Spot Bitcoin exchange-traded funds (ETFs) in the United States saw a strong resurgence after enduring four consecutive days of outflows that had drained over $1.2 billion from the market.

On Jan. 15, SoSoValue data revealed that these funds recorded $755.01 million in net inflows, adding approximately 7,548 BTC to their coffers.

Fidelity’s FBTC emerged as the key driver of these flows, attracting $463.08 million—the fund’s most significant inflow since March 2024. ARK and 21Shares’ ARKB also contributed to the positive trend with $138.81 million in inflows.

Other Bitcoin ETFs also added to the positive trend. Grayscale’s GBTC recorded $50.54 million, while Bitwise’s BITB secured $32.69 million. BlackRock’s IBIT saw inflows of $31.86 million, and VanEck’s HODL contributed $16.98 million.

Meanwhile, Grayscale Bitcoin Mini Trust added $13.69 million, Invesco Galaxy’s BTCO saw $4.47 million, and Franklin Templeton’s EZBC gained $2.9 million.

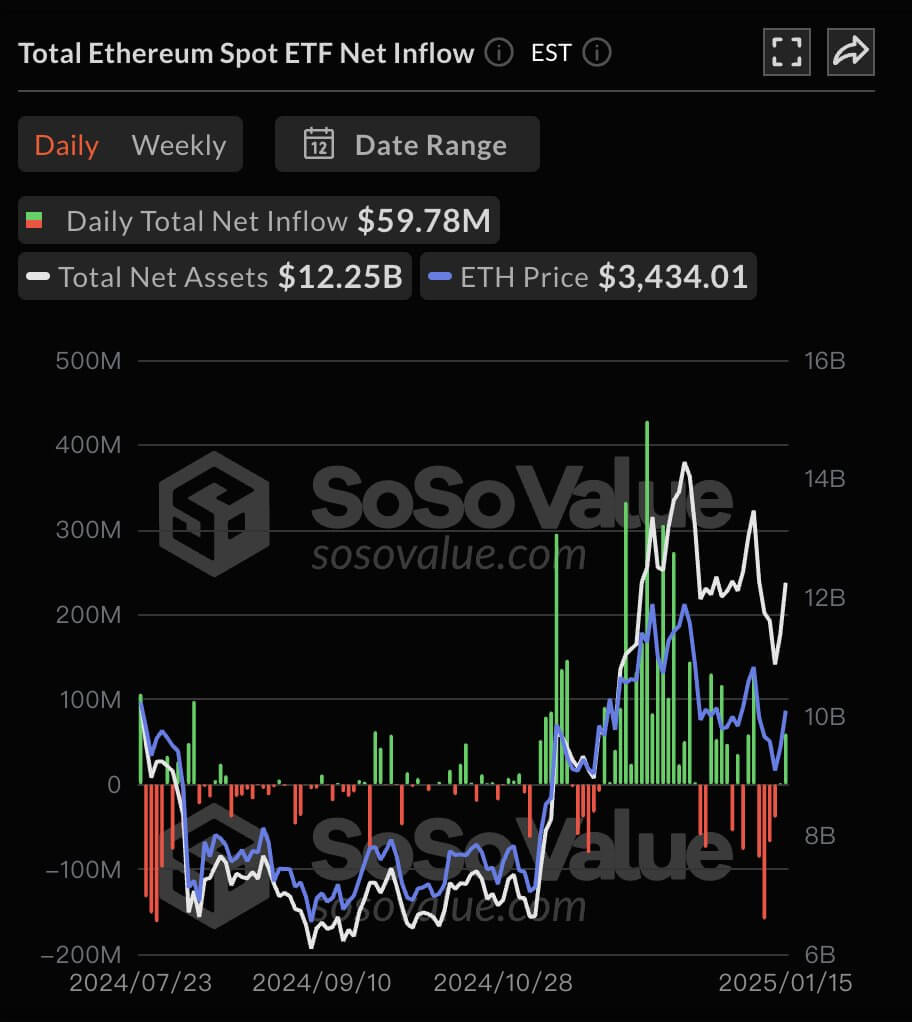

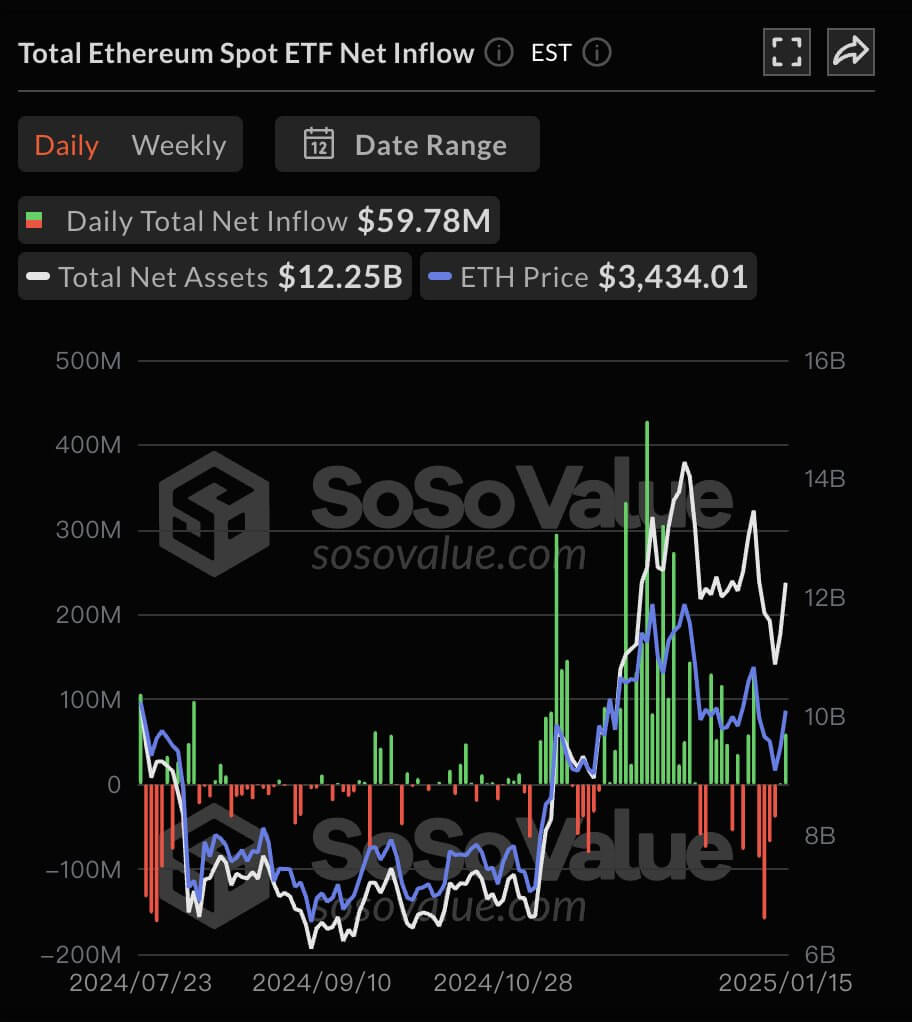

Ethereum ETFs

Ether ETFs also performed strongly on Jan. 15, recording $59.78 million in inflows, which translated to 18,520 ETH entering the funds.

SoSoValue data shows that Fidelity’s FETH led this category, attracting $29.32 million. BlackRock’s ETHA followed closely with $19.85 million.

Conversely, VanEck’s ETHV and Grayscale Ethereum Mini Trust saw cumulative inflows of more than $10 million on the day.

Other Ethereum ETF products recorded no flows on the day.