CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Binace’s survey revealed that 16% favor meme coins compared to Bitcoin’s 14.44%. Emerging projects like Solana-based Fartcoin are also attracting the attention of traders after it defied the recent market slump. However, other projects face regulatory scrutiny. Ritardio was recently flagged by the UK’s FCA for its unauthorized promotions. Meanwhile, a parody account turned meme coin profits into a $69,000 donation to Save the Children.

Meme Coins Gaining Momentum in Global Crypto Holdings

A recent survey that was conducted by Binance revealed that meme coins surpassed Bitcoin as the most-held cryptocurrency among users worldwide. The survey was released on Dec. 18 as part of the Binance Global User Survey, and the findings show that 16% of respondents reported holding meme coins, while 14.44% hold Bitcoin. The survey included more than 27,000 participants from various regions, including Asia, Europe, Africa, and Latin America.

Binance noticed that the popularity of meme coins is not limited to current holdings but extends to their future potential as well. Although the survey did not reveal the value of respondents’ holdings, data from CoinGecko estimates the total market capitalization of meme coins to be around $117 billion. Among these, Dogecoin (DOGE) is still a leader, trading at $0.362. Bitcoin’s market cap is higher than $2 trillion, and is trading at $101,000.

Survey main takeaways (Source: Binance)

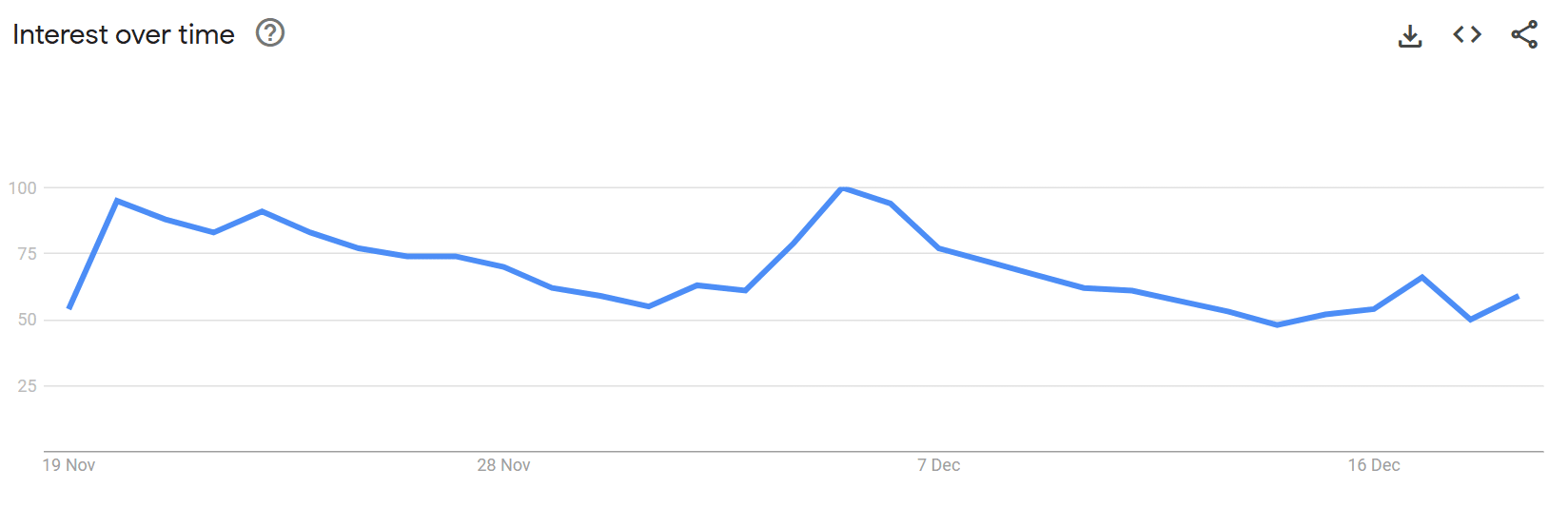

The survey also indicated that there is growing optimism for 2025. Some respondents predicted that artificial intelligence (AI) tokens and meme coins will be among the top drivers of market growth. AI tokens led with 23% of respondents favoring their growth potential, while 19% expressed more confidence in meme coins’ market value rising in the coming year. Google search trends also echoed this interest, and show a peak in searches for “meme coin” earlier in December. It also reached higher search volumes than “Bitcoin” during the same period.

