CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Schueler also still faces allegations of tax evasion and assault. Despite being listed on Interpol’s “Red Notice” and Europe’s most wanted list, Schueler is still very active online and promoting Hex. Meanwhile, in the US, early Bitcoin investor Frank Ahlgren III was sentenced to two years in prison for tax fraud, and the court ordered the surrender of his cryptocurrency holdings and private keys. Indian crypto exchange CoinSwitch decided to launch a $69.9 million recovery fund to assist users that were affected by WazirX’s $235 million hack in 2024.

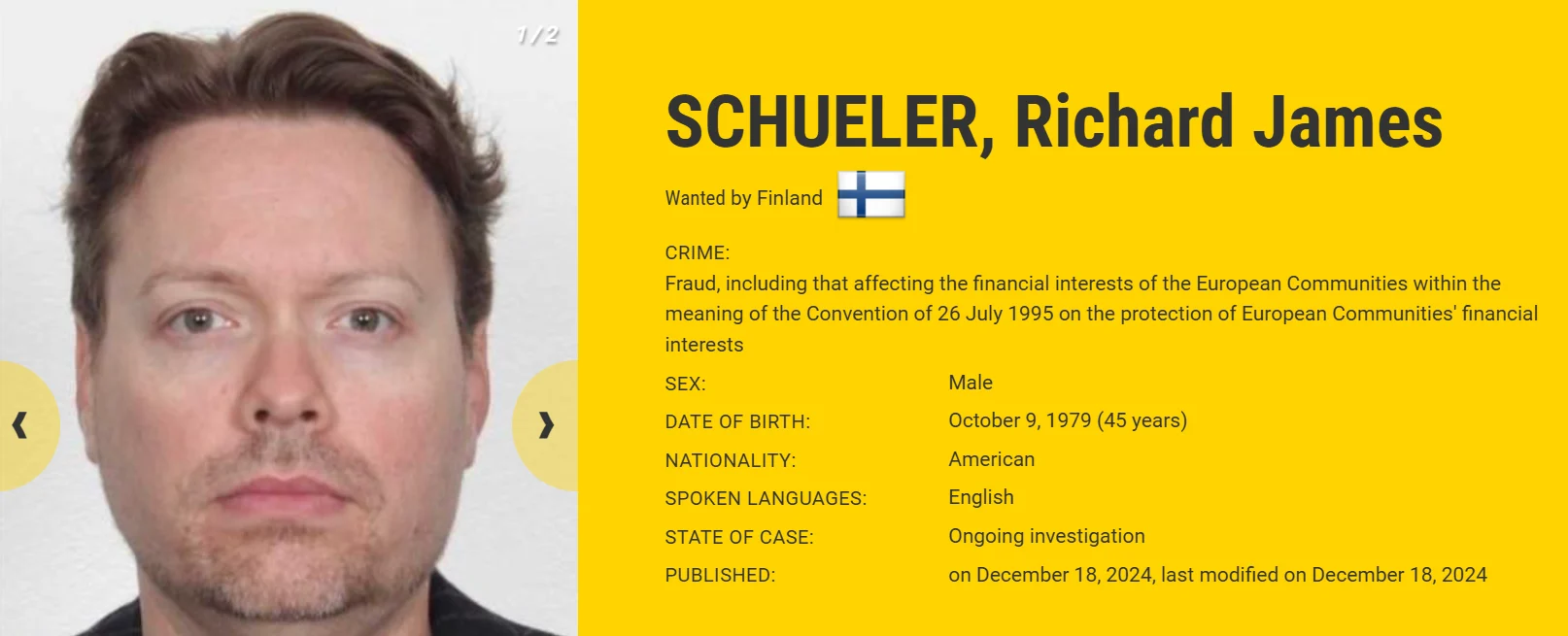

Richard Schueler Faces Mounting Allegations

Finnish authorities reportedly seized $2.6 million worth of luxury watches belonging to Hex founder Richard Schueler, who is also known as Richard Heart. The watches were discovered in a residence in Espoo, Finland, according to the national broadcaster Yleisradio Oy (Yle). In total, 20 luxury watches were confiscated, and their value was determined through receipts and assessments by a luxury goods expert. Some of the watches were purchased in Finland, while others were bought in the United States.

