CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Ethereum targets $11,865.6, with Fibonacci 1.618 extension signaling a potential 240% price surge from current levels.

- An inverse head and shoulders pattern hints at a breakout above $3,650, targeting $7,300 in the short term.

- Historical Fibonacci retracements and strong support at $3,250 set the stage for bullish momentum and altcoin growth.

Ethereum shows signs of bullish momentum with technical indicators suggesting growth potential. A major price target of $11,865.6 could be reached, reflecting a potential 240% increase from current levels. Additionally, a recently spotted inverse head and shoulders pattern provides further optimism. Should ETH break out from key resistance levels, it could soar to $7,300, signaling an exciting period for Ethereum and altcoins.

Fibonacci Analysis Points to Strong Potential

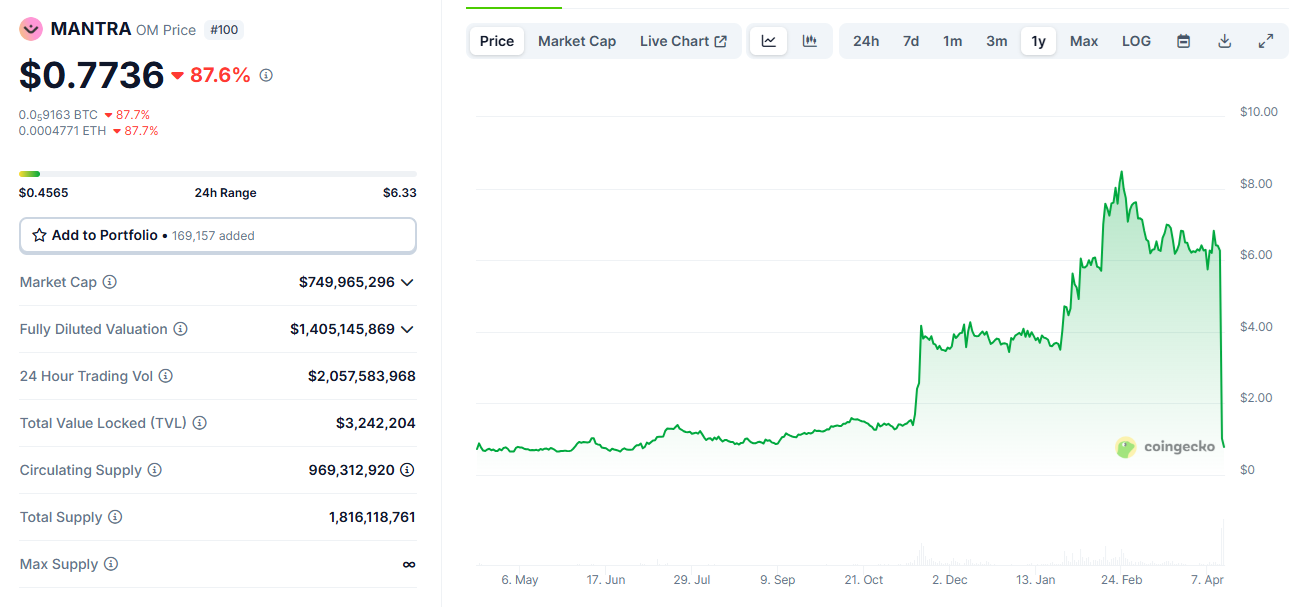

Ethereum’s price movement has historically been influenced by key Fibonacci retracement and extension levels according to analyst Javon Marks. A key component of earlier bull cycles, the 1.618 extension is undergoing another test. 2018 saw Ethereum soar from about $100 to over $1,400 before retracing and forming a bottom around $80. During that correction, Fibonacci levels were important to support zones, particularly the 1.0 retracement.

In 2020, Ethereum broke above $1,400 and reached a high of $4,800. Despite a correction, the $1,000–$1,200 range became a support zone. ETH has climbed back toward $3,000, reflecting steady upward momentum. If this trend continues, the 1.618 Fibonacci extension near $11,865.6 becomes a plausible target. Historical data suggests that Ethereum could easily reach these levels under strong bullish conditions.

Inverse Head & Shoulders Pattern Suggests Uptrend

Moreover, analyst Crypto Patel reveals an inverse head and shoulders pattern, a classic bullish reversal signal. This pattern forms after a prolonged downtrend and indicates a potential trend reversal. In this case, the left shoulder occurred during a decline, followed by the head at the lowest price point. The right shoulder formed with a higher low, confirming the pattern’s bullish implications.

The breakout zone lies at the neckline resistance near $3,650. A successful breakout above this level could see ETH rise toward a target of $7,300, calculated from the height of the pattern. Support levels around $3,250 provide a solid foundation for further price consolidation before the breakout occurs. Consequently, Ethereum could experience continued growth, which may spill over to altcoins in the coming months.

DISCLAIMER:

The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

.

.  MARKS (@JavonTM1)

MARKS (@JavonTM1)