30d search volume for ‘meme coin’ (Source: Google)

Interestingly, 45% of the Binance survey participants joined the crypto space in 2024, with nearly one-third engaging in regular trading. Despite their speculative nature and lack of utility, meme coins still gained a lot of traction.

Experts speculated about the possibility of a meme coin supercycle, despite some critics comparing their trajectory to initial coin offerings (ICOs) and non-fungible tokens (NFTs), both of which experienced dramatic rises before very sharp declines. Whether meme coins actually sustain their momentum or face a similar fate is still up for debate.

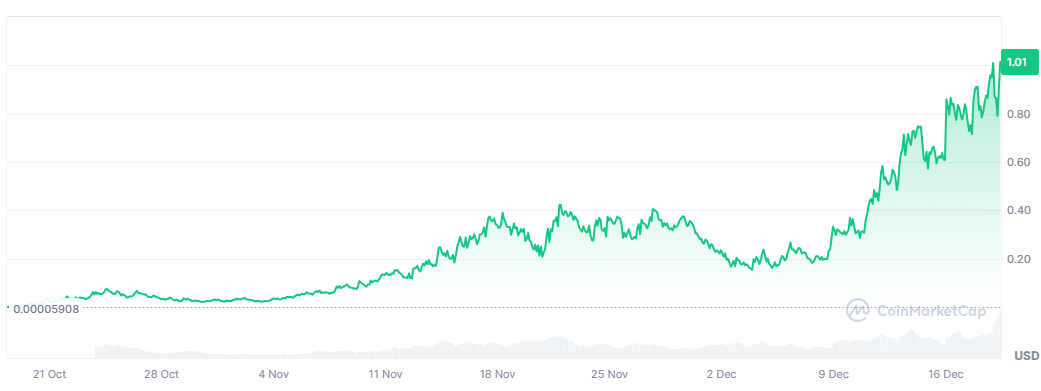

Fartcoin Defies Market Slump

Its not only the larger and more popular meme coins attracting the attention of investors. Fartcoin, a Solana-based meme coin with no utility, captured a lot of attention on Dec. 18 by briefly surpassing a $1 billion market cap and defying a broader altcoin market slump. Over the past 30 days, the token surged by over 250%, which made it an an outlier even as the crypto market faced pressure from the Federal Reserve’s announcement of a 25-basis-point rate cut.

Fartcoin all-time price action (Source: CoinMarketCap)

Between 8:20 pm and 9:00 pm UTC on Dec. 18, Fartcoin’s price jumped by about 21% to $1.02, which pushed up its market cap to $1.02 billion. However, the rally was short-lived as the coin retraced 16% in hours, bringing its price to $0.83 and its market cap to $838.4 million. At press time, Fartcoin was trading hands at $1.01 after its price again managed to climb by over 20% in the past 24 hours.

Despite this volatility, the rise sparked some very humorous reactions across social media. Investor Brandon Beylo commented that “the funniest possible outcome is usually the most likely.” Liquidity Capital’s founder joked about hedge fund managers underperforming against teenagers trading the token in their parents’ basements.

Fartcoin’s two-month trading history has been riddled with extreme volatility. Since its launch on Oct. 24, the token has fluctuated widely. Some market analysts speculated on the implications of these movements. Unlimited Funds co-founder Bob Elliot commented that Fartcoin’s parabolic rise could signal that monetary policy is still less restrictive than intended. Others like Syncracy Capital’s Daniel Cheung suggested that the current market cycle may offer prolonged “buy the dip” opportunities.

The broader market, meanwhile, saw painful losses. Tokens like Dogwifhat (WIF), BONK, and Theta Network experienced double-digit declines. Amid the chaos, some people pointed out that while central banks like the Federal Reserve cannot own Bitcoin, there are no restrictions against owning tokens like Fartcoin.

