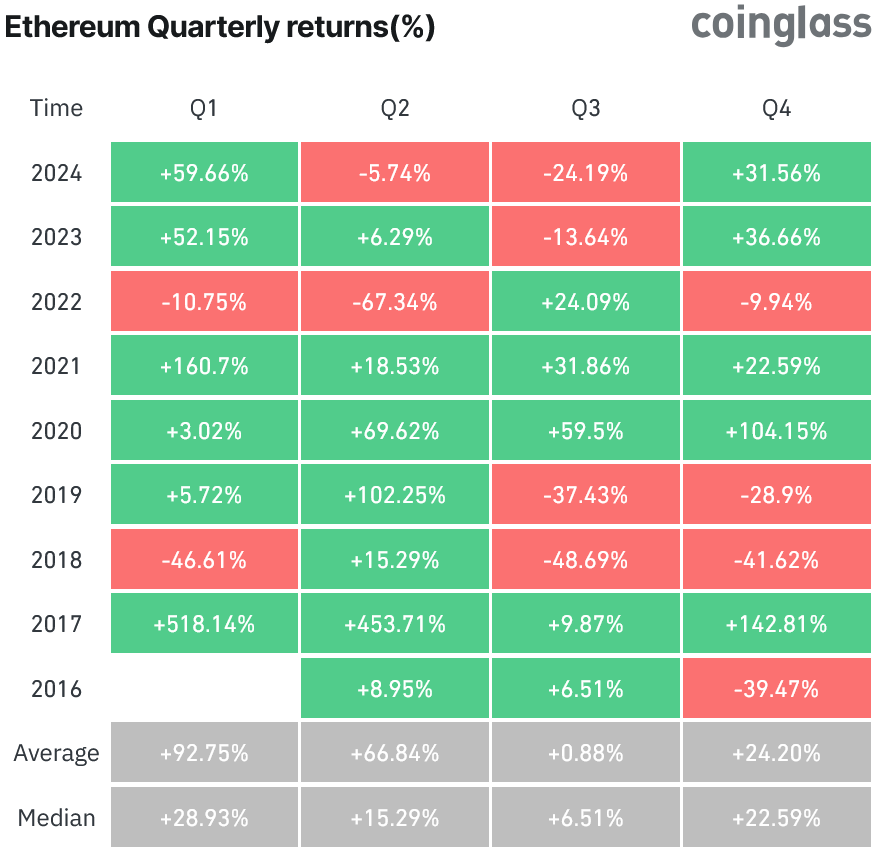

- Ether has historically surged in Q1s after U.S. elections and Bitcoin halvings, with strong performances in 2017 and 2021.

- Ethereum ETFs have attracted significant inflows, with predictions of over $50 billion in inflows by 2025.

- Economic challenges and reduced liquidity may hinder Ether’s growth and prevent it from reaching a new all-time high in 2025.

Ether (ETH) may steal the show in a possible Q1 2025 market rally, but analysts warn that unfavorable economic conditions may dampen the trend.

Ether’s Potential for a Strong Q1 2025 Rally

Traditionally, the quarters that followed U.S. elections and Bitcoin halving cycles were great for Ether. CoinGlass statistics have underlined Q1 2017 and Q1 2021 as remarkable times; Ether increased 518% and 161% correspondingly. Those are also far greater returns than the corresponding periods of 11.9% and 103.2% registered for Bitcoin.

A significant upside for Ether may come from spot Ethereum ETFs, which have been drawing much attention lately. According to Farside Investors, over $2.5 billion in inflows were recorded across 22 of the past 24 trading days.Some more optimistic ETH bulls even think these ETFs might witness more than $50 billion in inflows by 2025.

CK, Chief Investment Officer at ZX Squared Capital, believes that the incoming U.S. administration of 2025 will implement supportive policies for crypto, creating a boost in demand in digital assets. “We expect inflows to increase significantly with supportive regulations,” Zheng explained.

Economic Challenges Could Hold Back Ether’s Growth in 2025

Though many are optimistic, not everybody is. Markus Thielen, founder of 10x Research, has this to say about Ether 2025: Tightened economic conditions will mean liquidation and no breaking to a new all-time high for Ether.

“We see it more conservative this year given that liquidity is much less compared to previous cycles,” he said.

The crypto market has seen its headwinds, as the global market cap has plunged by 12.1% to $3.41 trillion.

This comes at the back of a decreased number of interest rate cuts the U.S. Federal Reserve sees for 2025, which signals a less friendly environment for riskier investments like crypto.

While Bitcoin might touch $160,000 in a best-case scenario, it is likely to stabilize around $125,000. Bitcoin trades at $93,492, and Ether is priced at $3,997, still 30% below its November 2021 all-time high of $4,878.