CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

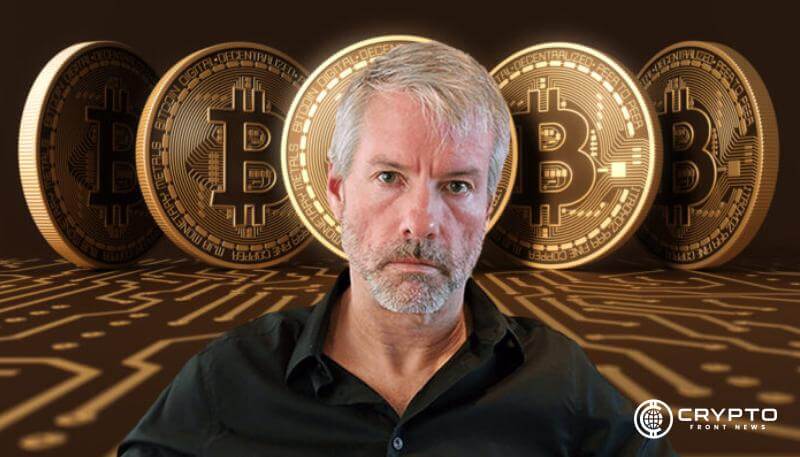

- Michael Saylor plans to burn his Bitcoin after death, sparking debate on scarcity and its role in Bitcoin’s long-term value.

- Burning private keys could drive Bitcoin’s value by tightening supply, but critics warn of ethical concerns and market disruption.

- Saylor’s 17,700 BTC holdings amplify his proposal’s impact, aiming to reinforce Bitcoin’s deflationary narrative and legacy.

Michael Saylor, the CEO of MicroStrategy, has shared plans to destroy all his Bitcoin after he passes away to make it more scarce. Saylor believes this move fits his goal of making Bitcoin a more valuable, limited resource and a reliable digital currency for the long term.

A Deflationary Vision for Bitcoin

Saylor emphasizes that burning private keys would permanently remove Bitcoin from circulation, tightening its supply. This scarcity could drive up Bitcoin’s value over time, benefiting long-term holders. Moreover, he likened this process to Bitcoin’s halving mechanism, which reduces the issuance rate every four years.

Proponents view this concept as revolutionary. Besides reducing the circulating supply, it could enhance Bitcoin’s appeal as a scarce and essential digital asset. Supporters argue that Saylor’s idea could cement Bitcoin’s legacy as a decentralized and sound monetary system. However, critics caution against potential market disruptions and ethical concerns over altering Bitcoin’s supply dynamics.

Community Divides Over Saylor’s Proposal

Saylor’s suggestion draws parallels to Bitcoin’s origins, where coins held by its mysterious creator, Satoshi Nakamoto, remain dormant. By encouraging others to burn their holdings after passing, he seeks to maintain and even intensify Bitcoin’s scarcity narrative. This move aligns with his larger goal of ensuring Bitcoin’s integration into mainstream commerce and governance.

However, detractors raise valid concerns. Besides disrupting market equilibrium, critics highlight the ethical implications of encouraging such drastic actions. They argue that Bitcoin’s decentralized nature should allow individuals to decide how they handle their holdings.

Saylor owns over 17,700 BTC, valued at approximately $1.7 billion, supporting the potential impact of his decision. Hence, his proposal is not merely symbolic; it could reshape Bitcoin’s scarcity-driven value proposition.

DISCLAIMER:

The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.