The global crypto market has seen many developments and twists in 2024 from Bitcoin ETF approval to Bitcoin’s long-awaited target of $100K achievement. In this article we will explore the significant event which has poured more excitement in the market boom.

January: The SEC Approves Bitcoin ETFs

The U.S. SEC has approved 11 Bitcoin ETFs, allowing investors to gain exposure to Bitcoin without directly owning it. These ETFs work like stock funds, making crypto investing easier for people who don’t want to use digital wallets or exchanges like Binance or Coinbase.

This is seen as a major step forward for the crypto industry, especially for large firms like BlackRock and Fidelity, which supported the move. The approval makes Bitcoin more accessible to regular investors and boosts institutional confidence.

However, the SEC cautions that Bitcoin investing still involves risks like market manipulation and fraud. While this decision simplifies Bitcoin investment, potential investors are urged to remain cautious. It’s a big win for mainstream crypto adoption but with a reminder to proceed carefully.

Anyhow Gargensler tweeted it was not official.

What This Means for Bitcoin’s Price

The approval of Bitcoin ETFs is a big win for the crypto market, especially after Bitcoin’s struggles in recent years. In 2022, Bitcoin’s price dropped to $16,000, but it’s been recovering since. After the SEC’s announcement, the price jumped to around $46,500.

Experts believe these ETFs could bring billions of dollars into the market, possibly pushing Bitcoin’s price to $100,000. Predictions suggest the market might see $50 to $100 billion in new investments this year. However, some worry that ETFs could make Bitcoin more volatile and risky, especially for people investing their retirement savings. While ETFs might help stabilize the market, they could also increase risks for everyday investors.

February: Telegram Introduces Tap-to-Earn

Tap-to-earn games on platforms like Telegram have become hugely popular in 2024, drawing in massive audiences and growing in value. Unlike play-to- earn, tap-to-earn games are free and only need a smartphone and some tapping to earn rewards. These games are simple, easy to access, and make money from ads instead of new players. However, critics say the games might feel shallow, and players could lose interest quickly if there’s no deeper experience to keep them engaged.

This trend could change Web3 gaming by making it easier for people to join without financial risks. From NOT COIN to Hamster Kombat a revolution. Since the games are simple and depend on ads, their long-term success is unclear. Some projects are trying to add more features and variety, with large market caps and very less profit.

March: Bitcoin Hits $73,097

Bitcoin has reached a record-breaking all-time high of $73,097, fueled by the rising adoption of Bitcoin ETFs and growing interest from institutional investors.

AI Tokens Gain Momentum

AI tokens are rapidly gaining attention in the crypto industry, by the excitement surrounding OpenAI’s Sora, a technology that creates hyper-realistic videos from text prompts. Major AI-based projects like Fetch.ai, SingularityNET, and Bittensor (TAO) are leading the charge, with Bittensor topping the AI token market with a market cap over $25 billion. Bittensor is an open-source protocol that uses blockchain to build a decentralized machine-learning network, while Render (RNDR) and Fetch.ai (FET) have also seen significant growth, with Render peaking at $13.50 and Fetch.ai at $2.55, showing strong performance in the sector.

As AI-driven projects continue to thrive, the AI coin market is experiencing rapid momentum. With NVIDIA’s growth being driven by AI, the market for computational power and blockchain solutions is expanding. Fetch.ai, Render, and Bittensor are all capitalizing on the increasing demand for AI in blockchain technology, offering decentralized solutions for tasks such as automating everyday activities and digital creation.

