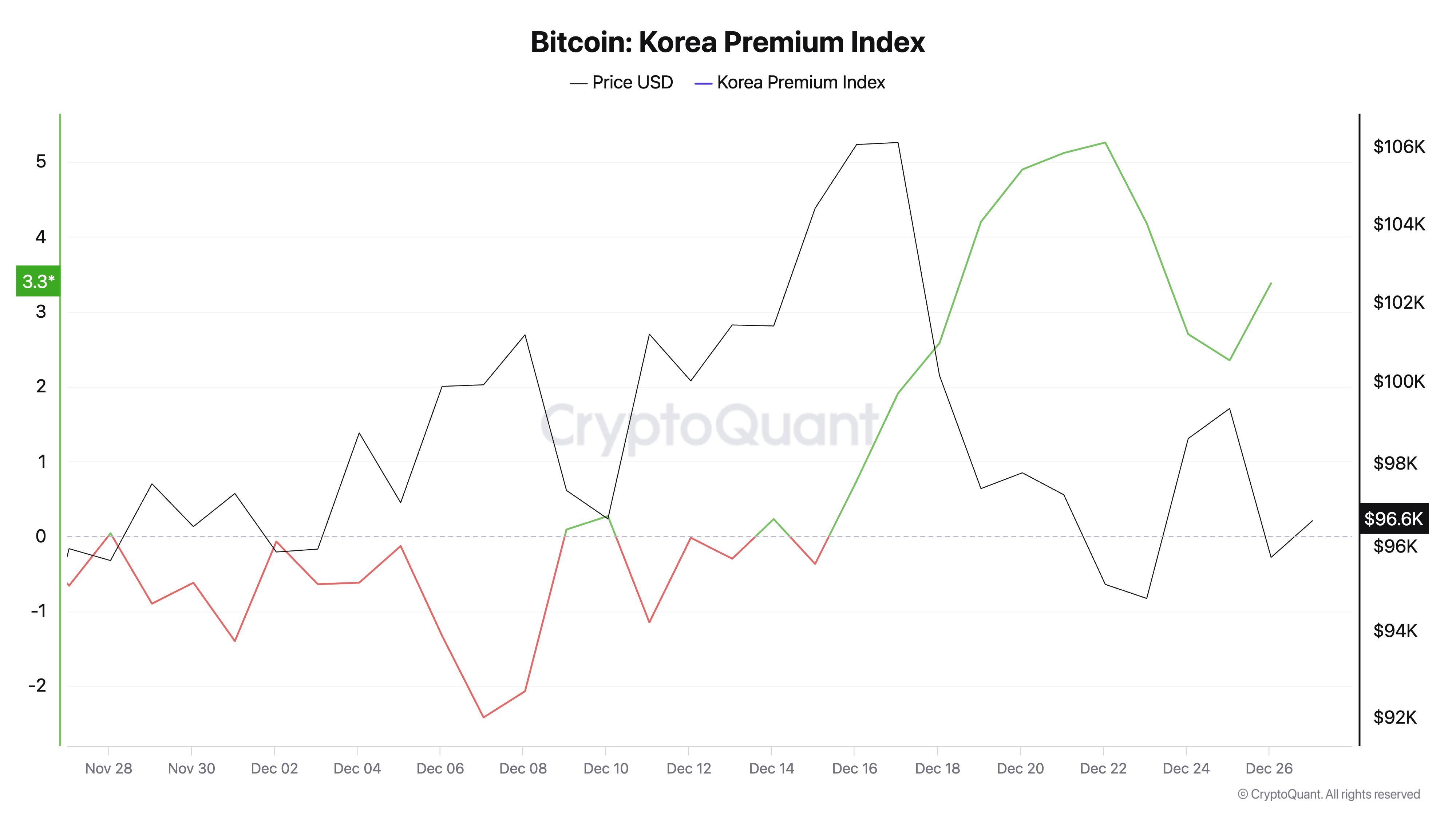

The Kimchi premium has seen a definite rebound after Christmas, recovering to 3.83% on Dec. 27. While this is still significantly lower than the 5.26% recorded on Dec. 22, it still represents a significant difference in Bitcoin prices between South Korea and global markets.

The current rebound comes amidst political and economic turmoil in South Korea, marked by the impeachment of the acting president, Han Duck-soo. This impeachment comes just two weeks after parliament voted to impeach its President Yoon Suk Yeol.

