CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Deaton’s announcement was made after Coinbase gained access to unredacted FDIC files related to the Chokepoint 2.0 controversy. Meanwhile, Bitwise CEO Hunter Horsley expects more crypto-friendly policies under Trump in 2025. In Congress, Georgia Rep. Mike Collins disclosed new crypto investments, which reignited debates over lawmakers trading cryptocurrencies. Bitcoin is projected to experience some short-term volatility ahead of Trump’s inauguration and the FOMC meeting at the end of January.

John Deaton Takes Aim at Chokepoint 2.0

John Deaton, a former United States prosecutor and well known advocate for cryptocurrency, extended an offer to the incoming Trump administration to lead an investigation into the alleged Operation Chokepoint 2.0. It is rumored that this initiative targeted the crypto industry by severing its access to traditional banking services.

In his statement on X, Deaton addressed President Donald Trump, Vice President JD Vance, and other key administration figures. He stated that actions like this, if left unchallenged, could set a very dangerous precedent of regulatory bodies undermining industries they oppose.

Deaton also pointed out that the issue transcends crypto, and described it as a broader fight against unchecked bureaucratic power and the erosion of institutional integrity. He offered to undertake the investigation without compensation because he believes in the importance of uncovering the truth over financial gain. Deaton also added that Americans deserve transparency more than he or anyone else needs a taxpayer-funded paycheck.

His proposal coincided with a court ruling that allowed Coinbase to access unredacted files from the Federal Deposit Insurance Corporation (FDIC) to scrutinize its role in the alleged regime. According to Coinbase’s chief legal officer Paul Grewal, these documents reveal a coordinated effort to suppress a wide range of crypto activities, from basic Bitcoin transactions to more complex offerings.

The alleged architect of Operation Chokepoint 2.0, Martin Gruenberg, resigned as FDIC Chair in November, which added even more intrigue to the controversy. The rumored initiative gained notoriety after the collapse of key banking partners for crypto exchanges, like Silvergate and Signature Bank, in March of 2023. These events left major exchanges, including Binance, without reliable banking relationships.

Deaton’s renewed activism in the crypto space happened despite his loss in the Massachusetts Senate race to Democratic incumbent Senator Elizabeth Warren. The Nov. 5 election was a decisive victory for Warren, who Deaton criticized during heated debates for focusing more on building an “anti-crypto army” instead of addressing issues affecting the middle and lower classes. Despite this setback, Deaton is still a vocal figure in the crypto advocacy landscape.

Trump Policies Could Propel Crypto Growth in 2025

Bitwise Asset Management CEO Hunter Horsley recently shared his optimism about the Trump administration’s economic policies and their potential impact on the cryptocurrency landscape in 2025. In a recent X post, Horsley predicted that the administration might “unfreeze” mergers and acquisitions, which could pave the way for major corporations to expand further. He mentioned scenarios like Amazon acquiring Instacart or Google buying Uber, and suggested that the economic shift could lead to larger companies growing even bigger while mid-sized players might struggle.

Horsley described 2025 as a pivotal year by stating that the world is on the “precipice of change.” He also stated that progress requires change and expressed his enthusiasm for the opportunities ahead.

After pinning a tweet listing the top 70 corporate Bitcoin holders, Horsley predicted an influx of corporations adopting Bitcoin this year. Supporting this view, HODL 15 Capital reported that 11 publicly traded companies have bought more Bitcoin since last Monday, while at least 16 billionaires have also invested in the cryptocurrency.

Horsley’s comments were made after MicroStrategy co-founder Michael Saylor’s hint at yet another Bitcoin acquisition. On Sunday, Saylor shared a Bitcoin chart on social media, which is a move that often precedes a purchase announcement.