Some of the watches that were seized by police (Source: Yle)

The seizure is part of an ongoing investigation into allegations against Schueler, who is accused of tax evasion and assault. Finnish police have been actively tracking his activities, and Inspector Harri Saaristola, the detective overseeing the case, revealed that intelligence operations led to the discovery of the abandoned items.

Schueler was remanded into custody on Sept. 13 of 2024, but authorities have not been able to locate him. The allegations include tax evasion between June of 2020 and April of 2024, as well as an assault on a 16-year-old victim in February 2021. The details of the assault were shared on Europe’s most wanted fugitives list, and describe Schueler grabbing the victim by the hair, dragging them into a stairwell, and knocking them to the ground.

On Dec. 22, Interpol issued a “Red Notice” for Schueler in connection with these charges, and Finnish authorities estimate his tax arrears to be in the hundreds of millions of euros. His declared income for 2023 was reported as €15.2 million ($16.9 million). Despite being listed as one of Europe’s most wanted fugitives, Schueler still has a very active online presence and is promoting his cryptocurrency, Hex (HEX), on social media platforms like X and YouTube.

Schueler on Europe’s most wanted list

In addition to the Finnish allegations, Schueler also faces legal action in the United States. The US Securities and Exchange Commission (SEC) filed a lawsuit against him in July of 2023, accusing him of raising more than $1 billion through unregistered securities tied to Hex (HEX), PulseChain (PLS), and PulseX (PSLX). The SEC alleges that some of these funds were misappropriated for personal use.

Texas Bitcoin Investor Sentenced for Tax Fraud

Shueler is not the only person avoiding tax responsibilities. Frank Richard Ahlgren III, an early Bitcoin investor from Texas, was ordered to surrender his cryptocurrency and all associated private keys and access codes as part of a restraining order that was issued by an Austin federal court. This order was made after his sentencing in December to two years in prison for tax fraud. Ahlgren owes approximately $1.1 million in restitution to the US government after underreporting capital gains on over $3.7 million in Bitcoin sales between 2017 and 2019.

On Jan. 6, Judge Robert Pitman directed Ahlgren, along with his family, friends, or representatives, to provide any physical devices that were used to store his cryptocurrency, as well as any public and private keys, seed phrases, or passphrases. The court also ordered them to identify all crypto accounts associated with Bitcoin, Bitcoin Cash, Bitcoin Gold, Ethereum, or Litecoin.

Additionally, they are prohibited from transferring or taking any actions that might conceal or reduce the value of Ahlgren’s cryptocurrency without court approval, except for use in normal monthly living expenses. This order will stay in effect until Ahlgren satisfies his restitution obligations or the court issues any other instructions.

Ahlgren pleaded guilty in September of 2024 to filing a false tax return and was sentenced in December. His legal troubles stem from his purchase of approximately 1,366 Bitcoin in 2015, when the cryptocurrency was only valued at around $465. Two years later, he sold half of his holdings for $3.7 million at a price of $5,800 per Bitcoin. However, he inflated the cost basis in his tax filings to reduce the reported capital gains. Between 2018 and 2019, he sold additional Bitcoin worth more than $650,000, which he failed to report entirely on his tax returns as well.

Prosecutors revealed that Ahlgren used multiple wallets, in-person transfers, and mixers to conceal details of his transactions. The total tax losses resulting from his actions exceeded $1 million. In addition to his prison sentence, Ahlgren will serve one year of supervised release.

The case was the first criminal tax evasion prosecution in the United States centered solely on cryptocurrency.

