CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

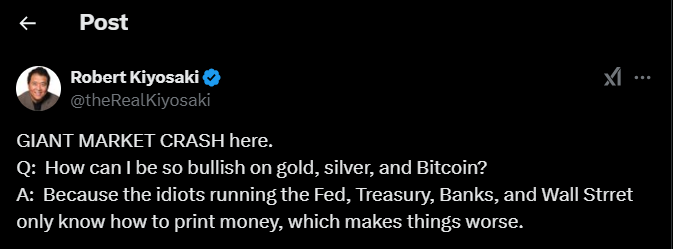

- Robert Kiyosaki warns of a market crash caused by reckless monetary policies and excessive money printing.

- He suggests investing in gold, silver, and Bitcoin as secure ways to protect wealth during economic challenges.

- Kiyosaki predicts Bitcoin could reach $175,000 to $350,000 by 2025 due to its scarcity and rising demand.

Kiyosaki’s Belief in Gold, Silver, and Bitcoin

Financial expert and author of Rich Dad Poor Dad, Robert Kiyosaki, has been warning about a “giant market crash.” Recently, he pointed out on X. That the reckless monetary policies of the U.S. Federal Reserve and other financial institutions are major contributors to the impending economic downturn.

He believes in gold, silver, and Bitcoin. He also believes them to be an excellent hedge against inflation and the economic problems and does not foresee a bright future in general.

Kiyosaki cited the government’s excessive printing of “fake money” as the major cause for aggravating inflation, devaluing fiat currencies, and widening the gap between wealth. He called upon investors to save real assets that can act as a hedge against the impending crash.

Traditionally, gold and silver have preserved their purchasing power in a downturn. Kiyoski believes Bitcoin is the modern version-a decentralized asset not pegged to any government.

Bold Predictions for Bitcoin

Kiyosaki further predicts that Bitcoin will hit between $175,000 and $350,000 by 2025. This he attributes to the fact that Bitcoin is scarce and it is being increasingly used by both institutions and individuals. The author also added that Bitcoin has the capacity to protect one against inflation. And how it keeps its buying power during uncertain economic times.

Market analysts agree with Kiyosaki’s positive view, saying Bitcoin’s price might go over $108,000 if it crosses the important $100,000 mark. Bitcoin is currently priced at $98,261, which is a 2% increase for the day, but trading volumes have dropped a little.

People are as confident in Bitcoin as they are in the overall market. Many institutions also believe gold and silver will do well. Goldman Sachs thinks gold will reach $3,000 an ounce by 2025 when interest rates go down. Deutsche Bank expects gold to average $2,725 per ounce. Silver is worth investing in more because there is not enough being produced.

Inflation is still rising, and interest rates are unlikely to go low anytime soon, so tangible assets are a haven. The takeaways from Kiyosaki and the alternative assets that are growing, such as Bitcoin, speak to strategic diversification. Indeed, investors are preparing for uncertain times, building resilient portfolios rather than focusing on preparation for stormy weather.

The next market crash may break the traditional financial systems, but for those who believe in Kiyosaki’s view, gold, silver, and Bitcoin will be the way to success in tough times.

Highlighted Crypto News Today

What’s Behind Just a Chill Guy’s (CHILLGUY) 50% Price Surge?