CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Michael Saylor is determined to keep his word and maintain Bitcoin purchases below $100,000.

His company Strategy just confirmed the pricing of its latest stock offering and may have just revealed how much could be invested into BTC.

According to Michael Saylor, the offering bumped up the expected net proceeds by about $122 million. Strategy initially projected that the sale would raise about $500 million.

Strategy recently revealed that it will price its 0.00% Series A Perpetual Preferred Stock (STRF) at $85 per share. In addition, it confirmed that 85 million shares will be issued and that it expects net proceeds to the tune of $711.2 million.

Strategy Once Again Signaling Institutional Interest as ETF Flows Turn Positive

The announcement means Strategy could be about to pump over $700 million into Bitcoin.

It is also timely considering that the bears have recently cooled off, paving the way for some recovery.

Moreover, sentiment is gradually shifting away from extreme fear and this outcome is reflected in liquidity flows.

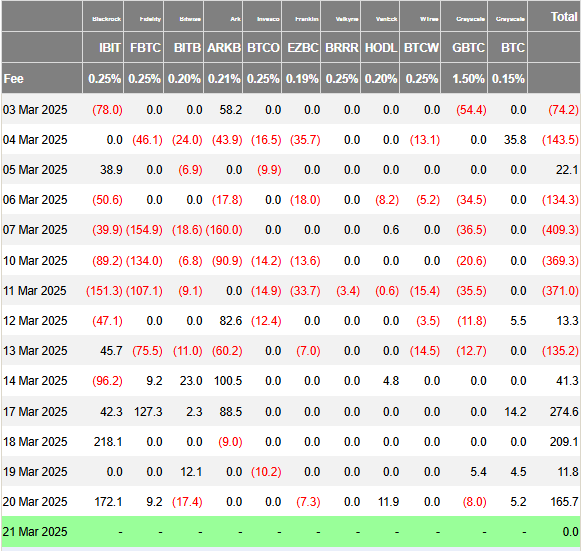

For example, Bitcoin ETF flows have been positive for the last 5 trading days after previously being in the red for the first half of March.

It is however worth noting that Bitcoin ETF inflows in the last 5 days have been relatively low.

This is because investors are still moving cautiously as sentiment is on track to conclude the week in fear territory.

Nevertheless, the return of Bitcoin ETF inflows confirms that institutions are eager to buy back BTC at its discounted prices.

Bitcoin Triangle/Wedge Pattern Indicates Critical Price Zone Ahead

Could Michael Saylor and Bitcoin ETFs steer Bitcoin back on track for a recovery towards $100,000?

Well, the switch to positive BTC ETF flows and Strategy’s upcoming share issuance suggest that liquidity injection could pave the way for more bullish activity.

The timing is also relevant especially based on BTC’s current price position. The king of the cryptocurrencies has been trading in a wedge pattern for the last 5 months and is now approaching a tight squeeze zone.

This price pattern suggests that Bitcoin could be headed for a breakout or break down from the pattern.

However, the probabilities could be leaning more in favor of the former, especially now that institutions are starting to buy back BTC.

The timeline of Bitcoin’s exit from the wedge pattern places that potential breakout or break down in early April.

While the data points to this potential outcome, it is worth noting that a lot could change in the remaining days in March.

Market headwinds risk the potential for sustained weak market sentiment. On the other hand, another major Bitcoin purchase from Michael Saylor and Co., could aid in a favorable sentiment shift.