CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Hashdex files SEC amendment to add XRP, Cardano to its cryptocurrency index ETF, excluding meme tokens.

- Eligibility criteria include trading on major exchanges, free-floating prices, and novel use cases.

- Bitcoin holds 88.3% of the ETF; Ethereum accounts for 11.7%, with $70.43 million in assets.

Hashdex, a Brazil-based digital asset manager, has submitted an amendment to the U.S. Securities and Exchange Commission (SEC) to broaden its cryptocurrency index exchange-traded fund (ETF). The proposed expansion includes adding altcoins like XRP and Cardano (ADA), alongside existing holdings in Bitcoin (BTC) and Ethereum (ETH).

To qualify for inclusion, cryptocurrencies must meet criteria such as availability on major exchanges like Bitstamp, Coinbase, and Gemini, and maintain free-floating prices not pegged to other assets. Hashdex also evaluates security, reputation, and whether a token offers “novel use cases” or “crypto-economic innovation”. Meme cryptocurrencies, which lack these features, will be excluded.

As of March 17, Bitcoin comprises 88.3% of the ETF’s holdings, with Ethereum accounting for the remaining 11.7%. New tokens will be weighted by their free-float market capitalization. The ETF currently holds $70.43 million in net assets. An expanded version of the fund, offering broader cryptocurrency exposure, is already listed on the Bermuda Stock Exchange.

Hashdex recently secured approval for the world’s first spot XRP ETF and a Solana (SOL) ETF, signaling its push into altcoin markets. Meanwhile, numerous proposals for spot altcoin ETFs in the U.S. remain pending. Betting markets suggest the SEC is likely to approve XRP and Solana ETFs in 2024.

SEC Approval Trends and Market Implication

The SEC’s approach to cryptocurrency ETFs has drawn attention as regulators balance innovation and investor protection. Hashdex’s focus on free-floating tokens and exclusion of meme coins aligns with broader efforts to prioritize transparency and utility. The firm’s expanded Bermuda ETF serves as a test case for diversifying digital asset offerings.

Bitcoin’s dominance in the current ETF structure reflects its established market position, though the inclusion of altcoins like XRP and Cardano highlights growing interest in diversification. Regulatory clarity remains key for these products, as seen in Hashdex’s recent approvals and the SEC’s anticipated decisions on pending applications.

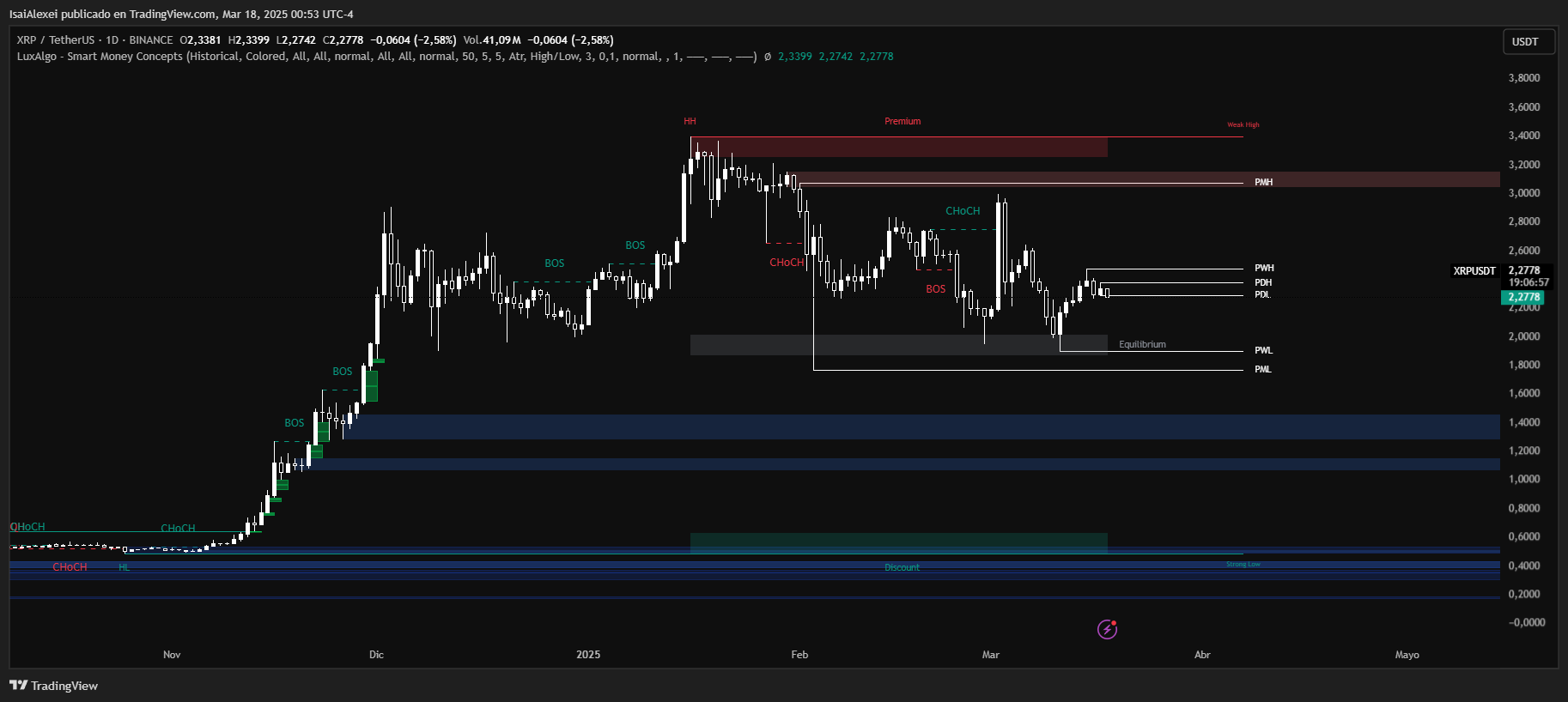

As of today, XRP is trading at $2.2776, reflecting a 0.74% decline in the past 24 hours. Over the past week, XRP has gained 14.80%, but in the last month, it has dropped 15.97%. Despite recent corrections, XRP remains one of the strongest performers over the past year, with a 267.89% increase in value.

XRP reached its all-time high of $3.40 on January 16, 2025, before entering a correction phase. Technical indicators currently show a sell signal in the short term, while the weekly and monthly trends suggest a buy signal, indicating potential for recovery.

If XRP holds above $2.20, it could attempt to retest resistance at $2.50-$2.70. However, if selling pressure increases, key support levels to watch are $2.10 and $1.95.

XRP remains highly volatile, with an estimated 2.89% daily volatility rate, meaning traders should be cautious and closely monitor market sentiment.