Bitcoin’s price has dropped to its lowest level since late November, dashing hopes for a traditional “Santa Rally”. Historically, this rally represents strong market gains during the holiday season, often seen in years leading up to market cycle peaks.

Bitcoin Price Drops Below Key Levels

Bitcoin hit $92,442 during late trading on December 23, marking a four-week low and reflecting a 14.5% correction from its all-time high of $108,000 on December 17. After briefly recovering to $95,000, the price slipped to $94,000 in early December 24 trading, experiencing an 11% decline over the past week.

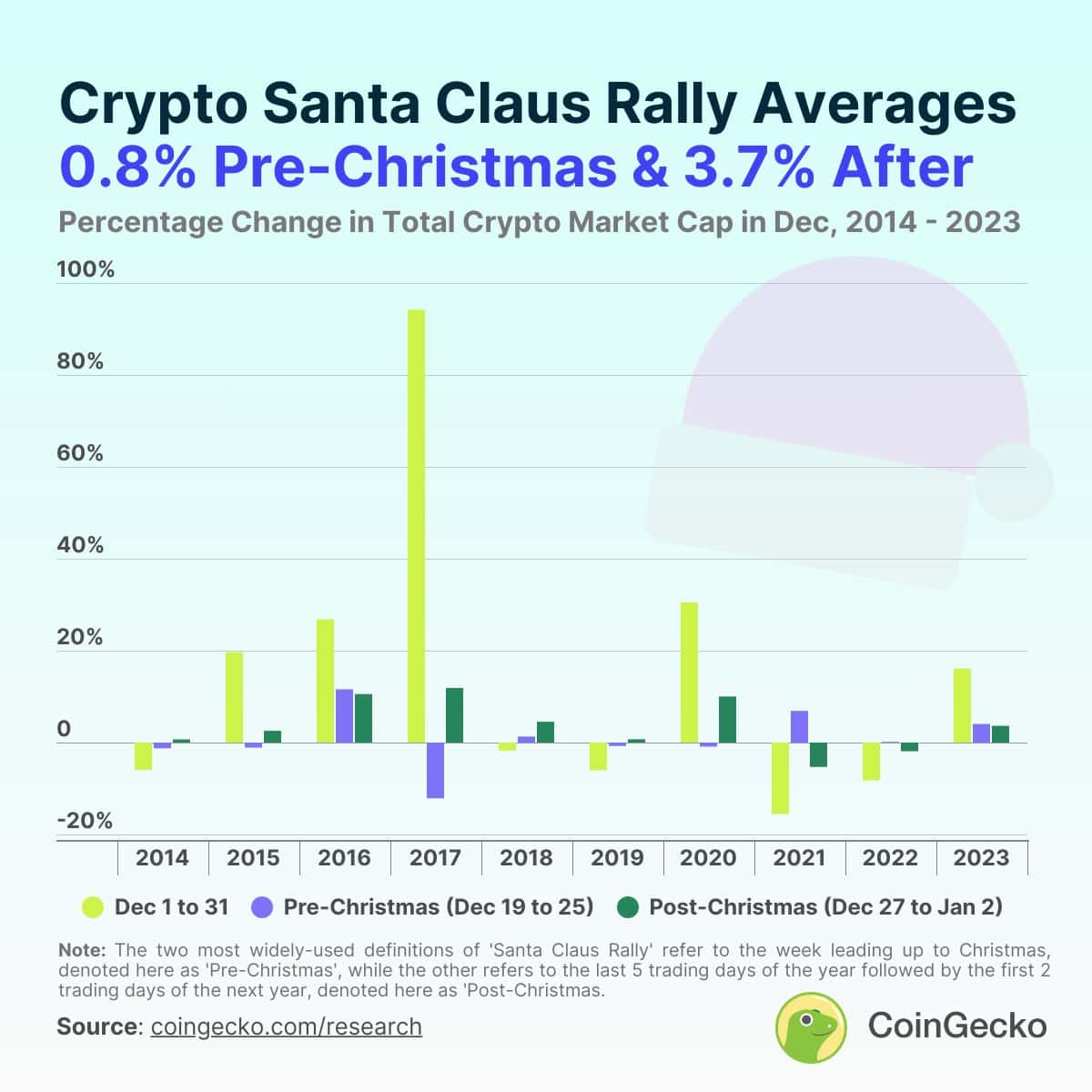

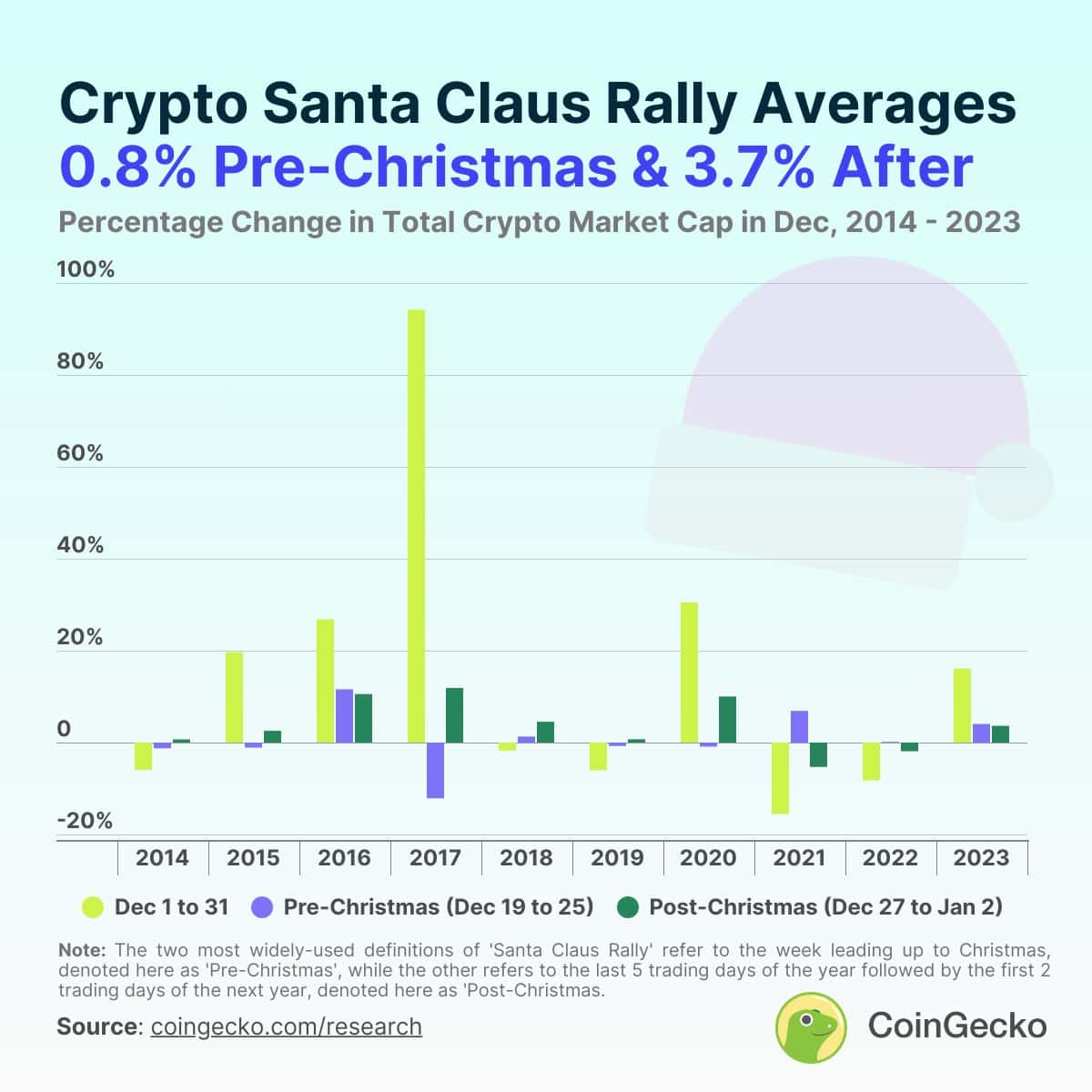

Historically, the crypto market has performed well during the holiday season in bull markets. However, Bitcoin’s lackluster December performance dims hopes for a Santa Rally, which typically sees price surges from the last five trading days of December to the first two trading days of January.

Historical Santa Rally Patterns

Crypto analyst Mister Crypto highlighted Bitcoin’s significant rallies during the holiday season in previous cycles, particularly in 2016 and 2020. A study by The Bit Journal using data from CoinGecko revealed that between 2014 and 2023, the crypto market experienced Santa Rallies 10 times. During these periods, the total crypto market cap increased by 0.7% to 11.8% from December 27 to January 2.

In contrast, 2021’s market cycle peak saw no such rally. Bitcoin had already dropped 26% from its $69,000 high by Christmas Day that year, continuing to decline throughout 2022. Analysts now expect 2025 to mark the next peak year in Bitcoin’s traditional four-year cycle.

Market Sentiment and Key Events

This year, the market remains volatile, with $18 billion worth of Bitcoin and Ether options expiring on December 27, potentially triggering significant price movements. Bitcoin’s social sentiment also hit a year-low on December 22, which some analysts believe could signal an impending recovery.

Recap of Recent Market Activity

Bitcoin’s trajectory has been volatile over the past week. It hit new highs early in the week, surpassing $108,000, only to drop below $100,000 following the FOMC meeting on Wednesday. The sell-off continued, with the price hitting $92,000 on Friday before stabilizing and briefly recovering to $99,000 on Saturday morning. However, this rally was short-lived, as Bitcoin fell back to $96,000 by Sunday. It continues to trade at similar levels as of now.

Despite the challenges, the crypto market remains dynamic, and Bitcoin’s next moves could redefine market sentiment. For the latest updates on cryptocurrency trends, follow The Bit Journal.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!