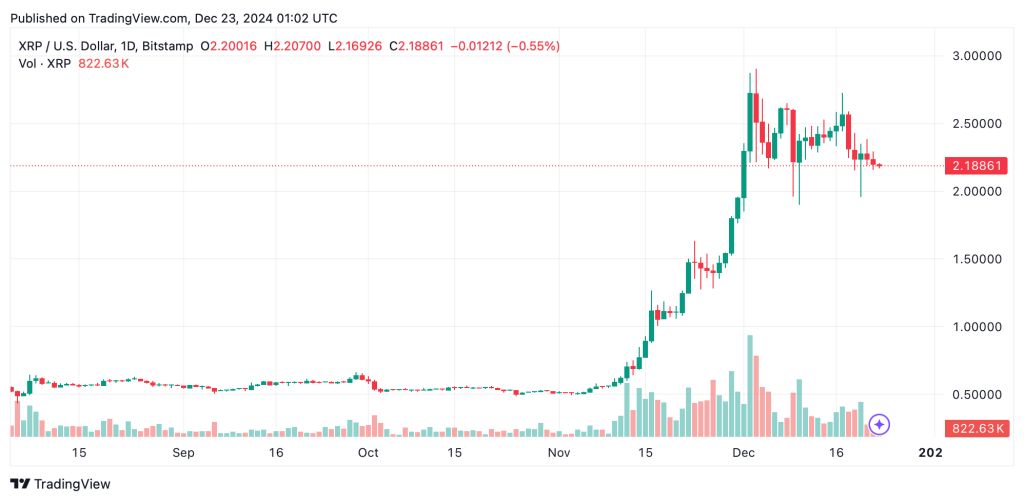

Ripple’s XRP keeps on defying the odds in the crypto market as it stands its ground and maintains a critical $2 support even as the battle burns. According to reports floated over the previous week, XRP lost 8.2% to the US dollar, showing a wider bearish sentiment pouring across a dismal week for most cryptos. However, on-chain activity remains substantial, with large whale transfers among others, and the company’s fiat-backed stablecoin RLUSD is growing in traction.

XRP’s Performance and Whale Transactions

Despite an 8.2% drop in price, XRP is one of the top performers in the crypto space. XRP is trading at $2.18, down from $2.68 on Dec 17 and still up 50.4% in the last 30 days. The drop below $2.4 hasn’t deterred investors, especially after a series of big on-chain transactions over the weekend.

On Dec 21, 30 million XRP was reportedly withdrawn from the South Korea-based exchange Upbit for approximately $70.89 million. South Korea continues to be one of the most prominent centres for XRP, with 22% of its trading volume emanating from the country.

