CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Michael Saylor, the eccentric chairman of MicroStrategy, sparked wide-ranging discussion across the cryptocurrency realm once more with a thought-provoking survey on the social media site X. The poll, which ended this previous Monday, asked users to forecast Bitcoin’s yearly return over the following 21 years. The results demonstrated an overwhelming surge in optimism for Bitcoin’s future, as most respondents anticipate substantial long-term growth.

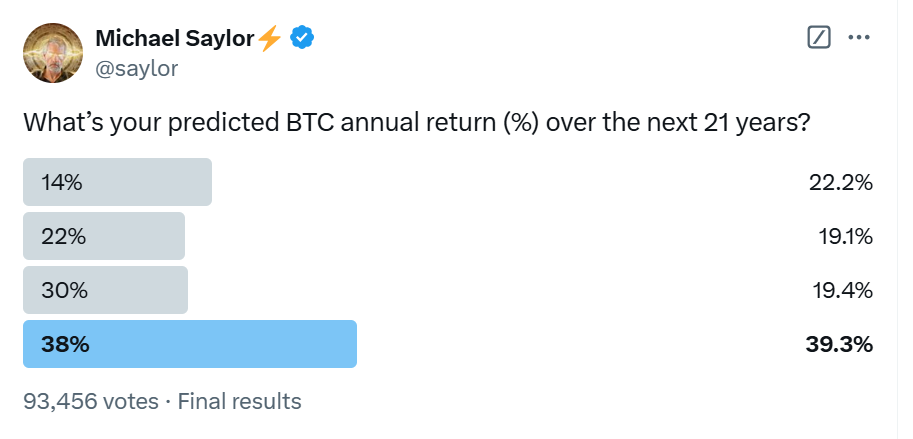

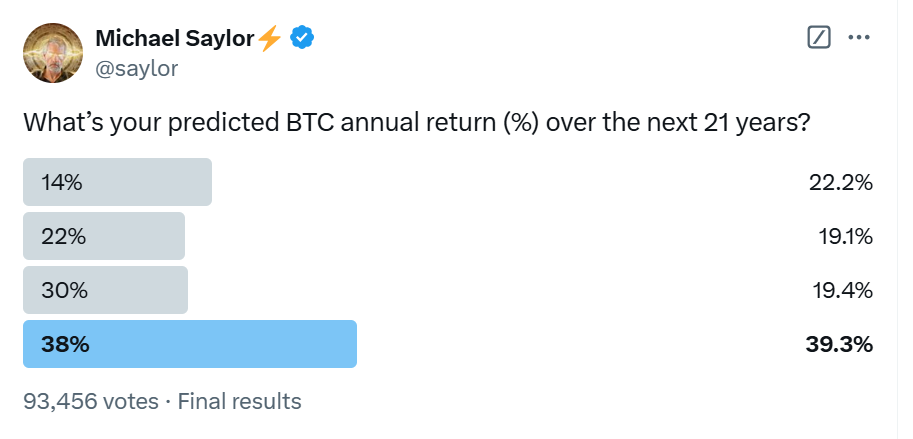

A Clear Verdict: 38% Annual Returns Dominate Poll Results

Saylor’s survey attracted the attention of 93,456 participants, offering them four options for Bitcoin’s projected annual returns: 14%, 22%, 30%, and 38%. The biggest share of respondents, at 39.3%, selected the boldest figure of 38% as their prediction. The second most popular choice was a 30% yearly return, which garnered 19.4% of the votes. The remaining participants were almost evenly split, with 19.1% predicting a 22% return and 22.2% envisioning a more modest figure of 14%.

These results underscore the faith held by Bitcoin advocates in its potential as a lasting store of value. Saylor, an outspoken proponent of Bitcoin, has regularly referred to it as “digital gold,” highlighting its role as a hedge against inflation and a foundation for future monetary systems.

