10h05 ▪

5

min read ▪ by

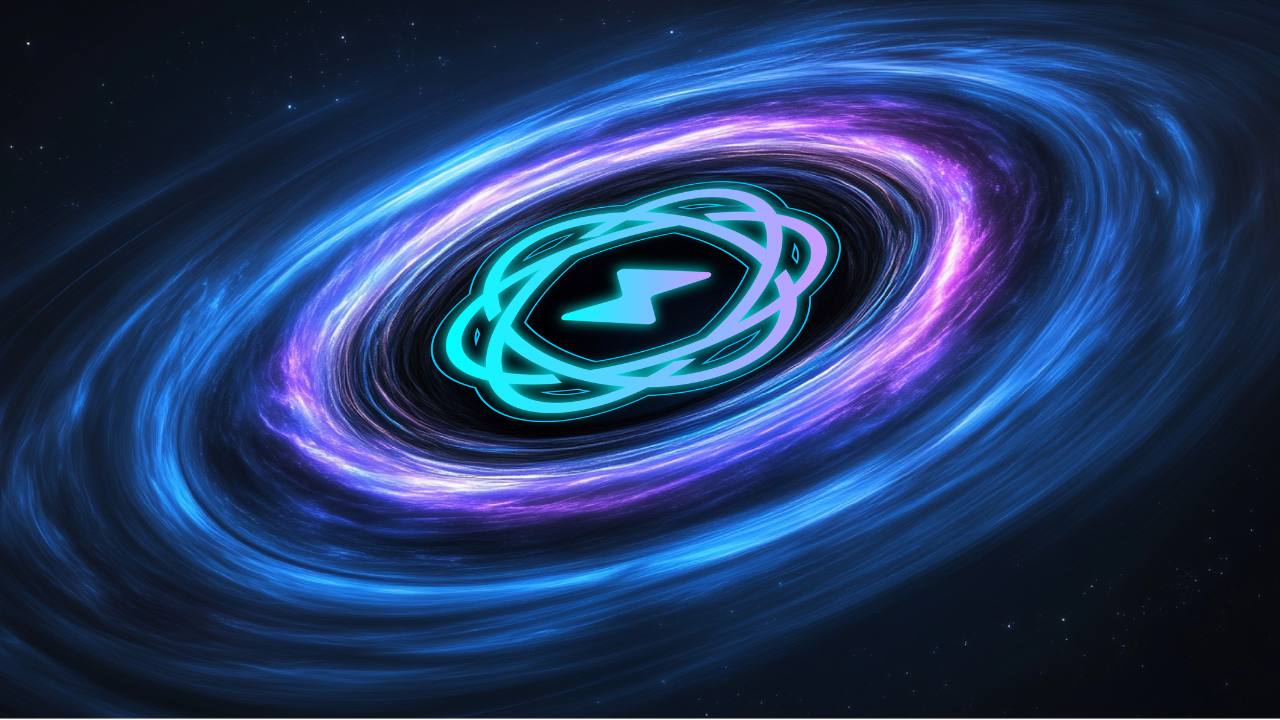

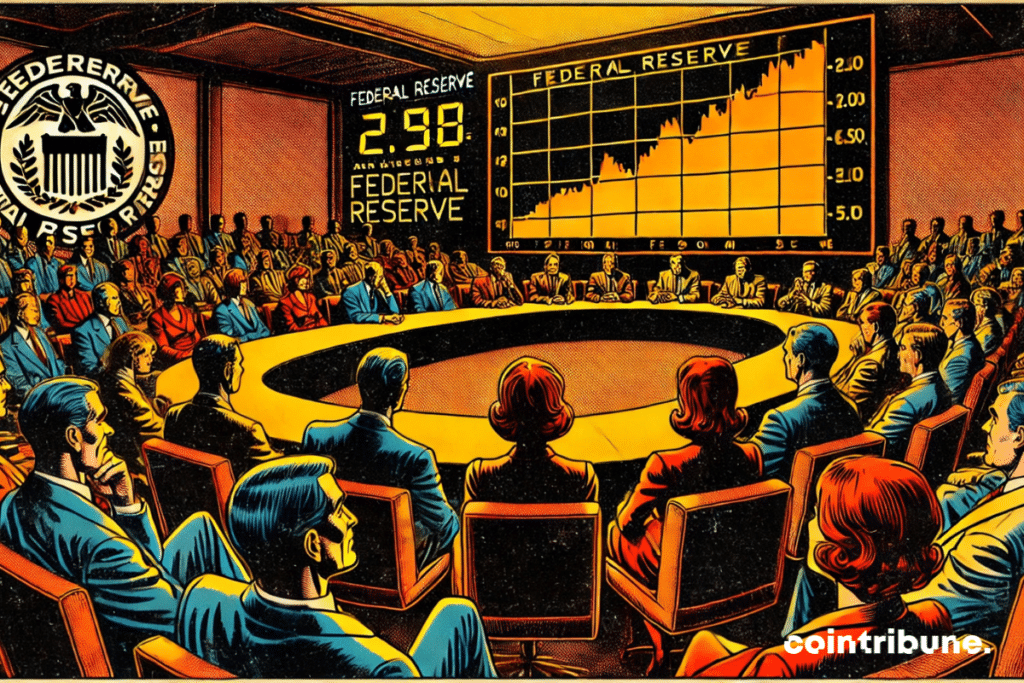

The global economic landscape is at a critical phase. Every decision from the American Federal Reserve (Fed) becomes a key signal, closely monitored by investors and financial analysts. In this context, the imminent announcement of a new interest rate cut sparks keen interest. As inflation, once rampant, begins to return to more controlled levels, the Fed is considering yet again reducing its benchmark rate, this time to a range of 4.25 % to 4.5 %. This measure, which is part of an economic stabilization strategy, does not leave any market indifferent. For cryptocurrencies, this announcement stirs both hope for a more favorable monetary environment and fear of increased instability. As bitcoin and Ethereum already suffer significant declines, investors are questioning the outlook ahead.

A strategic decision at the heart of a delicate economic context

The American Federal Reserve has confirmed its intention to reduce interest rates by 25 basis points, thus lowering the target range to 4.25 % – 4.5 %. This decision, which is part of a series of cuts started last September, represents a cumulative adjustment of one percentage point in recent months. For many observers, this approach aims to support the economy in a context marked by inflation still far from the 2 % target. Indeed, although inflation has significantly decreased from its peak of 9.1 % recorded in June 2022, it continues to pose a major challenge to monetary authorities.

Jacob Channel, a senior economist at LendingTree, explained on CBS NEWS on December 17, 2024 that “if the Fed continues its plan with a 25 basis point cut, it is unlikely to continue down this path in the short term”. This positioning reflects a measured approach, motivated by the need to fully assess the impact of previous adjustments. Furthermore, strong employment data, with 227,000 jobs created in November, reinforces the complexity of the situation. These performances, particularly in key sectors such as health and tourism, demonstrate a resilient economy, but add additional pressure on the Fed’s strategic choices. As economists ponder the possibility of further cuts, the current stability in the job market sends mixed signals that fuel debates.

