CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

The crypto market, valued at $2.3 trillion as of March 2025, teeters on a knife’s edge. Bitcoin, down from its $109,000 peak, signals a sector desperate for a reboot.

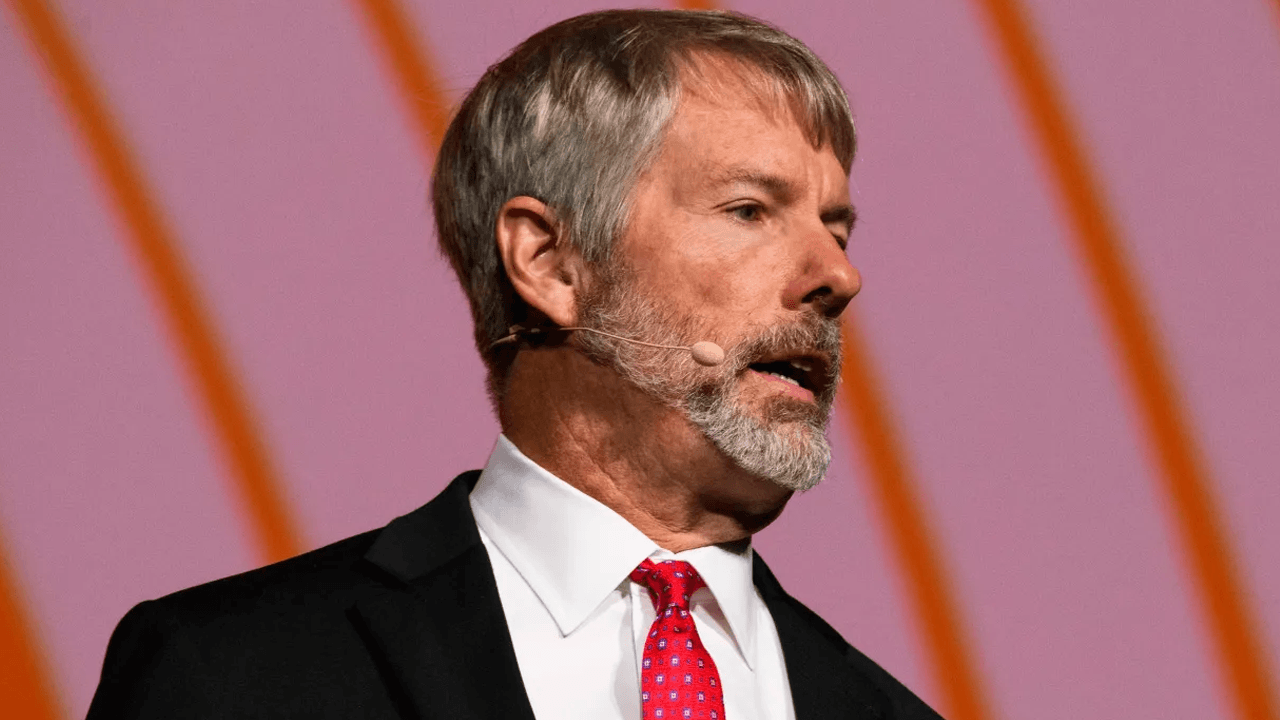

Enter Paul Atkins, President Trump’s pick for SEC chair. Nominated to replace Gary Gensler, Atkins promises a lighter touch—freedom for a market craving clarity.

But as his March 27, 2025, Senate hearing looms, his $5 million crypto fund and ties to FTX spark a fierce debate: will he unlock growth or unleash chaos?

Paul Atkins Takes the Reins: A New Era Dawns

Paul Atkins, a former SEC commissioner, steps up as Trump’s choice to lead the agency. He aims to ditch Gary Gensler’s tough rules, which saw 46 enforcement actions against crypto firms in 2023 alone, per SEC reports.

Atkins wants simpler regulations to spur innovation. His confirmation, if approved, could shift the SEC’s stance by mid-2025, with Mark Uyeda holding the chair temporarily until then.

Crypto players welcome Atkins’ nod. The market, still nursing losses—Bitcoin trades 40% below its $109,000 high—sees hope.

Industry leaders argue clearer rules could draw $50 billion in new investment. Atkins’ pledge to streamline aligns with their push for a regulatory reset.

Crypto News: Elizabeth Warren Fires Warning Shots

Senator Elizabeth Warren isn’t buying it. On March 20, 2025, she sent Atkins a 34-page letter on March 23, demanding answers. She flags his advisory role with FTX, the collapsed exchange, and his moves during the 2008 crisis as red lights.

Warren’s grilling, set for the Senate Banking Committee hearing on March 27, 2025, aims to expose risks in his playbook.

Atkins’ finances fuel the fire. His disclosures, filed in February 2025, show a $5 million crypto investment fund and $1 million in equity across two crypto firms.

His wife’s family wealth pushes their assets past $328 million. Critics, including Warren, cry conflict of interest—could his stakes sway SEC decisions? He’ll face that question head-on at the hearing.

A lighter SEC touch tempts trouble. Meme coins, like Trump’s unregulated $TRUMP token, thrive in gray zones—$TRUMP’s market cap hit $300 million in February 2025, per CoinMarketCap.

Experts warn lax oversight could invite scams. The 2022 crypto crash, which wiped out $2 trillion, looms as a cautionary tale. Atkins’ freedom might come at a steep price.

The stakes are sky-high. The $2.3 trillion market craves stability. Atkins’ policies could lift it—or sink it deeper.

With 16 million Americans holding crypto, per a 2025 Pew survey, his moves will ripple wide. The Senate’s final vote, expected post-hearing, decides the path.

Atkins faces the Senate Banking Committee today. He’ll pitch a “predictable crypto framework,” slamming Gensler’s “overcomplicated” rules. Warren and allies plan to push back hard.

The hearing, aired live on C-SPAN, will test his vision—and his past. The Senate’s call comes soon after.

What’s Next for Crypto Market?

Atkins’ rise marks a pivot. His crypto-friendly stance could unlock growth, with $5 million of his own skin in the game. Yet his FTX ties and $328 million fortune stir doubts.

As Uyeda steers the SEC now, the market watches. Freedom beckons—but at what cost? The Senate holds the answer.