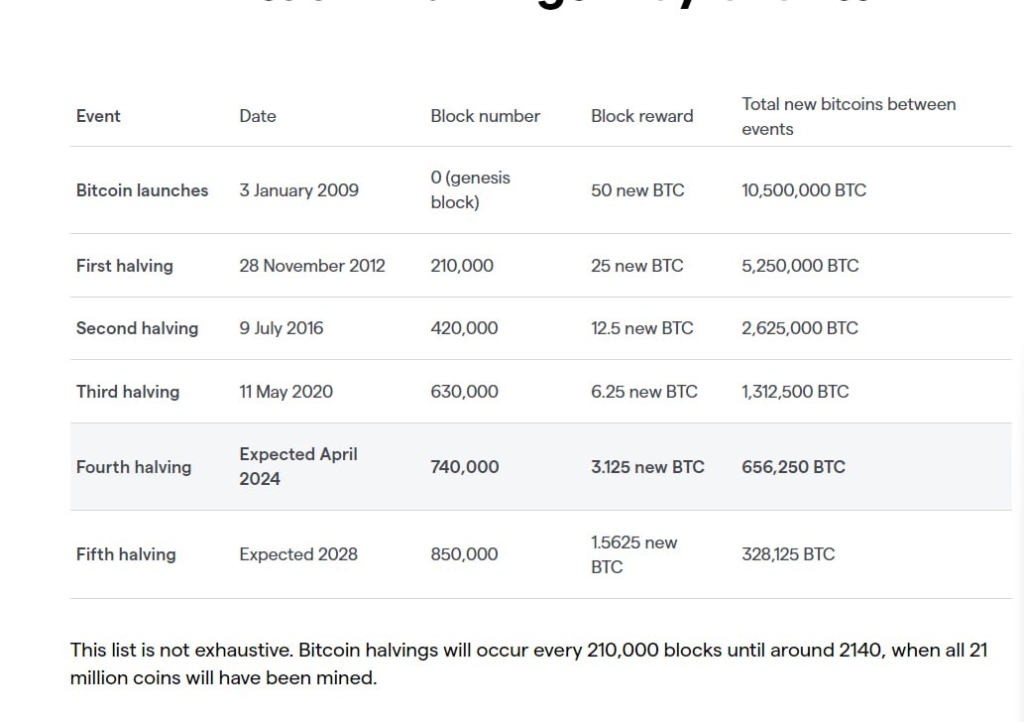

April: Bitcoin Halving Event

Bitcoin’s fourth halving on April 19, 2024, cut miners’ rewards from 6.25 BTC to 3.125 BTC, making Bitcoin more scarce. This sparked a lot of market activity, with users spending over $2.4 million in fees to secure transactions. The halving’s deflationary effect could drive Bitcoin’s price higher in the long term, but for now, Bitcoin’s price is around $64,000 to $65,000, showing short-term ups and downs due to market uncertainty and Federal Reserve decisions.

The halving has directly impacted miners by reducing their earnings, which could change the mining landscape. Historically, Bitcoin’s price has surged after halvings, but this time, external factors like regulations and market trends might affect this pattern. Experts believe the halving, along with developments like that.

May: Ethereum ETF Approved

After the approval and launch of Bitcoin Exchange Traded Funds (ETFs) in January 2024, the U.S. Securities and Exchange Commission (SEC) approved eight Ethereum ETFs for listing and trading on SEC-regulated exchanges on May 23, 2024.

July: WazirX Hack

In July 2024, Indian crypto exchange WazirX faced a major cyberattack, losing $235 million. Hackers exploited vulnerabilities in WazirX’s secure multisig wallet system, despite the exchange using strong security measures like a Gnosis Safe wallet requiring 4 out of 6 signatures, whitelisted addresses, and hardware wallets. The attackers tricked the system by changing the wallet to a malicious smart contract, bypassing both the multisig and whitelist. They also manipulated how the transaction appeared, fooling the required signers into approving it.

📢 Update: We’re aware that one of our multisig wallets has experienced a security breach. Our team is actively investigating the incident. To ensure the safety of your assets, INR and crypto withdrawals will be temporarily paused. Thank you for your patience and understanding.…

— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) July 18, 2024

This hack shows how tricky securing Web3 projects can be, even with advanced safeguards. It highlights the need for thorough security audits and continuous improvements to security systems to prevent such sophisticated attacks in the future.

August: Market Crash

The sharp market crash on 5 August 2024 was driven by a combination of factors, primarily the unexpected rate hike by the Bank of Japan and a concerning US job report. The rate hike disrupted the yen carry trade, leading to a sell-off in global markets, with significant losses in major indices like the Nikkei 225 and Nasdaq.

The weak US jobs data, which showed lower-than-expected payroll growth and a rise in the unemployment rate, intensified fears of a looming recession. This combination of global economic signals resulted in a dramatic rise in market volatility, as seen in the surge of the Cboe Volatility Index (VIX).

The downturn impacted not only stock markets but also forex and commodities, highlighting the interconnected nature of global financial systems. The US dollar saw a dip as traders adjusted expectations for Federal Reserve rate cuts, while the yen strengthened in response to Japan’s policy shift. Commodities like copper, gold, and crude oil also experienced significant declines, reflecting broader economic unease. As markets adjust to these shifts, the volatility is expected to continue, with key economic data, such as upcoming US CPI and jobs reports, playing a critical role in shaping future market movements.

