A shareholder of Meta Platforms Inc. has submitted a proposal urging the company to assess Bitcoin adoption for its corporate treasury.

The proposal was filed by Ethan Peck, an employee of The National Center for Public Policy Research, on behalf of his family’s shares.

This marks a notable move as Meta joins other tech firms approached with similar Bitcoin-related proposals, including Microsoft and Amazon.

According to Peck, cash and bonds in Meta’s reserves are exposed to depreciation due to inflation.

He said, with historical perspective, Bitcoin can serve as a protection against the devaluation of currencies.

Peck’s submission added that, with cash and cash equivalents of $72 billion as of September 30, 2024, Meta may be better off diversifying its investments.

– Advertisement –

Proposal Highlights Bitcoin’s Performance Against Traditional Assets

The shareholder proposal also focused on the fact that Bitcoin is a more profitable investment in the long term than bonds and cash.

According to Peck, the price of Bitcoin rose by 124% in 2024 alone. This is way higher than most other assets.

For the past five years, Bitcoin has appreciated by 1,265%. While bonds fell behind with an average return gap of 1,245%.

The proposal also mentioned that inflation erodes the value of cash and therefore can negatively affect shareholder return.

Peck revealed that putting Bitcoin into Meta’s treasury could be useful in maintaining shareholder value despite Bitcoin’s volatility.

He provided examples of businesses like MicroStrategy that have benefited from a 17,000% equity rise from Bitcoin investment.

Peck tied the Bitcoin treasury proposal to Meta’s origins and the company’s past experience in backing blockchain technology.

He cited CEO Mark Zuckerberg’s giving names Bitcoin and Max to his goats as evidence of the CEO’s direct interest in the cryptocurrency.

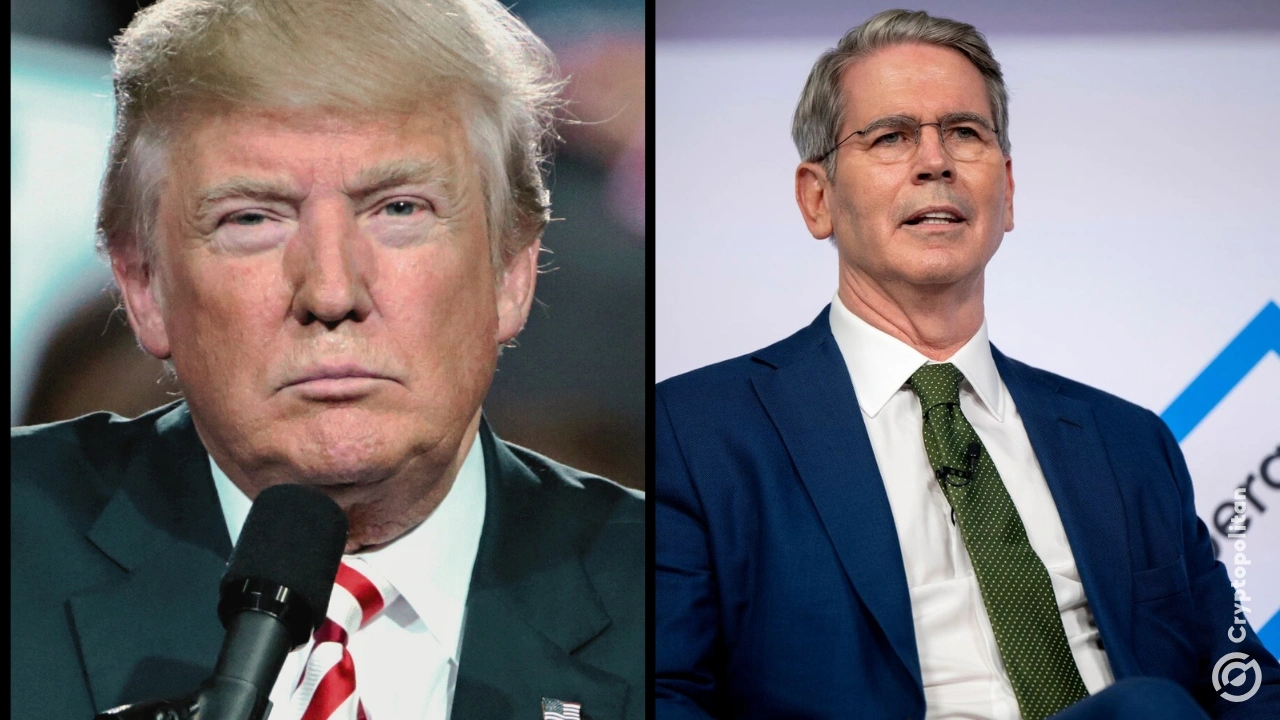

He also noted that another Meta board member and the Coinbase director Marc Andreessen has recently spoken favorably about cryptocurrencies.

The proposal also pointed out that Meta shareholders should be given an opportunity to invest in financial strategies that complement the progressive nature of the company.

Peck pointed to BlackRock and other institutional investors who recommend a limited exposure to Bitcoin.

He noted that BlackRock’s Bitcoin ETF was among the most popular ETFs on the market. This served as the evidence of the increasing institutional adoption of the cryptocurrency market.

The Problem With Bitcoin Adoption Proposals

Despite the advantages of the proposal, other large corporative technology giants have hesitated to accept Bitcoin as the treasury reserve asset.

Microsoft shareholders rejected a similar proposal in December 2024 even when the company was being informed that Bitcoin could be a good hedge against inflation.

The National Center for Public Policy Research made a similar request from Amazon, and the issue was scheduled for a vote at the company’s annual meeting in April of 2025.

According to the industry insiders, the major reason is that Bitcoin is volatile, and there are no ways to generate yield from it.

Nick Cowan of Valereum, a firm that specializes in financial technology, said that firms with solid market presence in viable sectors tend not to invest in risky assets.

This would mean that Meta’s response to the shareholder proposal may be quite measured.

Growing Institutional and Legislative Support for Bitcoin

It also pointed out that more and more companies and governments are using Bitcoin as a treasury asset.

It gave examples like MicroStrategy and Genius Group Ltd., who integrated Bitcoin into their financial plans.

Peck noted that in this regard Meta can follow the above examples to be a leader in financial innovation.

Also, the submission highlighted legal measures such as the State Bitcoin Reserve provisions of the Lummis Bill.

The initiatives serve to provide recognition of Bitcoin as a reserve currency along with conventional ones such as gold and silver.

Peck suggested to Meta’s board to consider the following opportunities presented by Bitcoin in view of these trends.