Kaspa (KAS) is in a price consolidation, with technical indicators and market data offering insights into its recent performance.

Moreover, an analysis of Kaspa’s daily chart on TradingView and CoinGlass data highlights key trends, including reduced volatility and bearish momentum. This data also indicates shifting market participation, setting the stage for potential market shifts.

Kaspa Price Analysis

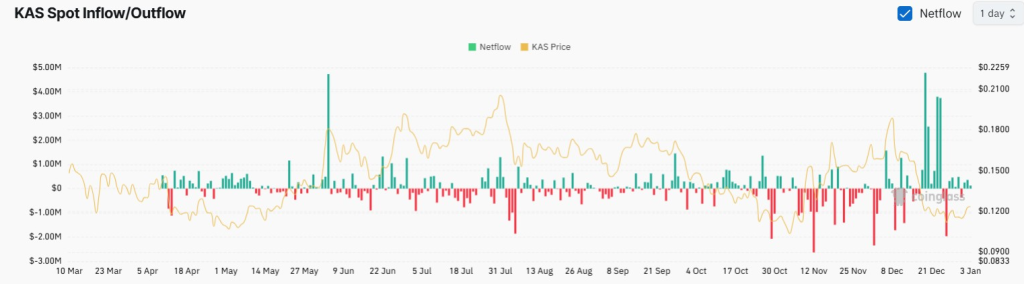

The KAS daily price chart, as analyzed on TradingView, shows the cryptocurrency trading in a tight range between $0.10 and $0.20 over the past few months.

Currently priced at $0.12349, KAS exhibits minor upward movement of 0.50% for the day. The price trend has been downward since mid-September, but recent activity suggests consolidation around $0.12, potentially forming a base.

The chart’s Bollinger Bands show contracting bands, an indication of less market shifts. The positions of the top and lower bands are $0.14601 and $0.10110, respectively.

Moreover, the middle band (SMA-20) aligns closely with the current price. This alignment reflects a consolidation phase, suggesting that KAS may experience a breakout as volatility returns.

Ichimoku Cloud Indicates Bearish Sentiment

The Ichimoku Cloud analysis portrays a bearish sentiment, with the price trading below a red cloud. The Tenkan-Sen and Kijun-Sen lines also indicate short-term bearish momentum, while the future cloud remains red, signaling resistance near $0.14 to $0.15. A trend reversal would require the price to break above this level.

There may be a bullish crossover imminent as the MACD line gets closer to the signal line. The indicator stays below zero, showing that the negative trend has not yet reversed, even though the histogram has turned green, confirming decreased bearish momentum.

Read also: Cardano (ADA) Price Could Hit $12, Expert Predicts – Here’s Why

RSI and Volume Indicate Stabilization

The RSI sits at 44.56, showing that KAS is emerging from oversold territory. The upward movement of the RSI suggests growing bullish momentum. However, muted volume levels during the consolidation phase indicate limited market participation, with traders likely awaiting a clearer trend.

Resistance levels are $0.14 and $0.15-$0.16, while key support levels are $0.12 and $0.10-$0.11. Stronger upward momentum may be possible if these resistance levels are broken.

Spot Inflows and Outflows Highlight Market Dynamics

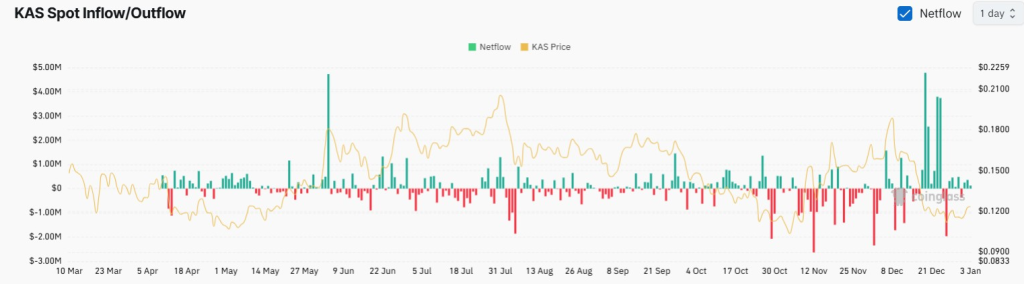

CoinGlass data reveals a strong correlation between Kaspa’s spot inflows/outflows and price movements. Heavy outflows during November coincided with a sharp price drop from $0.18 to $0.12, signaling strong selling pressure.

Conversely, late December inflows exceeding $4 million led to a temporary rebound toward $0.16, although resistance capped the gains. Early 2025 shows moderate inflows, with the price stabilizing near $0.12, reflecting cautious buyer activity.

The analysis indicates a consolidation phase for Kaspa, with potential for renewed momentum if key resistance levels are breached.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link