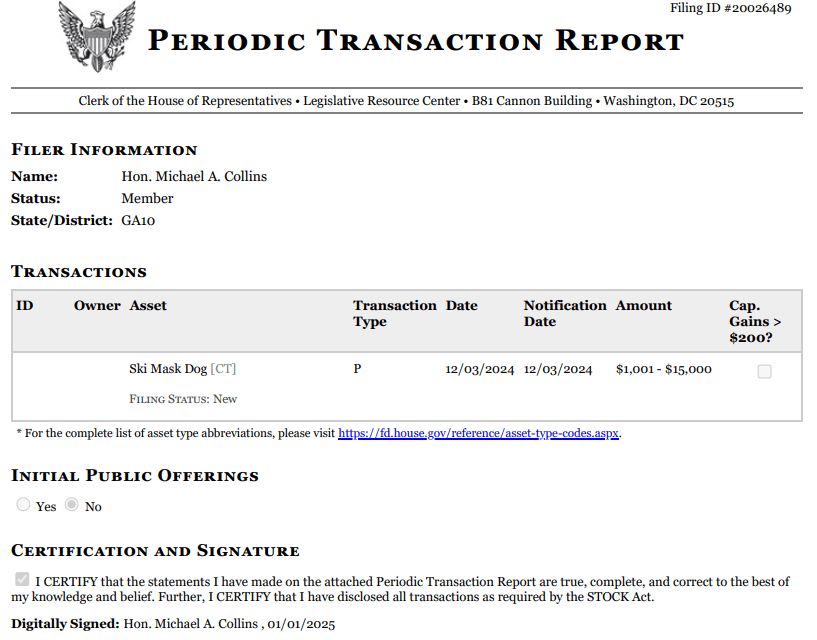

Georgia Congressman Reports Crypto Purchases

The attraction of crypto was made very evident after Representative Mike Collins of Georgia disclosed a crypto investment in a financial report that was filed on Jan. 1. Collins reported buying between $1,001 and $15,000 in Ski Mask Dog (SKI), which is a token that was launched in May of 2024. The report, along with a previous filing from December, showed that Collins made three separate purchases of SKI between Dec. 1 and 3, coinciding with a surge in crypto prices after the US elections.

Collins is a Republican who secured reelection in Georgia’s 10th congressional district with more than 63% of the vote. He also previously disclosed investments in Ethereum (ETH), Velodrome (VELO), Aerodrome Finance (AERO), and The Graph (GRT). The STOCK Act requires US lawmakers to report stock and cryptocurrency trades, and Collins appears to be the only member of Congress to have filed such a report in 2025 so far.

SKI experienced large price movements after trading below $0.01 since its launch. The token reached an all-time high of over $0.35 on Dec. 5 before stabilizing. It is unclear if Collins’ investment is connected to his election victory, but he voted in favor of legislation favorable to the crypto industry, including the Financial Innovation and Technology for the 21st Century (FIT21) Act. Despite his investments, Collins has not made crypto much of a focal point of his policy agenda.

The broader issue of lawmakers taking part in crypto trading has attracted a lot of criticism. In fact, in July last year, a bipartisan group of senators proposed changes to the STOCK Act to restrict these trades by lawmakers. It is still unclear if Congress will consider similar legislation in its upcoming session.

