CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

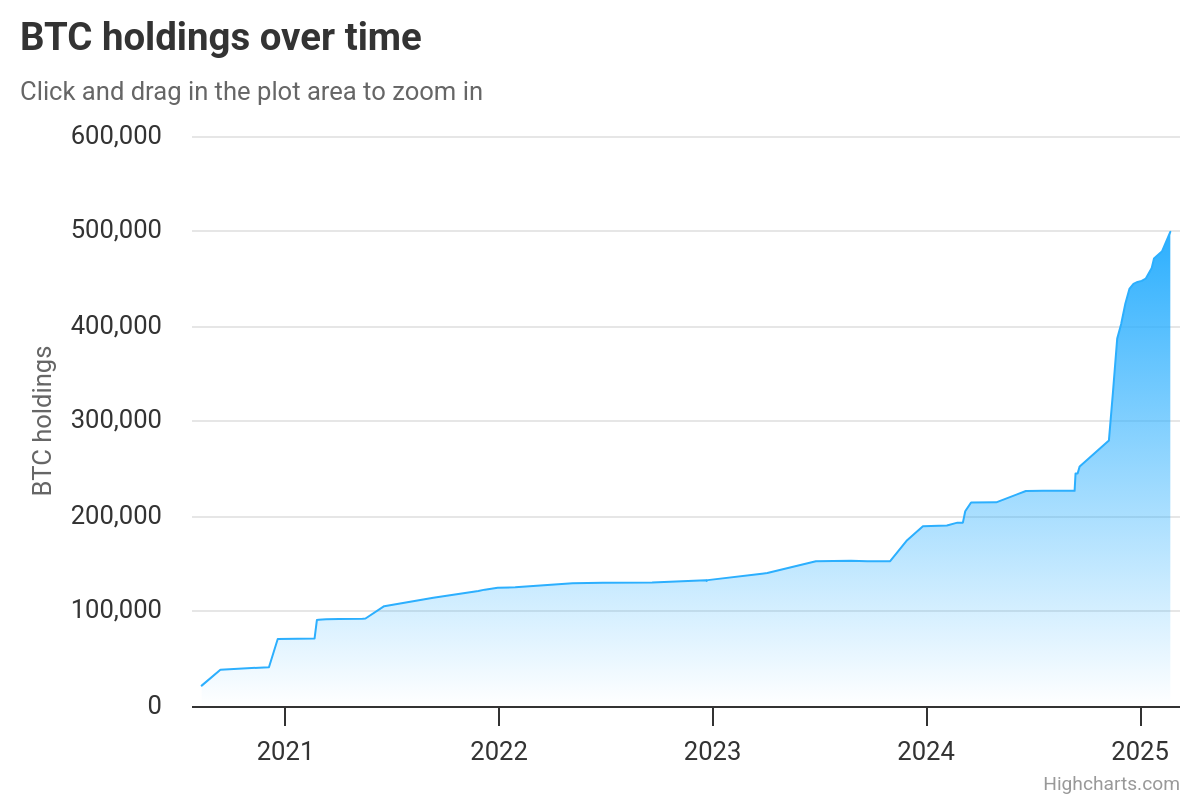

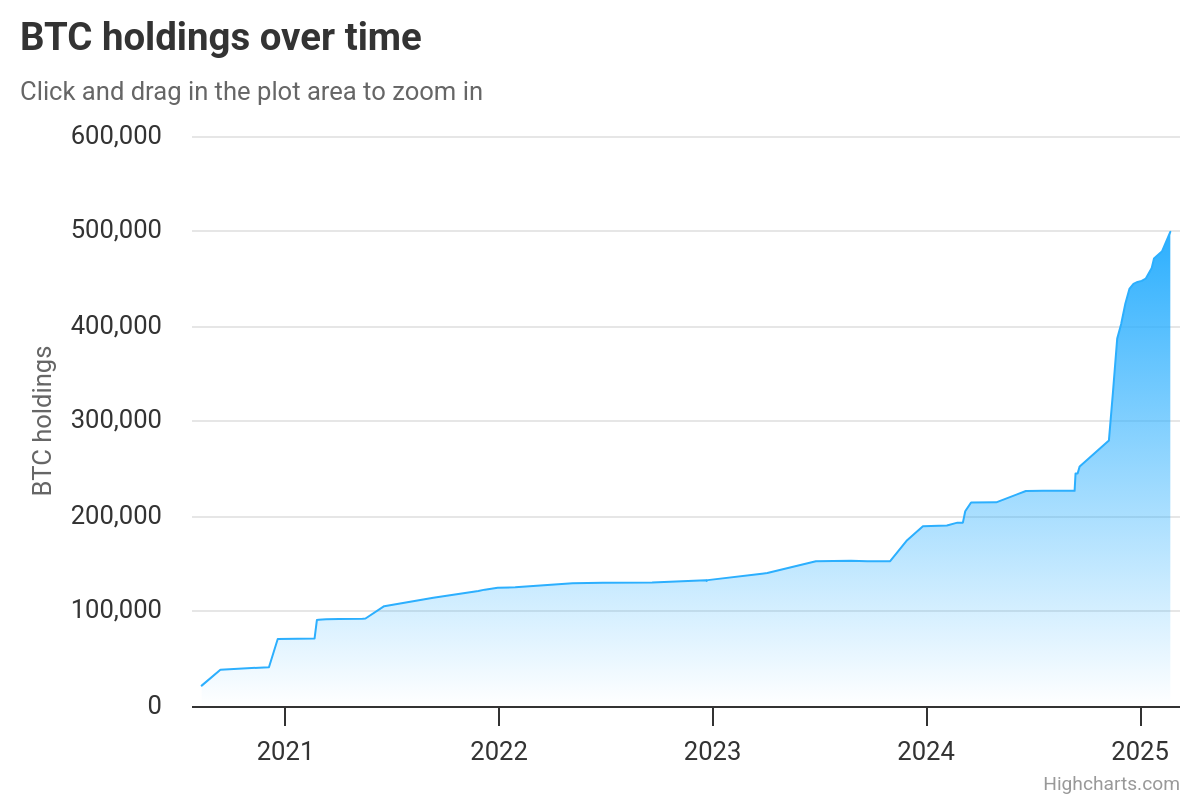

MicroStrategy definitely has a special place in the heart of the cryptocurrency community. At that time when this company entered the crypto market, not many public companies were enthusiastic about embracing Bitcoin. However, under the leadership of Michael Saylor, the company adopted an aggressive BTC investment strategy. Currently, it holds no fewer than 499,096 BTC tokens. Naturally, it made impressive headlines when the price of BTC achieved the $100K milestone. Since February 4, the BTC market has never closed above the $100K level. Currently, the BTC price stands at around $88,724.95 – at least 11.26% below the milestone. Has the price dip made any impact on the MSTR market? If ‘yes’, has Saylor’s strategy failed?

Michael Saylor’s Bitcoin Buying Strategy

A key component of MicroStrategy’s BTC investment strategy is Dollar-Cost Averaging. DCA is a very simple investment strategy. Instead of investing a large sum of money all at once, you invest a fixed amount of money at regular intervals.

This justifies why the company purchased BTC when the price was at a peak range of $95K and $106K.

Massive Losses from Recent Bitcoin Purchases

