CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Global liquidity-ZScore divergence hits -3, historically preceding major BTC price rallies.

- Binance buys $250M BTC, Metaplanet adds 150 BTC; selling pressure drops post-March lows, aiding recovery.

A rare buy signal has appeared for Bitcoin, triggered by a divergence between global liquidity trends and BTC’s price. This metric, which aligns Bitcoin’s logarithmic price scale with global money supply data, historically precedes major price movements.

The current signal coincides with institutional buying from firms like Binance and Metaplanet, alongside reduced selling activity—factors that may influence Bitcoin’s near-term trajectory.

The indicator uses a Z-Score model, flashing green when values drop below -3 and red when exceeding +3. Past signals have aligned with key market shifts: a buy alert in early 2016 preceded Bitcoin’s climb from under $500 to over $1,000, while a 2017 sell warning occurred just before BTC’s crash from its then-peak near $20,000.

Similarly, a 2020 buy signal preceded Bitcoin’s ascent to record highs. ETHNews analysts suggest the current green signal reflects improving liquidity conditions, which often correlate with upward price pressure.

Binance purchased $250 million worth of Bitcoin in the past 24 hours, transferring the tokens to market maker Wintermute. Japanese firm Metaplanet added 150 BTC to its holdings, echoing moves by BlackRock and MicroStrategy during recent price dips.

MM Update: #Binance just bought back at least $250m $BTC $ETH $SOL in the last hour. pic.twitter.com/yQF56lBzOK

— MartyParty (@martypartymusic) March 24, 2025

Such institutional activity typically increases demand, potentially drawing retail investors into the market. While these purchases do not guarantee price gains, they signal confidence in Bitcoin’s intermediate-term value proposition.

Disclosure: https://t.co/d1UIwxIMcL

— Metaplanet Inc. (@Metaplanet_JP) March 24, 2025

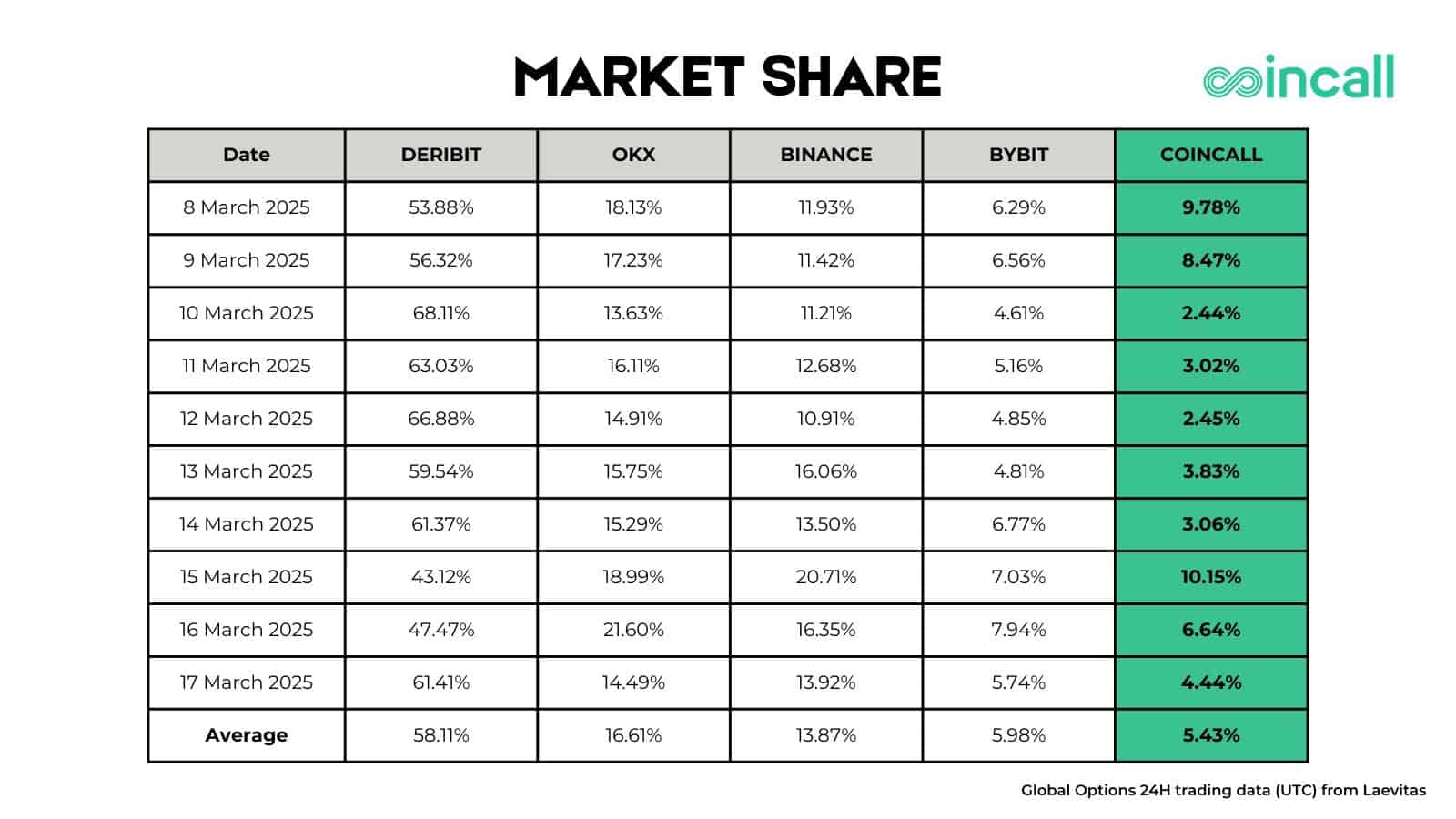

Selling pressure, which drove BTC from $95,000 to $75,000 between late February and mid-March, has eased. Data shows net taker volume—a measure of selling activity—declined sharply in March, coinciding with Bitcoin’s rebound above $85,000 by March 20.

Fewer large-scale liquidations and stable macroeconomic conditions have contributed to this stabilization. ETHNews notes that controlled asset exits, paired with institutional accumulation, create conditions for gradual price recovery.

Bitcoin’s recent performance underscores the interplay between macro liquidity and crypto-specific demand. While historical patterns suggest potential upside, the asset remains sensitive to shifts in institutional behavior and broader economic trends.

Current buying activity and tempered selling could lay groundwork for renewed momentum, but sustained growth hinges on continued equilibrium between inflows and market supply.