MicroStrategy’s Bold Moves: 446,400 BTC and Counting

MicroStrategy, a technology firm spearheaded by Saylor, has positioned itself as one of the most dedicated corporate Bitcoin holders. On the final day of December, the company revealed the procurement of over two thousand BTC worth roughly $209 million, ballooning its total reserves to a staggering 446,400 BTC valued at nearly $27.9 billion. These strategic purchases are part of the organization’s persisting goal to solidify a strong foothold in the cryptocurrency realm.

At the beginning of this year, MicroStrategy unveiled its visionary “21/21 Plan,” which aims to amass $42 billion over a three-year span. The plan, split evenly between equity and bonds, is designed to expand its Bitcoin coffers further still. Throughout 2024, the company’s commitment to Bitcoin has been a pivotal driver of stock performance. While inclusion in the Nasdaq 100 Index earlier boosted investor assurance, a recent dip in Bitcoin’s price has led to a slight decline in MicroStrategy’s stock price.

Bitcoin’s 2045 Price: Saylor Paints a Bullish Picture

Michael Saylor’s predictions for Bitcoin’s appreciation over the coming decades were met with a mixture of surprise and scepticism on Wall Street. In his most optimistic projection, the MicroStrategy CEO stated that a single Bitcoin could sell for a mind-boggling $49 million by 2045 if widespread adoption continues according to schedule. However, Saylor acknowledged that macroeconomic turbulence or regulatory uncertainty could dampen growth, noting that Bitcoin might reach only $3 million under a more pessimistic scenario.

As the largest corporate holder of Bitcoin, Saylor’s bullish thesis is rooted in his fervent belief that digital scarcity and decentralized security will drive unprecedented demand in the coming years.

“We are laying the foundation for a future in which every person on Earth has access to sustainable wealth and financial freedom,” he declared.

While some dismissed his projections as unrealistic hype, many crypto evangelists echoed Saylor’s vision of Bitcoin transforming the global economy by offering an inflation-proof alternative to fiat currency.

A Stellar Q4 Performance for MicroStrategy

MicroStrategy’s Q4 results clearly demonstrated the company’s skill in profiting from Bitcoin’s fluctuations. Saylor stated, “From the beginning of Q4, our treasury activities yielded a 47.8% return on Bitcoin, delivering a 120,600 BTC benefit to shareholders.” At Bitcoin’s current price of $96,000, this amounts to a noteworthy $11.6 billion realized in the quarter.

These figures underscore the dexterity with which the business navigates the nuanced cryptocurrency environment. Shareholders have reason to feel confident in management’s aptitude for maximizing opportunities born of Bitcoin’s volatility within the regulatory landscape.

The Road Ahead for Bitcoin and MicroStrategy

Saylor’s provocative poll, coupled with MicroStrategy’s bold moves, came as cryptocurrencies gained more mainstream attention. While some remain wary due to volatility and regulation, the survey outcomes and MicroStrategy’s tactics signalled growing belief in Bitcoin’s staying power and promise.

As Saylor continued championing Bitcoin, his impact in the crypto world stayed immense. “Bitcoin represents more than merely an investment; it embodies a revolution,” Saylor concluded. With 2025 on the horizon, both Bitcoin supporters and critics will watch closely to see if these ambitious predictions come to fruition, potentially reshaping financial landscapes for decades ahead.

FAQs

1. What were the results of Michael Saylor’s Bitcoin poll?

The broad-ranging survey unveiled enthusiastic expectations for Bitcoin’s prolonged success, with nearly 40% anticipating average annual returns of over 38% over the following two decades, underscoring strong faith in Bitcoin’s long-term appreciation.

2. How much Bitcoin does MicroStrategy currently hold?

After strategically obtaining Bitcoin in numerous acquisition campaigns costing approximately $28 billion total, MicroStrategy today safeguards over 446,000 BTC in its treasury, confirming its status as one of the heaviest corporate investors in the cryptocurrency.

3. What is the significance of the “21/21 Plan”?

Dubbed the “21/21 Plan,” MicroStrategy’s ambitious three-year scheme aims to amass $42 billion in funding to expand their colossal Bitcoin reserves even further, exemplifying their daring optimism regarding Bitcoin’s promising future and potential to transform the global financial landscape.