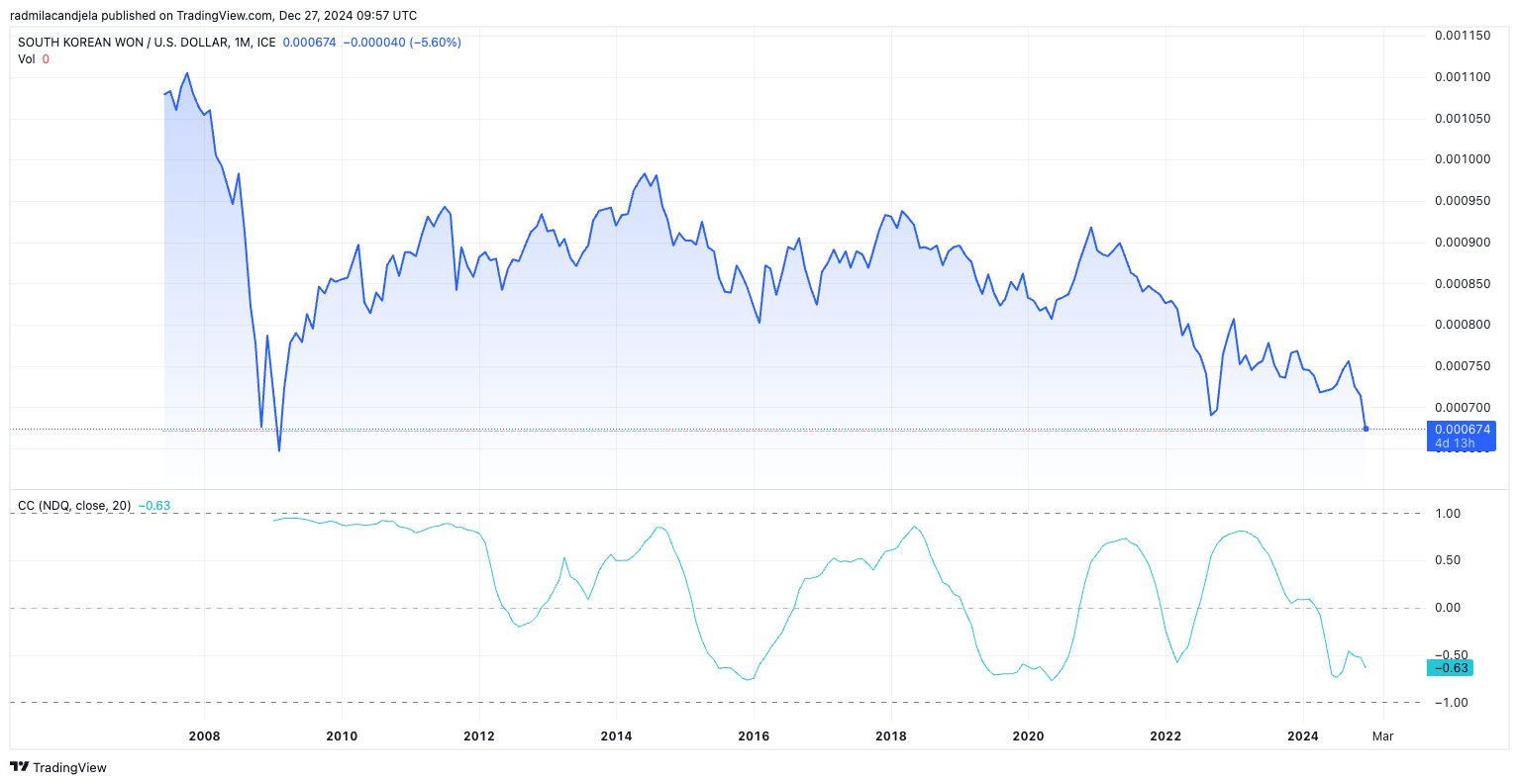

The ongoing political crisis created fears of economic instability, prompting heightened demand for Bitcoin. As local investors sought refuge in Bitcoin, the increased demand drove domestic prices higher than global averages. The ongoing devaluation of the Korean won, which reached its lowest level against the dollar since February 2009, further fueled the rise in the premium.

The kimchi premium has been particularly volatile in the second half of 2024. Late November and early December saw a significant decline, with the premium turning negative. Several factors led to this decline, the main one being political instability in the country. On Dec. 3, President Yoon Suk Yeol declared he was imposing martial law, citing the need to protect the country from political opposition. Shortly after, Yoon and officials from his government were arrested and indicted on allegations of insurrection, while Yoon is facing an impeachment trial.

The political unrest led to fears of regulatory tightening by South Korean authorities. Stricter measures on crypto exchanges aim to reduce speculative trading, which weakens local demand for Bitcoin. Additionally, global arbitrage activity played a role in narrowing the premium. As international traders exploited the price difference, Bitcoin inflows into South Korea increased, balancing supply and demand. Market sentiment also shifted during this period, with South Korean traders stepping back from speculative activity as global Bitcoin prices consolidated.

Despite these changes, the won continued to weaken against the dollar. Given that the devaluation didn’t immediately trigger an increase in the kimchi premium, we can safely say that local market conditions at the time were more influenced by regulatory and political factors.

By mid-December, the kimchi premium saw a sharp resurgence. This resurgence occurred against the backdrop of more political instability when the country’s acting president also faced impeachment. However, this time, fears of economic turmoil and potential capital controls led investors to turn to Bitcoin as a hedge, increasing local demand.

The speculative behavior often accompanying periods of uncertainty also intensified, further inflating Bitcoin prices in South Korea relative to global markets. Meanwhile, the continued depreciation of the won added to the attractiveness of Bitcoin as a store of value, contributing to the upward trajectory of the premium. The combination of these factors created a perfect storm, leading to a recovery of the premium.

The impact of the kimchi premium isn’t limited to South Korea. When the premium is high, it creates arbitrage opportunities for traders to move Bitcoin into South Korea, which increases cross-border capital flows. This arbitrage activity often results in short-term volatility as markets adjust. Additionally, a high premium can distort global Bitcoin price signals, as South Korea frequently represents a significant share of trading volume. Rising premiums also tend to attract regulatory scrutiny, as authorities aim to curb speculative trading and protect retail investors from potential risks.

On the positive side, the premium has historically confirmed Bitcoin’s role as a hedge against economic and political instability. The kimchi premium has traditionally been a barometer for South Korean market sentiment and macroeconomic conditions. During speculative booms, such as in late 2017 and early 2021, the premium reached double-digit levels, driven by a frenzy of retail demand. In contrast, periods of negative premium, like mid-2024, reflected tighter regulations and diminished speculative interest. The recent rise mirrors these historical patterns but is rooted in unique circumstances, including a political crisis and significant currency devaluation.

The post Kimchi premium recovers as KRWUSD drops to 15-year low appeared first on CryptoSlate.