Lido’s decision was approved by 99% of Lido DAO voters, and is very similar to Lido’s previous exit from Solana. Meanwhile, Aave is considering a similar move due to the risk profile of bridged assets and recent proposals to redeploy $1.3 billion in stablecoin reserves into Ethereum vaults. This plan caused some controversy in the crypto community over added risks. In contrast, Eliza Labs partnered with Stanford University to explore the role of AI agents in Web3 systems to improve trust, coordination, and decision-making in decentralized networks.

Lido Finance Exits Polygon

Lido Finance, the leading liquid staking protocol, announced it is winding down operations on the Polygon network due to limited user adoption, evolving ecosystem dynamics, and a strategic refocus on Ethereum. The decision was made after a request by Lido DAO Token (LDO) holders, extensive DAO forum discussions, and a community vote in November. During this vote, 99% of participants favored the proposal. Two proposals were initially presented: a full transition away from Polygon and a reevaluation of the middleware’s economic model.

According to Lido, maintaining operations on Polygon proved resource-intensive with very limited rewards and diminishing demand for liquid staking solutions, especially as the DeFi sector increasingly shifted focus toward zkEVM solutions. Shard Labs, the team responsible for bringing Lido’s staking service to Polygon in 2021, acknowledged that the DeFi migration to zkEVM weakened the role of Polygon’s proof-of-stake (PoS) network as a foundational building block for other protocols.

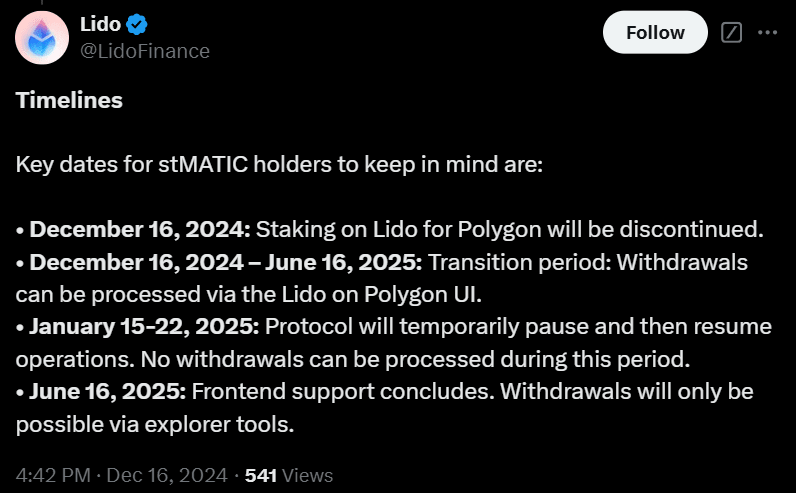

On Dec. 16, Lido stopped accepting staking requests on Polygon, though users will still be able to withdraw their staked MATIC through Lido’s interface until June 16 of 2025. However, rewards have been discontinued, and the protocol will temporarily suspend all withdrawals between Jan. 15 and Jan. 22, 2025. By June 16, front-end support will end entirely, and withdrawals will only be accessible through browser tools.

Lido’s exit from Polygon happened after a similar move last year when the protocol stopped operations on Solana due to unsustainable financials and low fees. Lido’s Solana operations launched in September of 2021 but struggled to maintain profitability.

Lido holds about $45 million in staked tokens on Polygon, while the network itself retains more than $1.2 billion in total value locked (TVL), according to DefiLlama data. Across all networks, Lido is still the largest liquid staking protocol.

Aave Also Considers Exiting Polygon

The community is also currently discussing the possibility of stopping operations on the Polygon network due to concerns over the risk profile of bridged assets. A proposal that was initiated on Dec. 13 by Aave chain founder Marc Zeller seeks to revise risk parameters for Aave v2 and v3 on Polygon.