Token2049 September

Token2049, at Singapore’s Marina Bay Sands on September 18-19, 2024, is shaping up to be one of the biggest global events in crypto and Web3. With over 20,000 attendees from 150 countries and 500 side events spread across a week (September 16-22), it will feature insights from top leaders like Balaji Srinivasan, Binance’s Richard Teng, and Solana’s Anatoly Yakovenko. Beyond talks, attendees can enjoy interactive activities like AI-driven art, virtual reality, and even padel and rock climbing for a fun, engaging experience.

What makes Token2049 special is its focus on community and inclusivity in Web3. Events like the Women in Blockchain Alliance Breakfast and Borderless Summit aim to make the crypto space more diverse and welcoming. Coinciding with the Formula 1 Singapore Grand Prix, the event offers a unique mix of fast-paced racing and cutting-edge blockchain tech. Token2049 promises to bring the global crypto community together and shape the future of the industry.

November: Trump Wins Presidency

In a surprising turn of events, Donald Trump, known for his pro-crypto stance, won the U.S. presidency. His victory sent shockwaves through the crypto market, sparking widespread optimism among investors. Many anticipated that his administration would bring looser regulations, tax cuts for cryptocurrency mining operations, and possibly even the establishment of a national Bitcoin reserve.

🚨 BREAKING: 🇺🇸Donald Trump officially elected President of the #UnitedStates!

The global #Crypto market is green today with #Bitcoin hitting an all-time high above $75K ❗️

With Trump’s pro-crypto stance, industry insiders are optimistic about regulatory support and U.S.… pic.twitter.com/2CrwQnxDvh

— TheNewsCrypto (@The_NewsCrypto) November 6, 2024

These potential changes were viewed as a major boost for the crypto industry, fueling expectations of a more favorable environment for digital assets and further driving market confidence.

December: Bitcoin Crosses $100,000

Bitcoin reached a huge milestone on November 5, breaking through the $100,000 mark and reaching a new high of $105,000 by December 4. This surge with open interest in Bitcoin futures exceeding $40 billion. The record-breaking price solidified Bitcoin’s position as a global asset, further fueling interest in cryptocurrencies as a viable alternative investment. The breakthrough not only marked a significant achievement for Bitcoin but also reinforced its growing prominence in the financial world, attracting more attention from both institutional and retail investors.

National Bitcoin Reserve Proposed

Event: The Trump administration unveiled plans to create a national Bitcoin reserve, which would function similarly to a gold reserve, holding Bitcoin as part of the U.S. monetary system. Simultaneously, over 132 countries began piloting or launching Central Bank Digital Currencies (CBDCs), with China leading the charge by expanding its digital yuan to 260 million wallets across 25 cities, while Europe started testing the digital euro. As VanEck also predicted.

Impact: These developments marked a significant shift in the global financial landscape, with Bitcoin gaining legitimacy as a sovereign asset and potentially becoming a cornerstone of future economic policy. The growing adoption of CBDCs highlighted the increasing importance of digital currencies backed by governments, potentially reshaping global financial systems. This convergence of Bitcoin as a national reserve asset and the rise of CBDCs sparked discussions about the future of money, privacy concerns, and the integration of digital currencies into cross-border transactions, positioning Bitcoin as a central figure in the evolving financial ecosystem.

FED rate cuts

Federal Reserve Chair Jerome Powell recently announced a rate cut to 4.50% and hinted at two more quarter-point cuts next year. However, he also made clear that the Fed is not allowed to own Bitcoin and has no plans to change laws regarding cryptocurrency ownership. Powell’s comments caused a major shake-up in the crypto market, with Bitcoin dropping below $100K, hitting around $98,000. While the rate cut was expected, Powell’s cautious stance on future cuts and his dismissal of Bitcoin as part of the central bank’s reserves dampened investor confidence, sending Bitcoin and other major cryptocurrencies into a decline.

The crypto market reacted strongly to Powell’s remarks, with Bitcoin dropping over 6% and other coins like Ethereum, XRP, Solana, and Dogecoin losing value. The total market value of cryptocurrencies fell by 4%, down to $3.5 trillion, and traders saw heavy liquidations.

Despite the downturn, Bitcoin managed to recover slightly, climbing back above $101,000 after reaching a record high of $108,000 earlier in the week. Meanwhile, President-elect Donald Trump’s pro-crypto stance, promising to make the U.S. the “crypto capital of the planet,” added uncertainty to the market as investors weighed the implications of both leaders’ positions.