CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Bitcoin has +50% odds to reclaim $109K ATH by July, per Swan Bitcoin CEO Cory Klippsten’s analysis.

- Current price: $88,210 (-14% post-Trump tariffs); consolidation phase precedes next bullish rally, per institutional accumulation trends.

Cory Klippsten, CEO of Swan Bitcoin, assigns a >50% probability to Bitcoin (BTC) reclaiming its $109,000 all-time high (ATH) by late June. However, he emphasizes that macroeconomic volatility—driven by U.S. tariff policies and inflation uncertainty—must first subside to catalyze upward momentum.

“The market first needs to digest tariffs, trade war fears and growth fears. Bitcoin trading below $100,000 right now feels like a pause, not the end of the bull run,” he said.

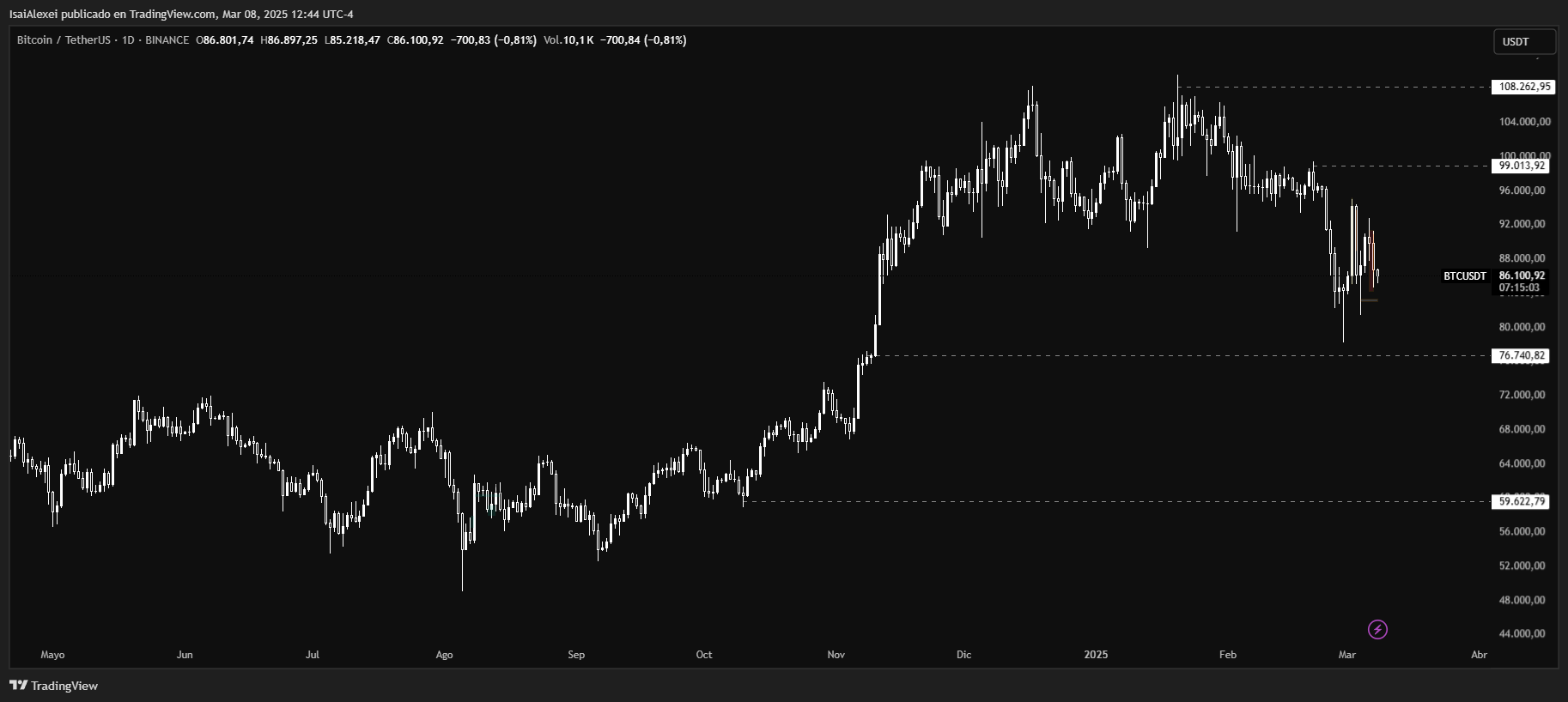

At press time, BTC trades at $86,210, reflecting a 7.9% 24-hour drop and a 16% decline since President Trump’s February 1 tariff announcement on Chinese, Canadian, and Mexican imports.