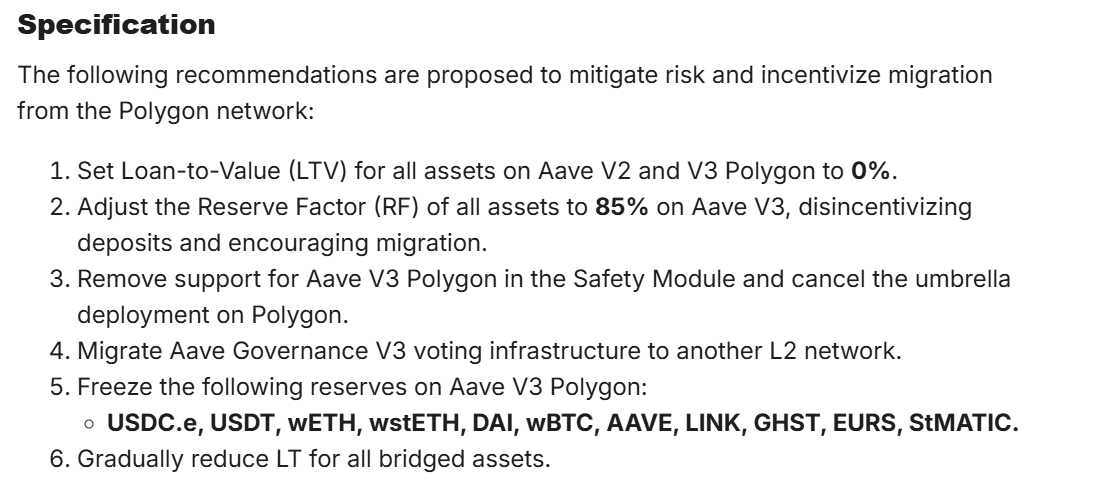

Zeller’s proposal was made after a Polygon governance plan to use over $1 billion in stablecoin reserves for yield farming on protocols like Morpho and Yearn. The proposed changes include setting loan-to-value (LTV) ratios to 0%, increasing reserve factors, and freezing certain assets.

Marc Zeller’s proposal (Source: Aave)

Setting the LTV to 0% will prevent users from using bridged assets as collateral, which reduces the risk of cascading liquidations in the event of bridge vulnerabilities. Additionally, freezing assets will stop interactions with multiple bridged tokens, including USDC.e, wETH, wstETH, WBTC, AAVE, LINK, GHST, StMATIC, USDT, EURS, and DAI.

Zeller believes that vulnerabilities in blockchain bridges pose very serious risks. Incidents like the Multichain and Harmony bridge hacks are perfect examples of this. He argued that revising Aave’s risk parameters will mitigate these risks while still incentivizing users to migrate from the Polygon network. Aave is one of the largest lending protocols on Polygon, with $461 million in total value locked (TVL), according to DefiLlama. Cumulative fees generated on Polygon for the Aave chain stand at about $122 million.

The discussion was started by a separate proposal on Dec. 12 from Allez Labs, Morpho Association, and Yearn.finance, which suggested deploying $1.3 billion in idle stablecoins held on the Polygon Portal bridge into yield-generating Ethereum vaults. This strategy will generate an estimated 7% annual yield, unlocking around $81 million in revenue that could be reinvested into Polygon’s DeFi ecosystem to incentivize liquidity and growth. Under the plan, Morpho’s vaults will serve as the liquidity protocol, Allez Labs would handle risk management, and Yearn would oversee rewards.

The proposal generated a lot of community debate, and most people seem to be opposing it due to concerns about added risk. Critics argue that stablecoin holders on the Polygon bridge consider it to be a low-risk environment, and reallocating funds into vaults will just add additional risk without offering corresponding rewards. Polygon Labs explained that the proposal is still only in its early days, and that security is a main priority for the ecosystem.

Blockchain bridges allow users to transfer tokens between different chains, and have become a major target for decentralized finance exploits. In fact, they accounted for over half of on-chain attacks between 2021 and 2022.

Eliza Labs Partners with Stanford

Other partnerships might perform a bit better than the ones with Polygon. Eliza Labs, the developer behind the AI-powered decentralized autonomous organization (DAO) ai16z, announced a partnership with Stanford University’s Future of Digital Currency Initiative to explore how artificial intelligence agents can improve Web3 systems.

The collaboration was revealed on Dec. 16, and will use Eliza Labs’ open-source AI agent framework, which is known as Eliza, to address critical questions about trust, coordination, and decision-making in decentralized financial networks.

The research is set to begin in 2025, and will focus on developing new frameworks to help AI agents establish and verify trust in digital currency networks, as well as investigate how these agents coordinate and interact in economic systems. Professors Dan Boneh and David Mazières from Stanford described the project as a unique opportunity to define the role of AI agents in digital economies.

Eliza is the AI agent that powers ai16z, which is a DAO created to automate on-chain trading and investment decisions. Its native token, AI16Z, hit a market cap of approximately $850 million since its launch in October. The DAO currently manages around $15 million, and Eliza-based AI agents are already being used by dozens of projects. Influencers in the crypto space have drawn comparisons between AI16Z and well known DeFi protocols like Aave, which played a pivotal role in the 2021 bull market.

The rise of AI-themed meme coins has also been quite impressive over the past few months. Projects like Zerebro (ZEREBRO) and aixbt by Virtuals (AIXBT) achieved market caps of close to $358 million and $202 million, respectively. Collectively, AI-themed meme coins bootstrapped over $3 billion in market capitalization since October of 2024.

Analysts believe this fusion of artificial intelligence and blockchain will fundamentally transform Web3, and allow autonomous AI agents to interact seamlessly with humans in decentralized digital economies.