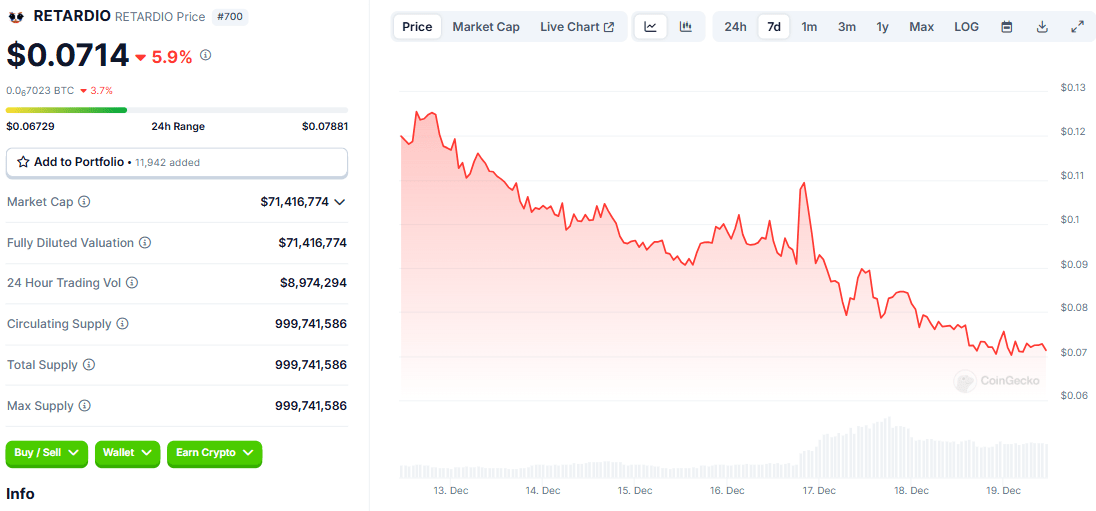

FCA Warns Against Solana-Based Retardio Project

Things are not going as well for other meme coin projects. The United Kingdom’s Financial Conduct Authority (FCA) issued a warning about the Solana-based Retardio project due to concerns over unauthorized financial promotions targeting UK consumers. On Dec. 16, the FCA stated that the project may be offering or promoting financial services without regulatory approval. The watchdog also reminded consumers to interact only with FCA-authorized firms for adequate protection.

The Retardio project features a Solana-based NFT collection that reportedly achieved $31 million in lifetime sales, alongside its associated meme coin trading under the ticker “Retardio.” The token is valued at around $0.07, and holds a market cap of close to $73 million, according to Dexscreener.

Retario price action over the past week (Source: CoinGecko)

According to the FCA, UK consumers dealing with Retardio will not have access to the Financial Ombudsman Service or protection under the Financial Services Compensation Scheme (FSCS). This means that they are unlikely to recover funds if the project collapses. The regulator urged consumers to verify the authorization status of firms through the FCA registry and report unauthorized entities through official channels.

In a now deleted response, the Retardio project humorously claimed to have “issued a warning” against the FCA.

Animoca Brands Chairman Yat Siu recently explained in an interview that meme coins represent the value of user attention. Unlike traditional social platforms that obscure the value of user-generated content, meme coins very transparently link market cap to the attention they garner. Siu described meme coins as a tokenized form of attention due to their correlation with user engagement and cultural significance in Web3.

Parody Account Turns Meme Coin Profits into Philanthropy

A parody X account claiming to represent a former trader donated proceeds from a meme coin inspired by him to charity after the token’s value briefly skyrocketed to almost $1 million. The account, named Richard E. Ptardio, received 700 million Richard Ptardio (PTARDIO) tokens on Dec. 17, created through the Solana token creator Pump.fun. The tokens were Initially valued at $53,250, but surged by 1,765% in hours to reach almost $1 million.

Despite the windfall, Ptardio distanced himself from the project, and stated that the token was created without his knowledge or consent. After announcing his decision to sell the tokens, he pledged to donate the entire proceeds to Save the Children, a global charity supporting education, health, and other programs for children. While the token’s value eventually dropped, Ptardio donated 313.4 Solana, which is worth $69,000, to the organization.

It is common for meme coin creators to allocate a portion of their tokens to the people or themes they are inspired by. The account behind Ptardio portrays an older man who spent 35 years trading in London, Hong Kong, and New York before joining the cryptocurrency space in September.