Since the peak of $106K, the price of BTC has plummeted by approximately 16.28%. At the start of February, the price was around $100,621.97. On the second day, it closed above $101,305.27. On the third day, the market saw a single day drop of 3.49%. Between February 5 and 23, the market remained within the range of $98,290.71 and $95,678.10. On February 24, the market slipped below this range. Between February 24 and 26 alone, the market dropped by 12.48%. Although between March 1 and 2, the market climbed by around 11.77%, it failed to recover from the previous correction. On March 3, the market declined by 8.49%. Currently, the Bitcoin market is struggling to reclaim the $100K range.

Due to this uncertainty in the Bitcoin market, MicroStrategy has suffered a huge unrealised loss of $1 billion. The biggest loss came from a $1.11 billion BTC purchase at $105,596 per BTC.

What’s Next for MicroStrategy’s Bitcoin Holdings?

The last BTC purchase by MSTR was reported on February 24. On that day, the public company purchased at least 20,356 BTC tokens for $1.99 billion.

Currently, the total value of MicroStrategy’s BTC holdings remains at $44,629,179,292.

If Bitcoin does not recover, the company may have to rethink its strategy.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As of now, MicroStrategy holds 499,096 BTC, valued at approximately $44.6 billion, despite market fluctuations.

Yes, recent BTC price drops have led to over $1 billion in unrealized losses, with a significant loss from a $1.11B purchase at $105,596 per BTC.

MicroStrategy’s stock (MSTR) often moves with Bitcoin, rising during BTC rallies and facing sell-offs during major corrections.