CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

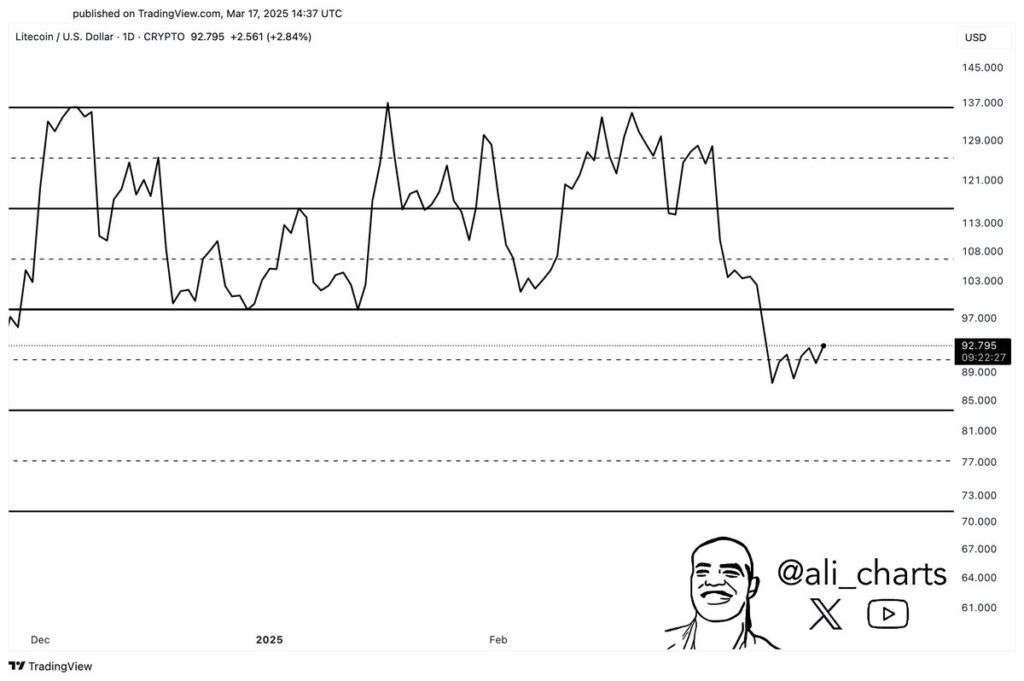

Litecoin price exceeded its trading channel by trading below, which suggested that prices may drop to a new level of $70.

The market value of LTC stands at $92.74 following its 1% increase yet its current breakdown indicates future price declines.

Its price data demonstrated its inability to maintain a position above $97, which stands as an essential resistance level.

The token could not build enough momentum before dropping from its peak value of $137 all the way to $89.

A temporary price increase existed as of press time, yet the primary market direction remained in the negative direction.

A failure to break above $97 by Litecoin could create opportunities for sellers to drive the price lower.

LTC primary support region spanned in the $80 region, suggesting a significant decline to $70 could develop in the coming sessions.

The price outlook for Litecoin suggested negative movement as long as the $97 resistance level remains beyond reach by bullish market forces.