Klippsten notes institutional accumulation continues despite price fluctuations, dismissing concerns about a prolonged bearish reversal.

Post-ATH Volatility and Strategic Reserve Impact

BTC initially surged to $100,000 in December 2024 following Trump’s election but faced sell-pressure after the U.S. Strategic Bitcoin Reserve (SBR) announcement. The executive order confirmed the government would retain seized BTC but omitted plans for incremental purchases, triggering a dip below $85,000.

“We’re in a consolidation phase now, but I don’t see it extending into a long-term sideways move,” Klippsten said.

Network economist Timothy Peterson analogizes current price action to the post-spot Bitcoin ETF in January 2024, when BTC corrected sharply before resuming its uptrend. Peterson projects a 6–12-week consolidation between $85K and $95K, followed by a gradual ascent above $100K.

Bitcoin sold off on Bitcoin ETFs launching

And then went on to a new ATH

Traders gonna trade

— Hunter Horsley (@HHorsley) March 7, 2025

Bitwise Invest CEO Hunter Horsley attributes the SBR-driven correction to profit-taking by short-term traders, mirroring ETF launch sell-offs.

“Post-event volatility is typical; structural demand remains intact,” Horsley stated via X on March 7.

Klippsten acknowledges macro headwinds—geopolitical tensions, Fed policy shifts, and tariff risks—but classifies these as transient. He highlights Bitcoin’s historical resilience, citing its 8-month rangebound phase ($53K–$72K) after March 2024’s $73,679 ATH before the Trump rally.

“Macroeconomic uncertainty – geopolitical tensions, inflation fears and Fed policy changes – is definitely creating noise, but I would say it’s mostly short-term.”

On-Chain Metrics

ETHNews analysts observe similarities between current liquidity conditions and Q1 2024, when ETF approval spurred whale redistribution. Blockchain data indicates stablecoin reserve growth and miner hodling, suggesting accumulation precedes next-cycle price discovery.

While Trump’s SBR failed to meet market expectations for aggressive buying, Klippsten argues the policy indirectly reduces BTC’s liquid supply by locking government-held coins. This aligns with Swan’s thesis of a deepening supply shock, exacerbated by institutional ETF inflows and retail FOMO.

BTC’s weekly chart shows weakening momentum (RSI divergence) but holds above its 200-day moving average ($82,400).

A sustained close below $85K could test $80K support, whereas reclaiming $92K may reignite bullish sentiment. Traders monitor CME gaps near $81K and $96K for near-term directional cues.

As of today, Bitcoin (BTC) is trading at $85,992, reflecting a 0.88% decline in the past 24 hours. Over the past week, BTC has seen a 2.01% increase, but in the last month, it has dropped by 10.98%.

Despite this, Bitcoin remains strong over the past six months, with a 56.73% gain, and it is still up 28.51% year-over-year. However, the recent price action has been volatile, particularly following the White House Crypto Summit on March 7, where BTC fell from its peak of $90,000 down to $85,000 before closing at $85,300.

Bitcoin’s total market capitalization currently stands at $1.71 trillion, with a 24-hour trading volume of $37.29 billion. The cryptocurrency remains well below its all-time high of $109,356, showing that there is significant room for future price action.

Speculation surrounding the U.S. government’s potential Bitcoin acquisition has added uncertainty, as discussions have emerged about the possibility of the Treasury using the Exchange Stabilization Fund or acquiring 200,000 BTC annually.