CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Jack Dorsey, the co-founder of Twitter and CEO of Block Inc., is once again doubling down on his long-standing Bitcoin conviction.

On Thursday, in an interview with Bitcoin News, he answered the futuristic fictional question of “what if Bitcoin fails in future? How did it Fail?”.

He reasoned, “Bitcoin fails and becomes irrelevant if it cannot be used by people on a daily basis. If it remains as a store of all, I don’t think it is relevant at all.”

However, as soon as his comments on the importance of real-world utility of Bitcoin Payments came in limelight, Manna Bitcoin Wallet Founder Adam Simecka questioned him on why Jack Dorsey’s own platform, Block, still doesn’t accept Bitcoin payments for the Bitkey and Square.

In response to it, he confirmed that the team is working on it and will soon integrate Bitcoin Payments in Block ecosystem.

His response has sparked fresh conversations around the future of crypto payments — and forces us to mull whether Dorsey’s vision can meaningfully challenge incumbent players like PayPal, Coinbase, and traditional payment rails or not.

Block’s Bitcoin Push

The integration, though still in development, is being designed with a focus on increasing the utility of Bitcoin Payments. This will help in making Bitkey a central piece of Block’s Bitcoin push.

Bitkey, which launched globally in December 2023, is a self-custody wallet that allows users to manage their Bitcoin without relying on third-party custodians.

This latest development will allow its current user base of 57 million to use Block’s hardware and software products—like Square readers and the Cash App—to start accepting Bitcoin for goods and services.

This vision marks a stark departure from the dominant crypto narratives of recent years, where Bitcoin is treated more as a store of value. It is often likened to digital gold, rather than as a medium of exchange. Dorsey, however, has always seen Bitcoin as a currency for the internet — a decentralized, censorship-resistant alternative to fiat and this development is evident of it.

Can Jack Dorsey’s Block then Compete with Payment Giants?

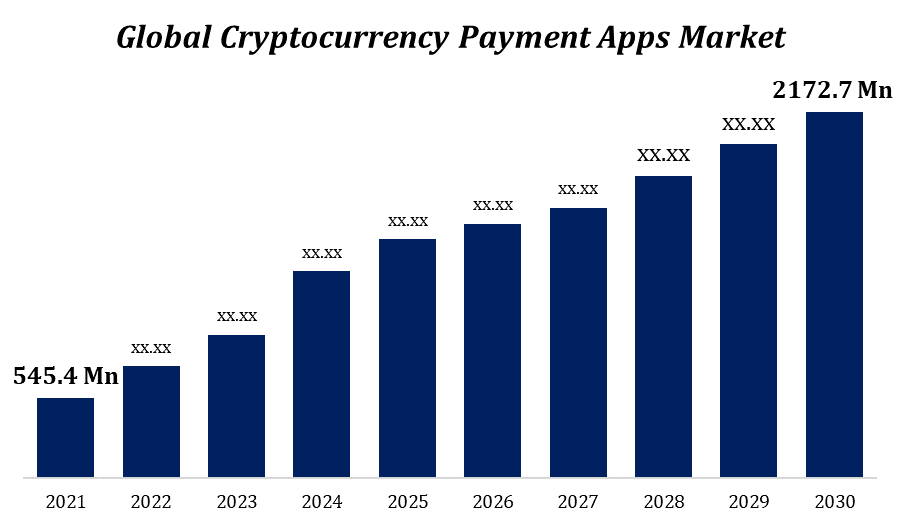

However, with this development, Block would soon enter a payments space that has grown increasingly competitive.

PayPal, for instance, has been allowing crypto purchases since March 2021. It enables payments with its “Checkout with Crypto” feature— but through custodial wallets where users don’t control their keys.

Coinbase also offers similar services but remains primarily an exchange and custodial platform. BitPay, CoinGate, and Binance Pay are also other dominating players in the crypto payments space.

But Block’s advantage could lie in its non-custodial, Bitcoin-native approach. By emphasizing user sovereignty and decentralization, Dorsey can tap into the core ethos of crypto — something often lost in the convenience-focused products from mainstream fintech.

The question of scalability also looms large. Bitcoin, in its current form, cannot handle thousands of transactions per second. While the Lightning Network has emerged as one solution for real-time BTC payments, it still faces user experience and adoption hurdles. There are Bitcoin Layer2s like Bitlayer working on the similar objective. It’s unclear whether Block will leverage Lightning or pursue another Layer 2 integration for scaling.

The Road Ahead

Block has not revealed a launch date for the new Bitcoin payment feature, but insiders suggest pilot tests may begin by mid-2025. If successful, this could mark a significant turning point for Bitcoin as a usable currency, not just a speculative asset.

Still, the transition won’t be without obstacles. The increasing competition is something Jack Dorsey would need to tackle. Additionally, consumer demand for paying in Bitcoin remains relatively low. Further, regulatory uncertainty around crypto payments persists in several markets. There’s also the matter of educating merchants and customers about how Bitcoin transactions work.

Thus, no doubt a boost to Bitcoin’s growing role in DeFi and real-world utility, the roll out must be implemented strategically with all the challenges in mind.

Disclaimer: The content may include the personal opinion of the author and is subject to market conditions. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.