CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Ethereum ($ETH) price remains precarious as it trades below the critical $2,000 mark, raising fresh concerns among traders.

The altcoin briefly showed hopeful signs as it reclaimed $2K as whales came to its rescue.

However, it has dipped below and is once again trading below this level at $1991. Notably, the coin lost this level on March 10 and is now hovering at its lowest point since October 2023.

Standard Chartered recently revised its 2025 price forecast for ETH, cutting it from $10,000 to $4,000.

The move signals a more cautious outlook amid ongoing structural declines in the network.

Despite the downturn, some analysts point to whale accumulation and real-world asset (RWA) growth as signs of potential long-term resilience.

Ethereum Faces Selling Pressure as Price Holds Below $1,900

Ethereum’s prolonged weakness has fueled fears of a deeper selloff, with analysts warning that a drop below $1,850 could spark panic selling.

Research firm IntoTheBlock highlighted a crucial demand zone between $1,843 and $1,900, where 3.56 million ETH were accumulated.

If Ethereum breaks below this range, analysts expect a sharp decline due to weak demand at lower price levels.

Geoff Kendrick, Standard Chartered’s global head of Digital Assets Research, reinforced this cautious outlook. On March 17th, he stated that ETH could continue its structural decline in the short term.

The bank’s decision to cut its price target underscores a broader market recalibration as crypto prices retreat from their post-election highs.

ETH and BTC are Struggling in a Wobbly Market…

The revised ETH target aligns with broader market struggles as major assets fail to sustain gains.

Bitcoin, which hit an all-time high of $109,114 in January, has since dropped 24.12% to $82,787. Ethereum, once above $4,000 in December, now trades near $1,897.

CryptoQuant and Bitwise maintain a bullish long-term view, setting Ethereum’s price target at $7,000 for this cycle.

Ali Martinez and Altcoin Moe have echoed similar projections, suggesting Ethereum could rally alongside Bitcoin if bullish catalysts emerge.

Whales and RWA Tokenization Signal Long-Term Confidence

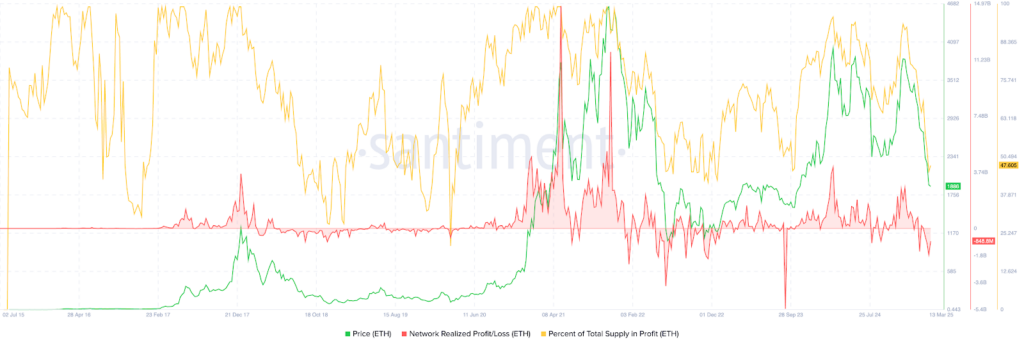

Despite market uncertainty, Ethereum whales continue to accumulate. Santiment data shows that large holders have added 420,000 ETH in recent days, signaling confidence in the asset’s long-term value.

Meanwhile, the rapid expansion of RWA tokenization is emerging as a crucial growth factor.

Hitesh Malviya, founder of DYOR crypto, recently argued on X that “it is not a great time to be bearish on ETH,” citing Ethereum’s dominance in this space.

RWA-based assets have surged 51% in the last month and 850% over the past year, with Ethereum and ZKsync controlling over 80% of that market.

While Ethereum remains under pressure, long-term trends suggest a potential rebound.

The coming months will be pivotal as traders watch whether ETH can reclaim lost ground or continue its downward trajectory.