CoinSwitch Offers Recovery Fund to WazirX Hack Survivors

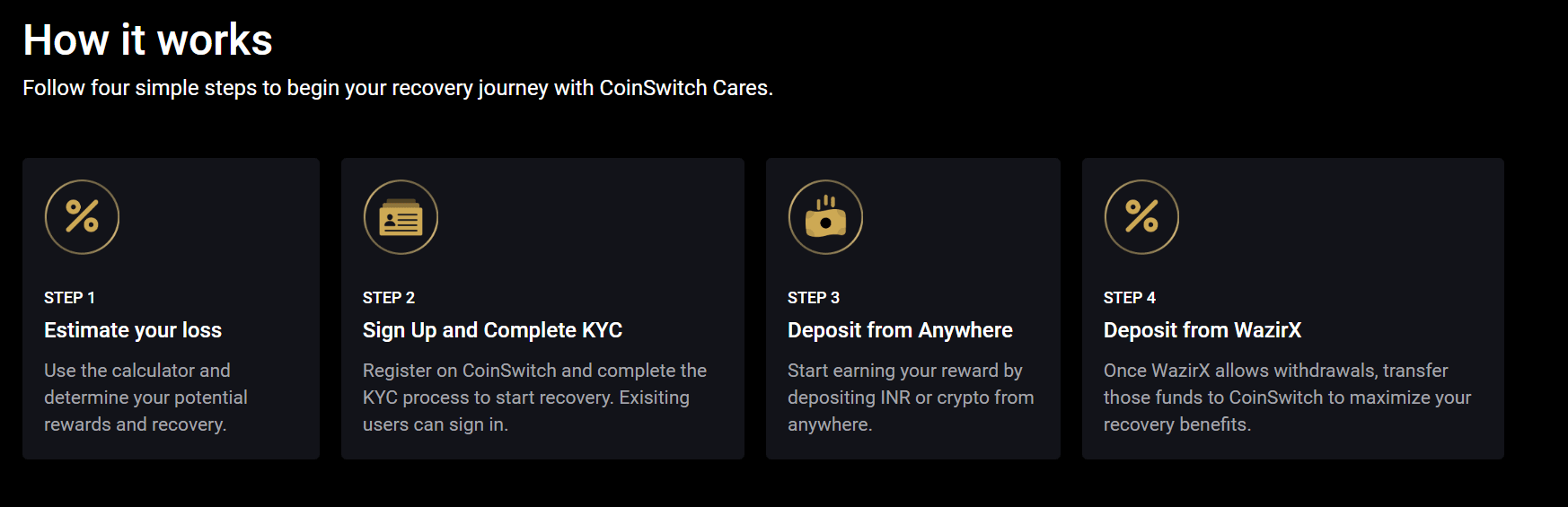

Meanwhile, Indian crypto exchange CoinSwitch launched a recovery fund worth 600 crore Indian rupees, or $69.9 million, to assist users of the hacked competitor platform WazirX. The initiative is called “CoinSwitch Cares,” and it is designed to help WazirX users who suffered losses in the alleged cyberattack that took place in July of 2024. Through this program, CoinSwitch plans to distribute the funds over a two-year period to the affected users.

Eligibility for the recovery fund requires users to provide proof of their losses, including WazirX loss statements and any additional documentation CoinSwitch may request. The program offers three types of rewards: sign-up bonuses, revenue sharing, and referral bonuses. However, while users can sell their recovered crypto for rupees, direct cryptocurrency withdrawals are not currently supported.

(Source: CoinSwitch)

The recovery fund will be fully financed by CoinSwitch from its cash reserves. Co-founder Ashish Singhal stated that the exchange has sufficient financial resources, with a runway of about five years, and pointed out that the ongoing crypto market uptrend also strengthened their financial position. CoinSwitch plans to screen the affected WazirX users by reviewing their balance statements to verify their claims and calculate losses. Once WazirX reopens crypto withdrawals, CoinSwitch expects to streamline the process of tracking user claims and calculating rewards.

CoinSwitch was founded in 2017, and is one of India’s largest cryptocurrency exchanges that boasts 20 million registered users and major funding from investors, including Andreessen Horowitz, Tiger Global, and Coinbase Ventures. The recovery fund targets approximately four million WazirX users.

WazirX’s alleged $235 million hack led to the suspension of withdrawals, and generated serious controversy in the crypto community. The exchange’s custody provider, Liminal, accused WazirX of negligence, and also claimed it used compromised devices.