CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Analysts now predict that Bitcoin could climb to $187,500 in the coming months. On the other hand, Ethereum shows signs of outperforming Bitcoin in 2025 due to a potential breakout in the ETH/BTC ratio and increasing inflows into ETH-based ETFs. Adding to Bitcoin’s momentum, Israel is launching six Bitcoin-tracking funds next week, and Russia is embracing Bitcoin for global trade as part of its efforts to reduce reliance on the U.S. dollar.

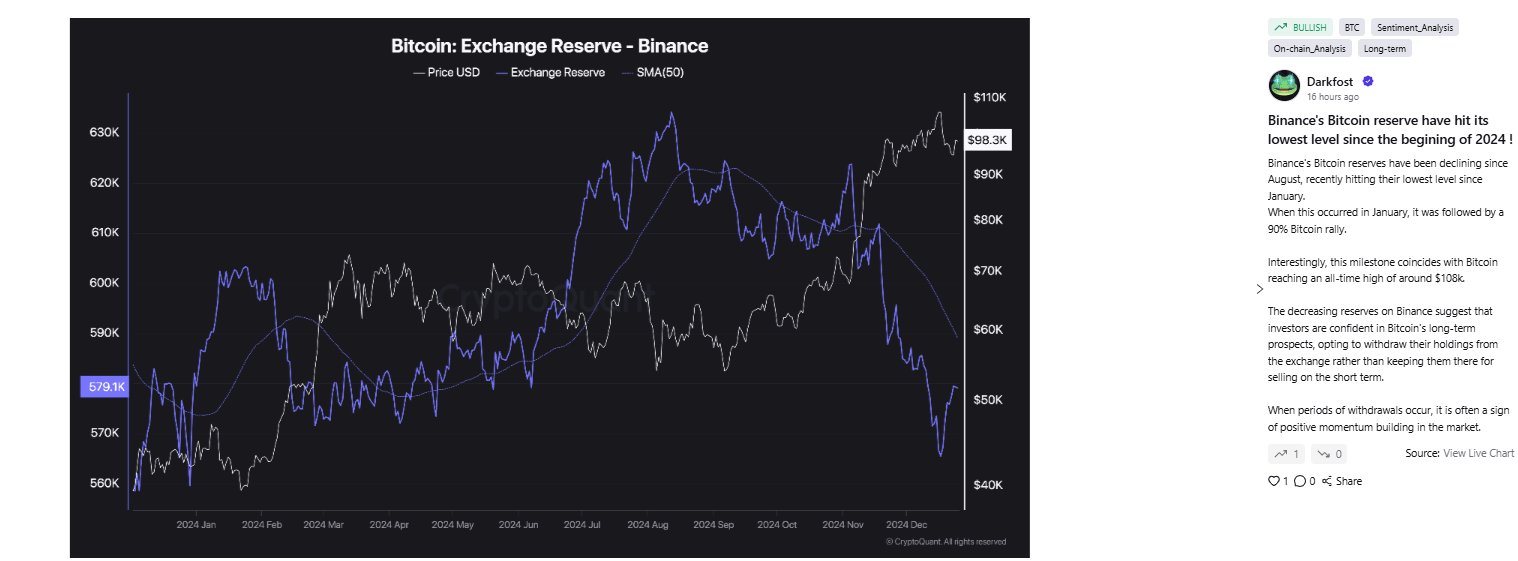

Binance Reserves Signal Investor Confidence in Bitcoin

Bitcoin (BTC) reserves on Binance, the largest crypto exchange by trading volume, have dropped to levels not seen since January of 2024, right before a 90% surge in Bitcoin’s price by March. Bitcoin currently trades close to $98,160, and some analysts suggest that a similar trajectory could see its price reaching $187,500 in the coming months.

The decline in reserves dipped below 570,000 BTC according to CryptoQuant contributor Darkfost, and it is considered to be a bullish signal because investors typically move Bitcoin into cold storage during periods of long-term confidence.

Binance Bitcoin exchange reserve (Source: CryptoQuant)

This trend is very similar to early 2024 when Binance’s reserves also plummeted before Bitcoin’s price surged to a then all-time high of $73,679 on March 13. According to Darkfost, withdrawals from exchanges often signal positive momentum building in the market, and current conditions align with this historical pattern.

Despite this, Bitcoin’s dominance stands at 58.40%, just shy of the critical 60% level, which analysts like Into The Cryptoverse founder Benjamin Cowen believe could trigger a rotation toward other crypto assets. Cowen predicted Bitcoin dominance will reach 60% by December, a milestone it last achieved on Oct. 30.

Bitcoin faced some challenges holding above the psychological $100,000 level since first breaking it on Dec. 5. The price stayed below this mark since Dec. 19, after reaching a new high of $108,300 on Dec. 17.

