CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

The cryptocurrency market faced a sharp downturn as the U.S. Federal Reserve’s recent monetary policy announcements sent shockwaves across the sector. Bitcoin’s plunge below $100,000 triggered a broader market collapse, leading to liquidations exceeding $860 million. Among the hardest-hit were Ethereum (ETH), Dogecoin (DOGE), XRP, and Solana (SOL), all witnessing significant corrections between 5% and 10%.

$860 Million Liquidated Amid Market Chaos

On Wednesday, the Federal Reserve announced its third 25-basis-point interest rate cut, with Chair Jerome Powell striking a hawkish tone for 2025 and beyond. While signaling fewer rate cuts in the future, Powell’s stance unnerved markets. Bitcoin tumbled below the key $100,000 support level, erasing all its weekly gains after recently hitting an all-time high of $108,000.

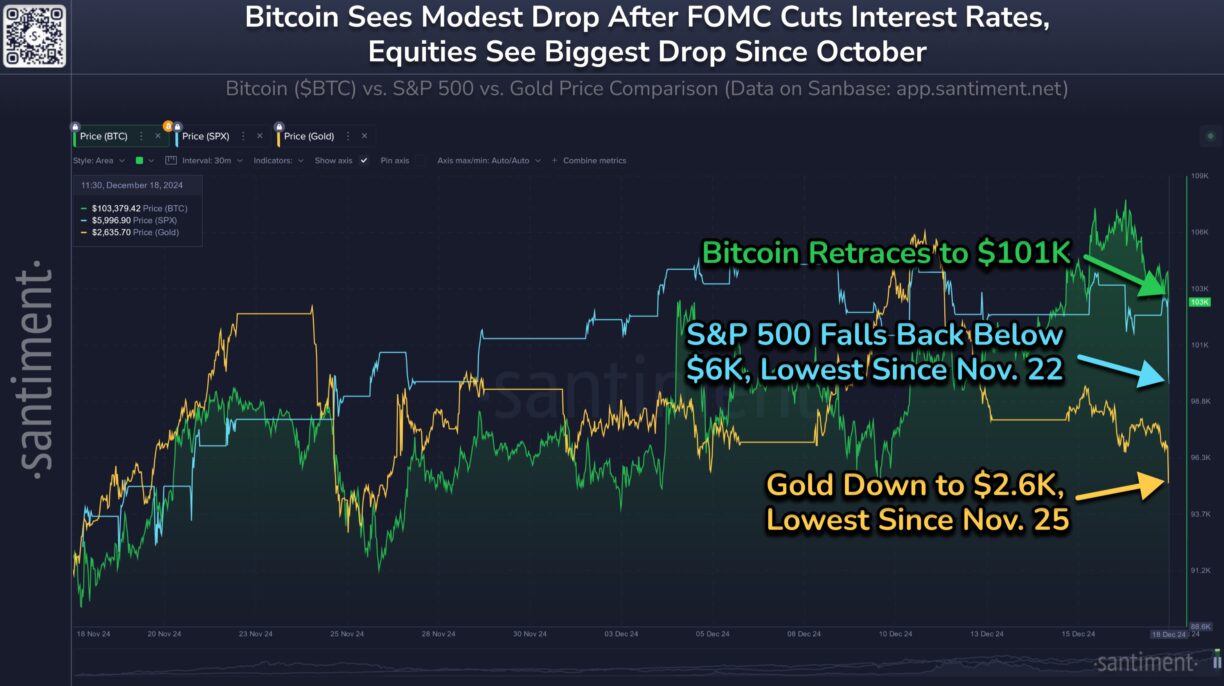

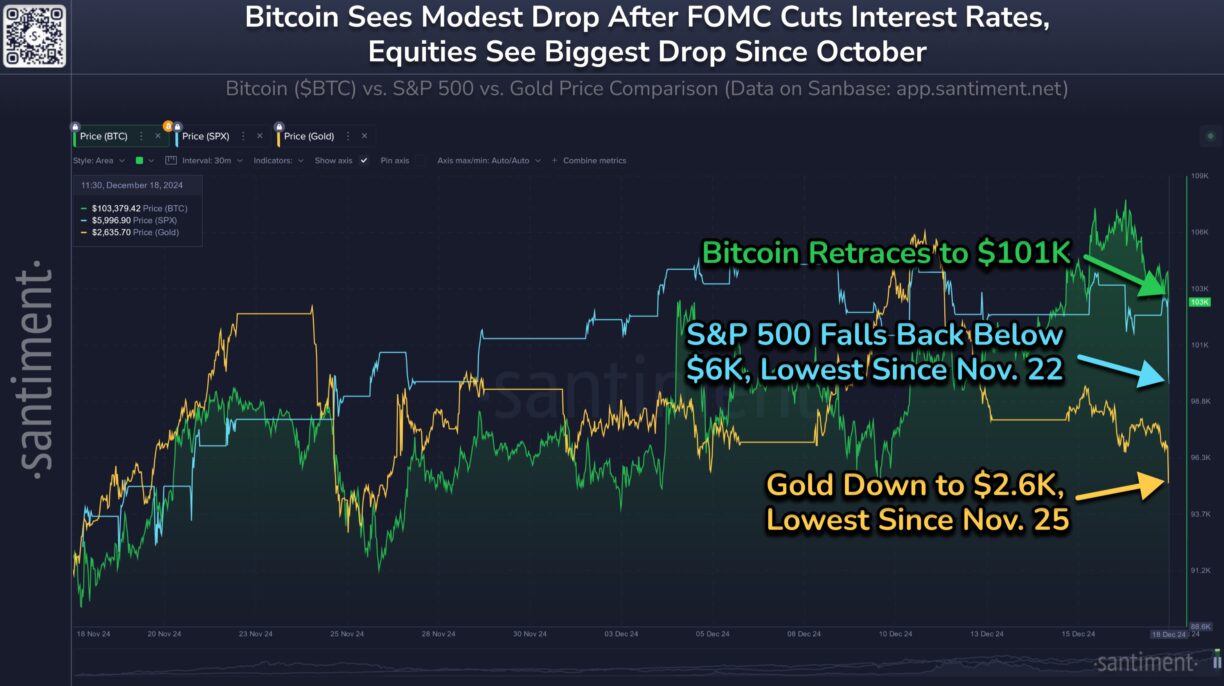

Powell reiterated the Fed’s commitment to reducing inflation to its 2% target, stating it could take another 1-2 years to achieve this goal. Meanwhile, blockchain analytics platform Santiment highlighted Bitcoin’s relative strength compared to the S&P 500 during this correction, suggesting it could signal resilience once the dust settles.

Major Liquidations Across Key Assets