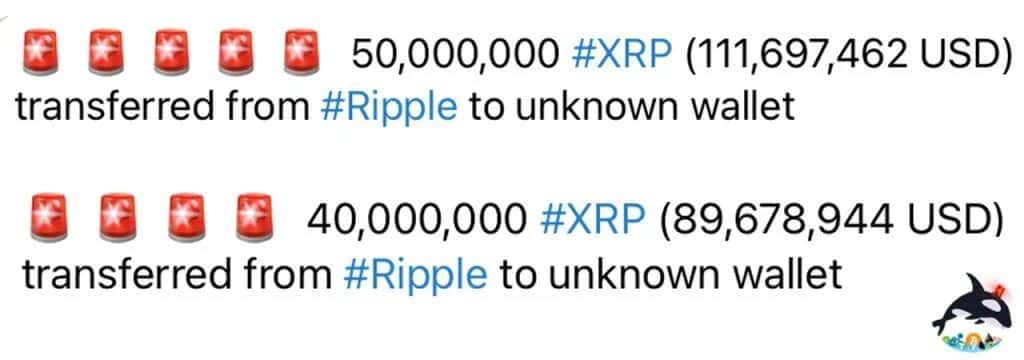

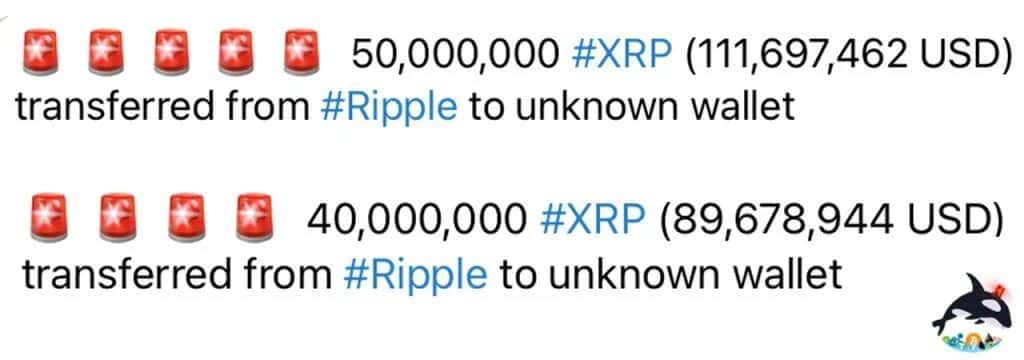

Ripple itself also moved big amounts of XRP, with two transactions totalling 90 million XRP on the same day. These transactions were 50 million XRP worth $111.69 million and 40 million XRP worth $89.67 million. Both transactions were sent to unknown wallets, raising speculations on what Ripple is up to, which could be anything from institutional partnerships to liquidity provisioning.

The Whale Alert blockchain monitoring system plays a pivotal role in tracking these movements.

Ripple’s RLUSD Gains Momentum

Attention is also on Ripple’s ecosystem as RLUSD is growing. The market cap of RLUSD is currently at $53 million, ranking 37th among stablecoins. It’s now on the Ethereum blockchain, having issued 53 million RLUSD tokens.

According to reports, about 73.87% of RLUSD supply is held in the Ripple Deployer wallet, which is 39,298,912.01 tokens. The second largest is institutional liquidity provider B2C2 Group at 5.71%.

Following this is an unknown wallet with 2,899,910 RLUSD, while Uphold holds 2.28 million RLUSD and another 305,295 RLUSD in another wallet, making it the 4th largest holder. The 5th largest is Mexico-based exchange Bitso, which plays a big role in the liquidity of RLUSD.

RLUSD has done 1,396 on-chain transactions so far, with most of the activity concentrated on Bitso and Mercado Bitcoin, Brazil’s largest cryptocurrency exchange. RLUSD’s journey to the top 10 stablecoins is not easy, as PayPal’s PYUSD occupies the 10th spot with a much higher valuation.

Key Insights into Ripple’s Strategy

Ripple’s recent activities indicate a focused strategy to strengthen its ecosystem. The big XRP transactions by Ripple is liquidity management, possibly in line with broader market or institutional activity.

RLUSD is also part of Ripple’s play in the stablecoin market. Ripple backs RLUSD with fiat, using its existing network for the token’s distribution as a competitive advantage in the crowded market dominated by Tether (USDT) and USD Coin (USDC).

Simultaneously, the prominent South Korean role in XRP trading contributes heavily to Ripple’s overall strategy. South Korea is, in fact, one of the top countries that provide XRP trading volume, and for Ripple, it is an important area in which to promote adoption and liquidity in the Asia-Pacific region.

Conclusion

XRP is still in the spotlight despite the market challenges. It held the $2 support after an 8.2% weekly drop, showing that it is strong and there’s huge demand for it. The big whale transactions and the growing RLUSD is Ripple’s way of actively building its ecosystem and growing.

Though not without challenges, Ripple is in a good position to play in the market and create long-term value with its multi-faceted approach to large transactions, stablecoin development and regional market engagement.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What is the current price of XRP?

As at the time of this publication, XRP is currently at $2.194, down 8.2% against the US dollar in the last week.

2. What is RLUSD, and how is it doing?

RLUSD is Ripple’s fiat-backed stablecoin, with a market cap of $53 million. It’s ranked 37th among stablecoins and trades on Bitso and Mercado Bitcoin.

3. Who holds the majority of RLUSD tokens?

Ripple Deployer wallet holds 73.87% of RLUSD supply, the rest is held by B2C2 Group, an unknown wallet and exchanges Uphold and Bitso.

4. What do the recent XRP whale transactions mean?

Ripple did two big transactions of 90 million XRP while 30 million XRP was withdrawn from Upbit. These are believed to be liquidity management and potential institutional strategies.