Bitcoin’s price action over the past month (Source: CoinMarketCap)

Ryan Lee, chief analyst at Bitget Research, predicts that Bitcoin’s price could surpass $105,000 once liquidity returns after the holiday season. He believes the current downtrend is due to typical holiday illiquidity and expects increased market activity post-Christmas. For this week, Lee predicted that Bitcoin will likely trade within the $94,000 to $105,000 range.

Israel to Launch Six Bitcoin Funds

Bitcoin’s price could also receive a nice boost from the launch of six Bitcoin-tracking funds next week in Israel after the approval by the Israel Securities Authority. These funds will be available for purchase at banks and investment firms from Dec. 31, and will mirror Bitcoin’s price movements by using various indexes and strategies.

Among the funds, some will track U.S.-based Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust ETF (IBIT), while one will be actively managed to outperform Bitcoin’s performance.

The funds will also be managed by leading Israeli firms like Phoenix Investment, IBI-Kessem, Meitav, More, Ayalon, and Migdal, and will charge management fees ranging from 0.25% to 1.5%. The regulatory approval came after two years of requests from asset managers asking for local investors to gain exposure to Bitcoin using Israel’s fiat currency, the shekel. Transactions will initially be processed once daily, and will reflect Bitcoin’s price at the time of execution.

Eyal Haim, vice president of Ayalon Mutual Funds, shared that their investment house wanted to engage with the digital currency sector for a long time now by offering mutual funds tied to companies in the field.

Since May, Israel also made strides in progressing on its central bank digital currency initiative, the Digital Shekel Challenge. This project plans to encourage innovation by encouraging participants to develop real-time payment systems by using the digital shekel. The Bank of Israel offers a sandbox environment for testing. A key objective of the digital shekel initiative is to increase competition among local banks. While the project has received public support, there are still some concerns about privacy.

Russia Embraces Bitcoin for Global Trade

Russia is advancing its use of digital financial assets (DFAs), including Bitcoin, in foreign trade as part of its strategy to reduce reliance on the U.S. dollar. Russian Finance Minister Anton Siluanov shared these developments in a recent interview on Russia-24, and revealed that legislation has been passed to allow these transactions under an experimental legal framework that was established in September of 2024. According to Siluanov, the adoption of DFAs, like Bitcoin, offers a modern and innovative approach to international settlements. He even described it as a vision for the future of global trade.

According to the finance minister, Russia already initiated foreign trade transactions using DFAs and plans to scale these efforts in the coming year. Siluanov also pointed out that Bitcoin mined in the country could be used in these transactions. This shift is made possible by Russia’s legalization of Bitcoin mining earlier in the year, which paved the way for its use in regulated trade operations.

Russian Finance Minister Anton Siluanov

Despite advocating for the use of digital assets in trade, Siluanov still maintained a more cautious stance on cryptocurrency investments. In November, he warned against speculative investment in cryptocurrencies due to their volatility and the risks involved.

Russia’s experimentation with DFAs builds on its earlier efforts to regulate digital assets. The country officially recognized Bitcoin as a digital financial asset in 2021 under the “On Digital Financial Assets” law, which granted it legal status while restricting its use as a payment method in the nation.

Ether Gears Up to Outpace Bitcoin in 2025

Despite these developments, Ethereum (ETH) is showing signs of outperforming Bitcoin as 2025 approaches, according to crypto analysts. The ETH/BTC ratio, which is currently close to 0.0356, has attracted a lot of attention. MN Capital founder Michael van de Poppe suggested it could break above 0.04 in January 2025.

The last time this level was reached was on Dec. 8, when ETH’s price climbed just above $4,000. Van de Poppe expects increased inflows into Ether, potentially accompanied by outflows from Bitcoin. This could lead to Bitcoin price consolidation and trigger an “altcoin run.”

Supporting this outlook, Ethereum-based tokens like Shiba Inu (SHIB) and Mantle (MNT) recently saw impressive gains after recently rising by 7+% and 3+%, respectively. Meanwhile, Bitcoin is still trading below $100,000 after first breaching the six-figure mark on Dec. 5.

Analysts also pointed out the growing potential of spot Ether exchange-traded funds (ETFs). Nate Geraci, president of ETF Store, shared that net inflows into ETH ETFs are keeping pace with gold ETFs and are expected to accelerate. Similarly, pseudonymous trader Brent described Ethereum as an undervalued asset, and also compared its potential to a submerged ball ready to surge upward.

This optimism aligns with earlier views that Ethereum’s underperformance relative to Bitcoin may be concluding. Benjamin Cowen, founder of Into The Cryptoverse, stated in early December that the ETH/BTC collapse appears to be over, and predicted a stronger performance for Ethereum over the next 6 to 12 months. These factors all point to a promising start to 2025 for Ether.