Ethereum (ETH) investors seem to be confident that the cryptocurrency’s rebound above $3,400 could be the start of something better. This assertion could be attributed to their recent behavior, which has seen many holders refrain from selling despite a drawdown that happened recently.

Will ETH price accelerate upwards? This on-chain analysis looks at the possibility.

Ethereum Profit-Taking Dips, Bullish Sentiment Improves

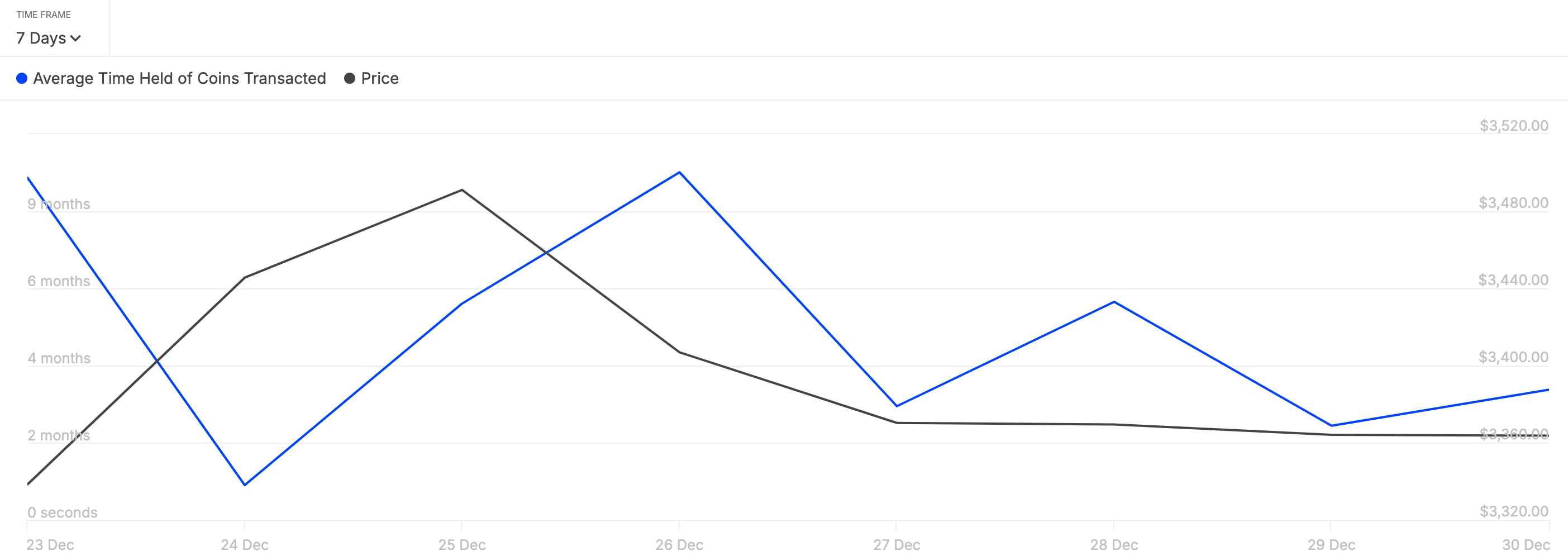

On December 30, the ETH price dropped below the $3,400 mark amid a short consolidation period. But as of this writing, the value has risen above that threshold. Findings show that Ethereum investors’ actions were vital in enabling it to record a quick recovery.

According to IntoTheBlock, the coin holding time has increased by 40% in the last seven days. The coin holding time measures the period a cryptocurrency has been held without being sold. When it rises, it means holders are not selling, but a decline implies otherwise.

Since it is the former for ETH, this suggests that Ethereum investors are bullish on the short-term price action. Thus, should the holding time sustain this momentum, then the cryptocurrency’s value could rise higher than its current position.

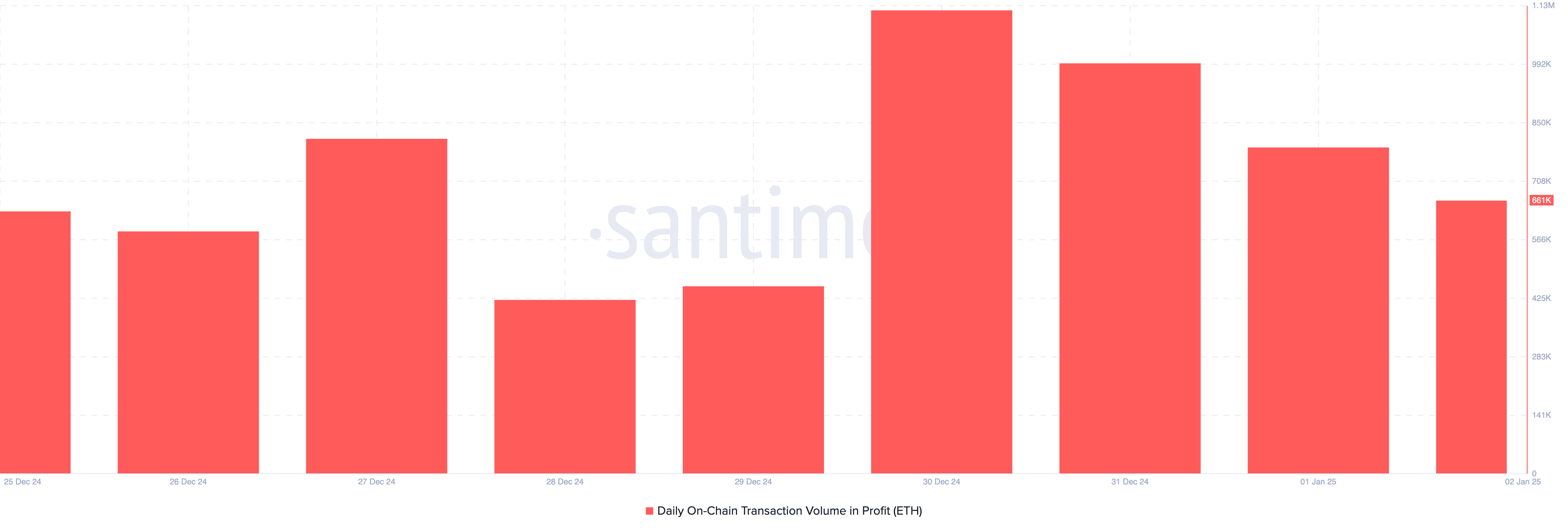

Despite the optimism and recent price increase, the on-chain volume in profit has decreased. On the last day of 2024, the transaction volume in profit was 995,000 ETH. Today, it has decreased to 661 ETH.

This decline reinforces the bullish sentiment around Ethereum investors. Should the figure continue to decline, then Ethereum’s price is less likely to experience selling pressure. Instead, the cryptocurrency might inch toward a notable uptrend.

ETH Price Prediction: Run Above $4,000 Very Close

On the technical side, bulls have successfully defended the support at $3,328. Furthermore, the Money Flow Index (MFI) reading has increased. The MFI is a technical indicator that measures the level of buying and selling pressure around a cryptocurrency.

When the rating rises, it indicates buying pressure. But when it drops, it indicates selling pressure. With the former happening, ETH might close above 4,111 soon. If validated, then the price could jump toward the $4,500 mark.

However, if bears tug Ethereum’s price below the support at $3,328, this might not happen. Instead, ETH might slide to $3,081. In a highly bullish scenario, it could decline to $2,878.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.