CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Metaplanet Inc. issues 2 billion yen zero-interest bonds to EVO FUND.

- The company aims to purchase Bitcoin with the funds.

- Metaplanet’s largest Bitcoin holder status remains in Asia amid market reactions.

Metaplanet Inc., a Japanese listed company, announced on March 31, 2025, that it has issued 2 billion yen zero-interest ordinary bonds to EVO FUND, with plans to purchase Bitcoin. This strategic move seeks to capitalize on recent Bitcoin price downturns, positioning Metaplanet as a leader in holdings within Asia.

Metaplanet’s Board decided on March 31, 2025, to issue zero-interest 2 billion yen bonds to EVO FUND, focusing the raised funds on Bitcoin purchases. The bonds, each with a face value of 50 million yen, are scheduled for redemption by September 30, 2025. This supports Metaplanet’s plan to increase its Bitcoin holdings, aligning with their goal of accumulating 10,000 BTC by 2025.

Metaplanet’s Strategic Bond Issuance for Bitcoin Acquisition

Metaplanet currently holds 3,350 BTC, acquired at an estimated cost of $270 million. With this purchase, Metaplanet seeks to optimize its Bitcoin yield, ensuring long-term value for shareholders. Eric Trump, recently appointed to the Strategic Board of Advisors, is expected to bring expertise that may influence these efforts.

Community responses highlight a mixed sentiment, as Metaplanet’s stock price fell over 9% on bond issuance day amid broader Japanese market declines. Simon Gerovich, Metaplanet’s Representative Director, commented on X, “Buying the dip!”, indicating strategic timing intended to maximize investment returns.

Bitcoin Market Trends and Future Projections

Did you know? Metaplanet’s strategy to accumulate Bitcoin aims to achieve 21,000 BTC by 2026, setting a precedent as the first Asian company with such a target.

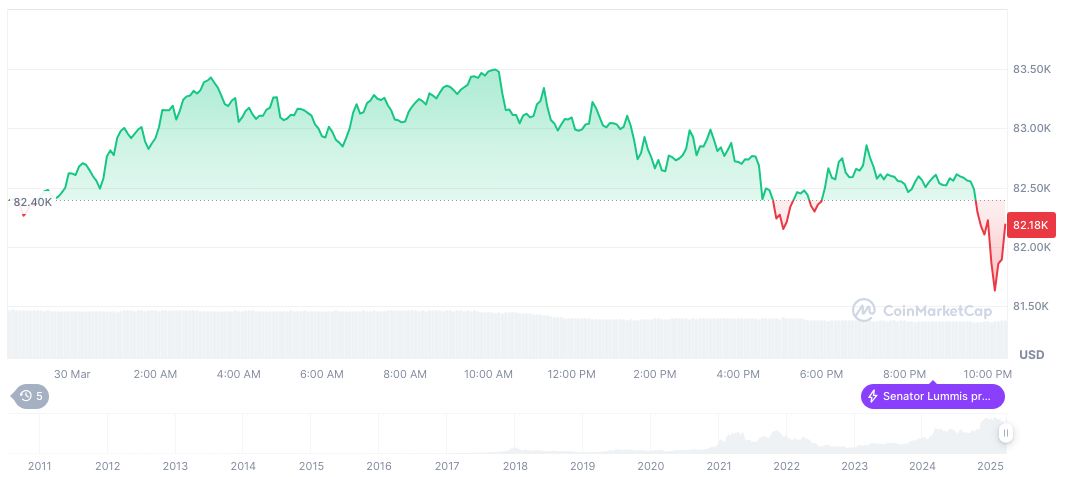

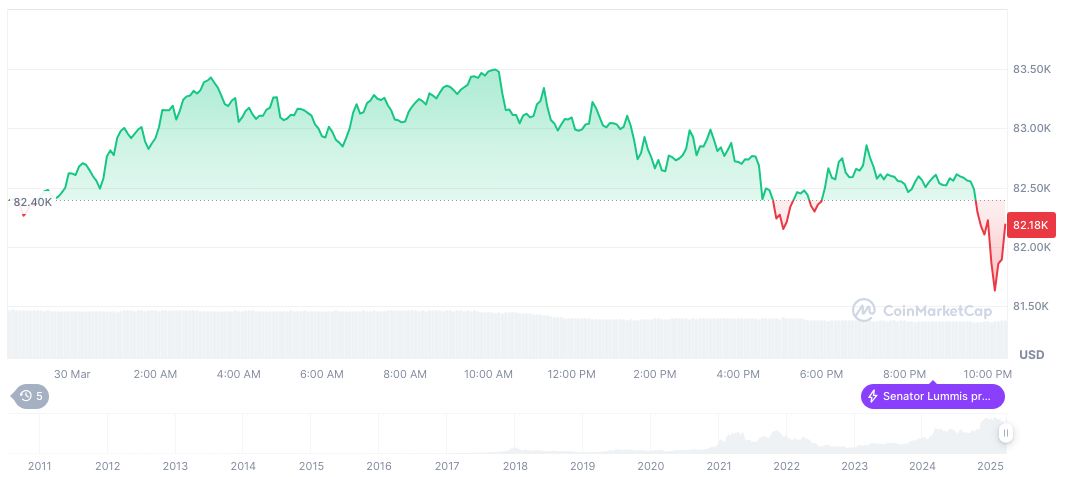

Bitcoin’s current market data, according to CoinMarketCap, reveals a price of $82,820.41 with a market cap of $1.64 trillion and dominates with 61.74% market share. Despite the 24-hour volume increasing, Bitcoin’s price recorded a 0.25% decrease over the past day, part of a wider movement including a 5.15% decline over the week.

The Coincu research team projects that Metaplanet’s bold bond issuance could inspire similar strategic acquisitions by other corporations. Using market downturns as leverage, companies may continue to explore Bitcoin as an asset class, fostering increased institutional adoption in Asia.