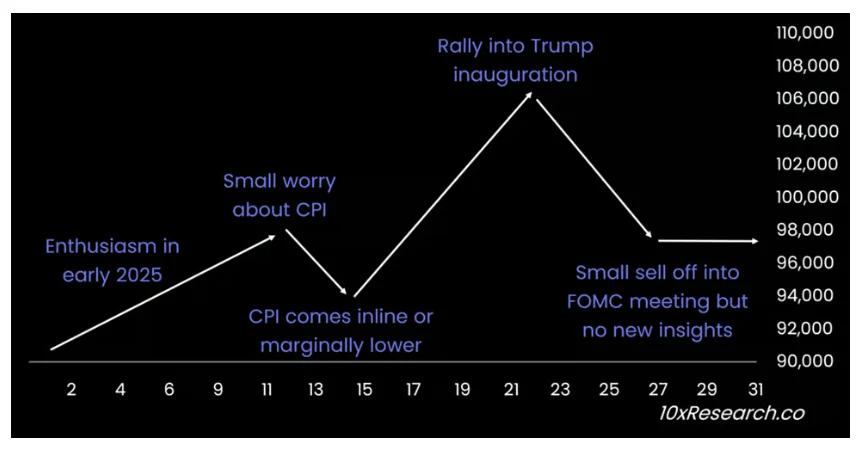

Trump Rally Could Push Bitcoin Before Fed Pullback

Despite the optimism surrounding Trump’s influence on the crypto sector in the next year, a Bitcoin rally anticipated ahead of Donald Trump’s presidential inauguration on Jan. 20 may lose steam toward the end of the month as the Federal Reserve prepares its first interest rate decision of 2025. In a Jan. 5 report, 10x Research founder Markus Thielen projected a positive start to the month for Bitcoin, with a rally possibly fueled by favorable inflation data on Jan. 15. However, he also warned that the momentum could weaken ahead of the Federal Open Market Committee (FOMC) meeting on Jan. 29.

Projected Bitcoin path for January 2025 (Source: 10x Research)

According to CME Group’s FedWatch tool, there is an 88.8% chance that the federal target rate will remain between 425 and 450 basis points after the meeting. Bitcoin previously dropped by close to 15% after the Dec. 18 FOMC meeting, when the Federal Reserve reduced its 2025 rate cut projections from five to two.

Thielen identified the Federal Reserve’s policies as the primary risk to Bitcoin’s rally but pointed out that lower inflation in 2025 could eventually support market optimism. He forecasted Bitcoin will trade between $97,000 and $98,000 by the end of January.

John Glover, chief investment officer at crypto lending firm Ledn, suggested that Bitcoin could initially pull back to $89,000 before rebounding to $125,000 by the end of the first quarter. He also predicted further fluctuations, with Bitcoin retracing to $100,000 before targeting $160,000 in late 2025 or early 2026.

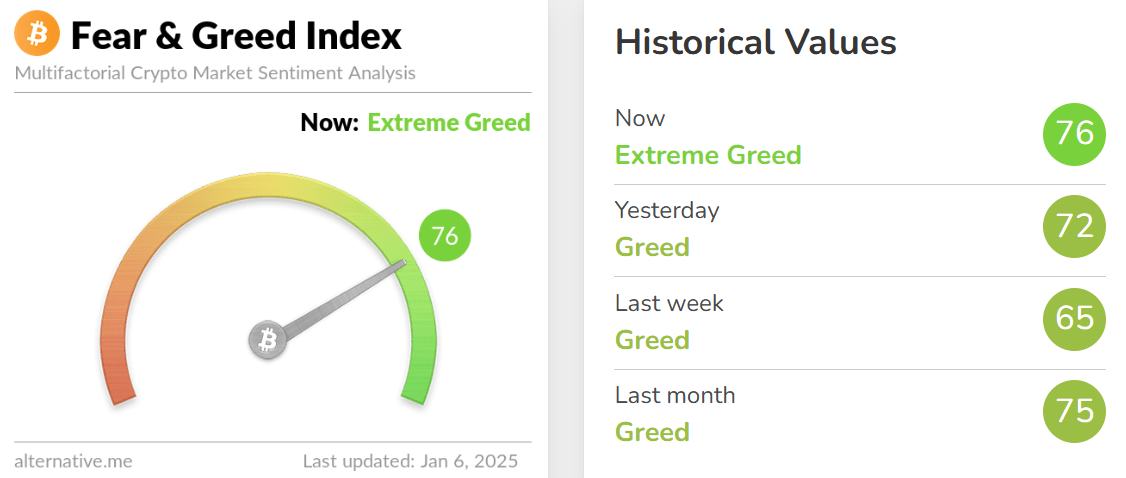

Crypto fear and greed index (Source: Alternative.me)

Despite short-term volatility, the Crypto Fear & Greed Index returned to the “Extreme Greed” zone on Jan. 5, with a score of 76. The index fell to the “Greed” zone on Dec. 27, where it stayed for 10 days.