The sudden downturn led to massive liquidations across the crypto market. Ethereum, Dogecoin, XRP, Solana, and Bitcoin saw combined liquidations surpass $860 million. Bitcoin alone accounted for $148 million in long liquidations over 24 hours, up from $114 million, according to Coinglass data. Ethereum also faced significant liquidations as it struggled to hold above critical support levels.

Amid this turmoil, U.S. Bitcoin ETFs, including Bitwise’s BITB, Invesco’s BTCO, Ark Invest’s ARKB, and Grayscale’s GBTC, reported net outflows. However, BlackRock’s IBIT ETF bucked the trend with a substantial $356 million inflow, partially offsetting the broader negative sentiment.

Analysts Remain Optimistic Despite Volatility

Despite the market’s turbulence, analysts remain cautiously optimistic. Prominent economist Alex Kruger noted:

“Next week’s Christmas period could shift market dynamics. Ideally, BTC rebounds from $98k and SOL from $195, paving the way for upward momentum. Leverage and euphoria have largely been flushed out, minimizing downside risks. The big picture remains intact.”

Global Developments Impacting Crypto Markets

On the international stage, the Bank of Japan maintained its short-term policy rate at -0.1%, signaling a cautious approach while monitoring wage growth and inflation trends. This decision weakened the yen further, pushing it past the critical 155 level against the dollar. Consequently, Bitcoin managed a recovery from sub-$100,000 levels, trading at $101,020 at press time.

As the market digests these developments, The Bit Journal continues to provide comprehensive coverage and insights to keep investors informed.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!