Cryptos : between immediate volatility and expectations of opportunities

The approach to the Fed’s announcement has already resulted in marked volatility in cryptocurrency markets. Over the past 24 hours, bitcoin has fallen by 2 %, while Ethereum has recorded a loss of 4 %. The overall market capitalization of cryptocurrencies has dropped by 4 % and now stands at 3.8 trillion dollars. This correction has also affected major altcoins, notably Solana and Binance Coin. Such movements reflect the uncertainty of investors regarding the impact of imminent monetary adjustments, thereby reinforcing a palpable nervousness within the sector.

In the longer term, however, rate cuts could offer a more favorable context for cryptocurrencies. Indeed, a relaxed monetary environment could stimulate investors’ appetite for higher-risk assets, including cryptocurrencies. Nevertheless, the outlook remains mixed. Jacob Channel warns that “current forecasts could be disrupted by a resurgence of inflation.” He also mentions potential revisions of economic strategies under the Trump administration, which could amplify uncertainties weighing on the markets. These elements underscore the need for investors to act cautiously in a context still marked by uncertainties.

The Fed’s decision constitutes a pivotal moment for markets seeking stability and direction. For cryptocurrencies, this evolution represents both an immediate challenge and a future opportunity. In the short term, the increase in volatility reflects investors’ uncertainties regarding monetary adjustments. However, if a stable policy were to persist, it could encourage a gradual return of capital to these assets. The forthcoming balance will depend on regulators’ ability to manage inflationary tensions and adapt to global economic challenges, in an environment that remains marked by notable uncertainties.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d’une certification consultant blockchain délivrée par Alyra, j’ai rejoint l’aventure Cointribune en 2019.

Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l’économie, j’ai pris l’engagement de sensibiliser et d’informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu’elle offre. Je m’efforce chaque jour de fournir une analyse objective de l’actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.