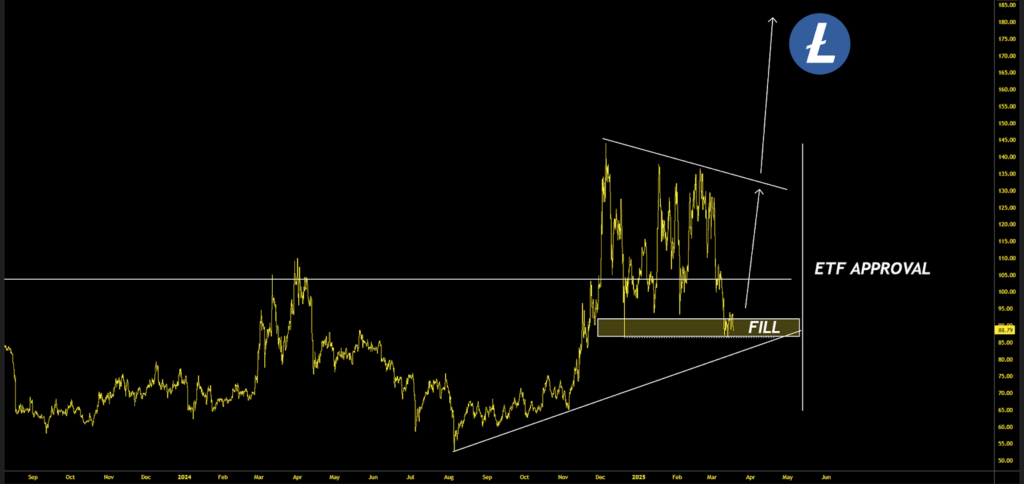

Litecoin Price at a Maximum Fill Zone Prior to ETF Approvals

The currency remains in an optimal accumulation state while it prepares to take place before upcoming ETF authorizations in May.

The $88.79 price point for Litecoin allowed it to challenge a solid support structure that likely will produce substantial market expansion.

The price movement remained confined in a descending wedge formation that acted as a bullish indicator for market reversal.

Structurally, LTC has a strong support area between $85 and $95 that will enable its price to rise toward $125 and potentially reach $140.

Additionally, a solid breakout would drive prices above $150 until they reach their estimated price target of $180.

The ETF approval represents a potential catalyst that could boost market demand.

Failure to maintain its fill zone could result in LTC retesting the $75 price range.

Market participants should track the $105 and $130 resistance points while following market sentiment trends.

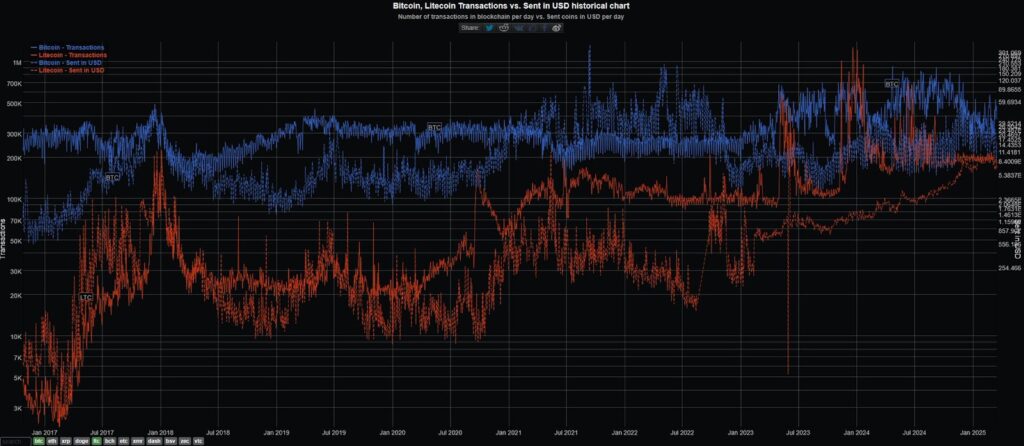

Litecoin Transaction over Historical USD Sent

LTC adoption rate demonstrates gradual expansion according to its transaction records.

The USD valuation of LTC transfers has grown substantially in recent years because of Litecoin’s expanding use case.

The gradual adoption of Litecoin over time suggests that an inevitable large-scale price adjustment will occur. Executive investors need to maintain leading positions to prevent losing value in LTC.

The number of transactions for Litecoin has shown a direct correlation with Bitcoin’s transaction growth rate.

Daily LTC transaction volume has exceeded 200K, which indicates the usefulness of this fast and economical transaction system.

The USD value sent through Litecoin has exceeded $1 Billion as trust and demand for the cryptocurrency continue to grow.

LTC’s robust on-chain activity amid market instability may reflect its effectiveness as a digital payment system.

Its growing adoption creates expanding conditions for substantially reduced pricing. Current trends suggest that Litecoin may rise above its existing valuation point.