Peter Schiff, the chief economist and global strategist at Euro Pacific Asset Management, has voiced strong concerns over the Federal Reserve’s recent economic strategy. In a post on X, Schiff warned that the Fed’s policies are leading to long-term damage, particularly regarding inflation.

According to Schiff, inflation is expected to rise in the coming year. He suggested that any future rate cuts by the Fed would likely be aimed at averting a financial crisis, boosting asset markets, or providing relief to struggling banks and labor markets, not to reduce inflation.

Fed officials were doing damage control today following Powell's comments on Wednesday. Inflation is likely headed higher next year. So, if the Fed does cut rates, it's only to avert a financial crisis, prop up asset markets, bail out banks, or to "stimulate" a weak labor market.

— Peter Schiff (@PeterSchiff) December 20, 2024

On Wednesday, the Federal Reserve reduced its key interest rate by a quarter-point, marking the third rate cut this year. The move, however, was coupled with a notable shift in the central bank’s outlook for 2025. The Fed now expects to slow the pace of rate cuts next year, primarily due to persistent inflation.

US Fed change 2025 economic projections

According to recent reports, the US central bank’s projections for the rate have been revised upward to 3.9%, up from 3.4% in September. Additionally, inflation expectations were adjusted from 2.1% to 2.5%, indicating a more difficult battle ahead in the coming years.

Fed Chair Jerome Powell defended the decision during a news conference, stating that the slower pace of rate cuts reflects both the higher-than-expected inflation this year and the anticipation of continued inflationary pressure into 2025.

Despite the rate reduction, Powell’s comments suggested a future trajectory of slow and cautious cuts to address inflation concerns.

Schiff, appearing on Fox Business after the Fed’s announcement, criticized Powell’s rhetoric, particularly his portrayal of the Fed’s hawkish stance on inflation. Schiff argued that Powell’s actions did not align with his words, pointing out that the Fed’s early rate cuts were premature. He contended that rates never reached restrictive levels, and cutting them further now would be a mistake.

Schiff also expressed skepticism over Powell’s claim that inflation could return to the Fed’s target of 2% in two years. He believes inflation will remain elevated, dismissing Powell’s projections as overly optimistic. “Inflation won’t be anywhere near 2% in two years. It’s going to be higher than it is right now,” Schiff remarked.

Impact of deficits and fiscal policy concerns

Schiff warned that the US may be heading for a scenario that could complicate economic conditions for the incoming Trump administration. As the administration prepares to take office in January, Schiff speculated that Trump may inherit a fragile economic environment marked by a sluggish economy and heightened financial risks.

Schiff’s concerns also extended to broader fiscal issues. A recent article on SchiffGold, that the economist reposted on X, highlighted the US government’s ballooning deficit.

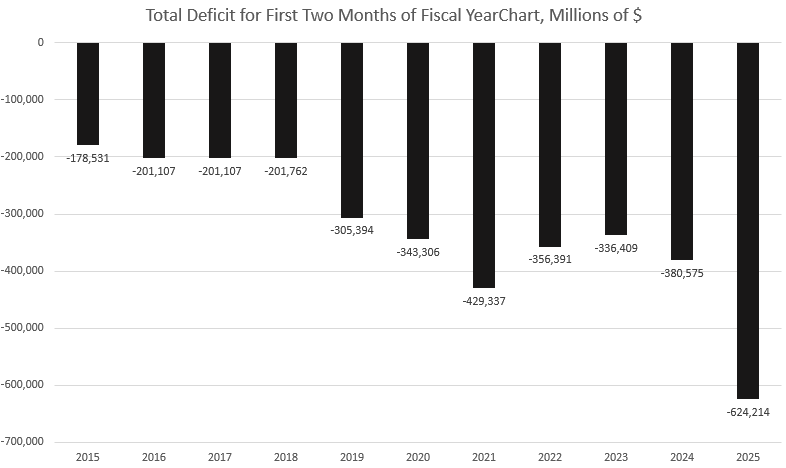

According to the latest figures from the Treasury Department, the US government spent $668 billion in November, adding to October’s $584 billion in spending. This brings the total deficit for the first two months of the 2025 fiscal year to a staggering $624 billion, the highest such total ever recorded for this period.

With government revenues amounting to just $628 billion, the US is on track for a record deficit by the end of the fiscal year, potentially exceeding $3.5 trillion. Schiff warns that this unprecedented spending is draining the real economy, and such fiscal policies could lead to long-term economic instability.

Schiff’s criticism of Trump’s policy suggestions

Schiff also criticized President-elect Trump’s approach to international energy markets, particularly his suggestion that the European Union should increase its purchase of US oil and gas. The economist argues that this would lead to reduced domestic supply and rising energy prices for Americans.

#Trump wants the EU to buy more U.S. oil and gas. If they do, the added demand will reduce domestic supply, pushing up energy prices for Americans. Also, if dollars are used to buy oil and gas instead of buying our debt, the result will be higher bond yields and mortgage rates.

— Peter Schiff (@PeterSchiff) December 20, 2024

He further contended that if dollars were used to buy US energy exports instead of financing debt, the result would be higher bond yields and mortgage rates, exacerbating economic challenges for households.

Yesterday, Schiff took a dig at Trump’s “cutting costs” policies, saying the US President-elect is campaigning for debt reduction, yet he is forcing the hand of House Republicans to “vote to suspend the debt ceiling for the next two years.” He believes this will set up the US Congress to “run up an unlimited amount of debt.”

From Zero to Web3 Pro: Your 90-Day Career Launch Plan