CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

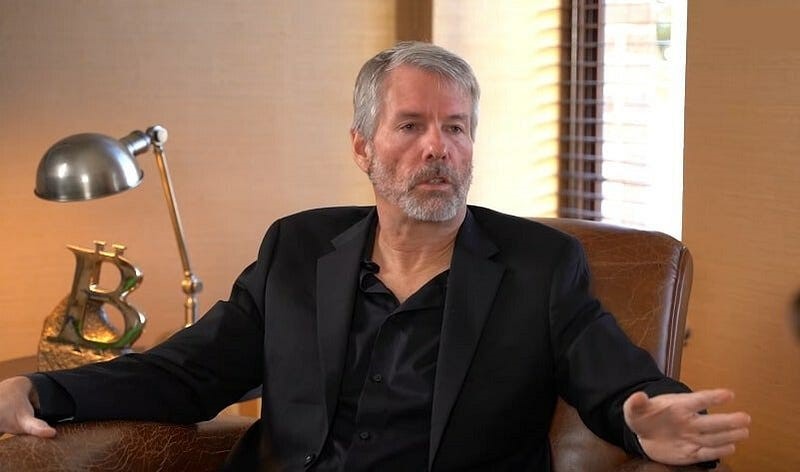

MicroStrategy plans to increase its share issuance to boost its Bitcoin purchases, aiming for $42 billion in Bitcoin through equity and debt financing. MicroStrategy’s stock has jumped almost 420% in 2024, similar to how well Bitcoin is doing. A special shareholder meeting is set to approve changes to the company’s equity issuance policy for this plan.

MicroStrategy plans to increase its authorized Class A common stock from 330 million to 10.33 billion shares and its preferred stock from 5 million to over 1 billion shares, as stated in a recent SEC filing.

This big increase will give the company more options for future funding needs, matching its 21/21 Plan announced in October, which aims to secure $42 billion in Bitcoin over three years, divided equally between equity sales and fixed-income securities.

In December, MicroStrategy bought 42,162 BTC for more than $4 billion, making it their biggest buying period so far. CEO Michael Saylor highlighted the approach of buying Bitcoin when prices are high to get the best returns, saying, “If you are not buying Bitcoin at the top, you are leaving money on the table.” The company reported a Bitcoin yield of 17.8% and plans for an annual yield of 6% to 10% from 2025 to 2027.

MicroStrategy has raised $13 billion from stock sales and $3 billion from convertible bonds, but there will be a pause in Bitcoin purchases in January because of a planned blackout period.

The company’s performance has improved due to Bitcoin’s rising value, resulting in its addition to the Nasdaq-100 and possible consideration for the S&P 500. MicroStrategy, the biggest corporate holder of Bitcoin, stands out in the cryptocurrency world due to its bold buying strategy led by Saylor.