CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Ethereum’s native token, ETH, continues to face intense selling pressure against Bitcoin, repeatedly entering oversold conditions.

Despite multiple attempts to stabilize, ETH/BTC remains locked in a bearish trend, with no apparent signs of recovery.

The market structure indicates further downside risks, raising concerns about Ethereum’s trajectory in the coming months.

Ethereum Struggles with Persistent Bearish Momentum

Over the past months, ETH spent long periods in the oversold zone, yet it could not set a clear market bottom point.

The price rally requires that the three-day RSI indicator remain beneath 30. Analysis reveals that every underselling situation brought new market price drops, which prevented price growth from becoming permanent.

ETH/BTC experienced multiple successive breakdowns starting from mid-2024 that caused price drops reaching 13%, then 21%, followed by 25%, and finally achieving 19.5% losses.

Continuous trader selling causes the pair to descend further because traders seize each available selling chance.

The bearish market outlook has strengthened due to the descending 50-day and 200-day Exponential Moving Average price levels.

According to market analyst @CarpeNoctom, the current ETH/BTC performance remains negatively inclined since no bullish divergence patterns have emerged.

When the price shows bullish divergence, it implies market reversion because it makes successive lower low points, but the RSI shows rising lows.

The dominant bearish trend shows no indication through ETH/BTC because the pattern has not been confirmed.

Spot ETFs and Onchain Data Weaken Market Confidence

Ethereum’s bearish trend aligns with declining inflows into US-based spot ETH exchange-traded funds (ETFs).

When March 2023 arrived, spot ETH exchange-traded funds gathered $2.54 billion in funds, but investors sent less than 9.8% of this amount the following month.

The overall net cash flow for Bitcoin ETFs decreased by 2.35% during this period up to $35.74 billion.

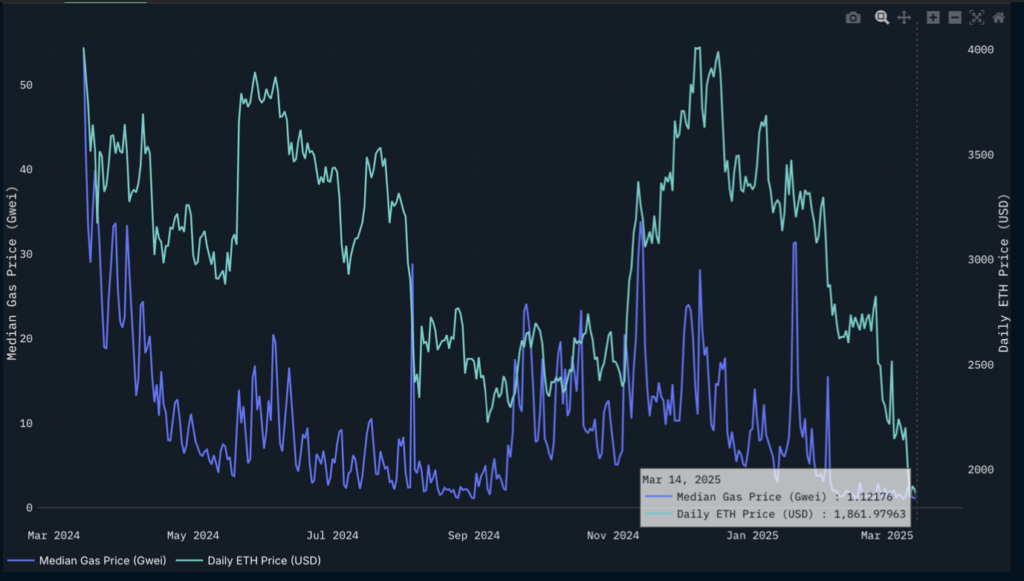

Ethereum’s onchain data also indicates diminishing network activity as gas fees drop significantly.

The daily median gas consumption on the Ethereum mainnet fell to 1.12 GWEI in March, marking a nearly 50-fold decline compared to the previous year.

The current data implies users and developers have started using networks such as Solana alongside Layer 2 solutions instead of Ethereum.

According to analytics platform Nansen, Ethereum’s declining demand stems from its unfavorable risk-reward ratio.

Alternative cryptocurrencies that target distinct market segments continue to attract rising amounts of capital investment as the firm monitors their market growth.

The analysts maintain a somber view of ETH’s upcoming performance since they expect its underperformance will continue into Q2 and Q3 of 2024.

ETH/BTC Forms Bearish Pattern with Potential 15% Drop

ETH/BTC creates a bear pennant formation within the daily timeframe, which suggests more price declines are coming.

One of the key features of bear pennants occurs right after significant price declines, when traders create trendlines for consolidating positions.

A price violation of the lower trendline would verify a negative trend, which may lead ETH/BTC to fall to 0.01968 BTC while decreasing by 15%.

ETH/BTC keeps moving downwards and rests below both the 50-day and 200-day EMAs.

The long-running bearish market structures show indications that BTC and ETH asset value drops could continue without end.

ETH’s odds for major recuperation suffer additional damage since there are no signs of strong buying demand.

Bullish momentum can be validated when ETH/BTC breaches its pennant’s upper resistance boundary.

The bearish pattern would disappear if the pair managed to transform the 50-day EMA from resistance into support.

ETH will lose its competition against BTC until it finds an effective game-changing factor.