CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

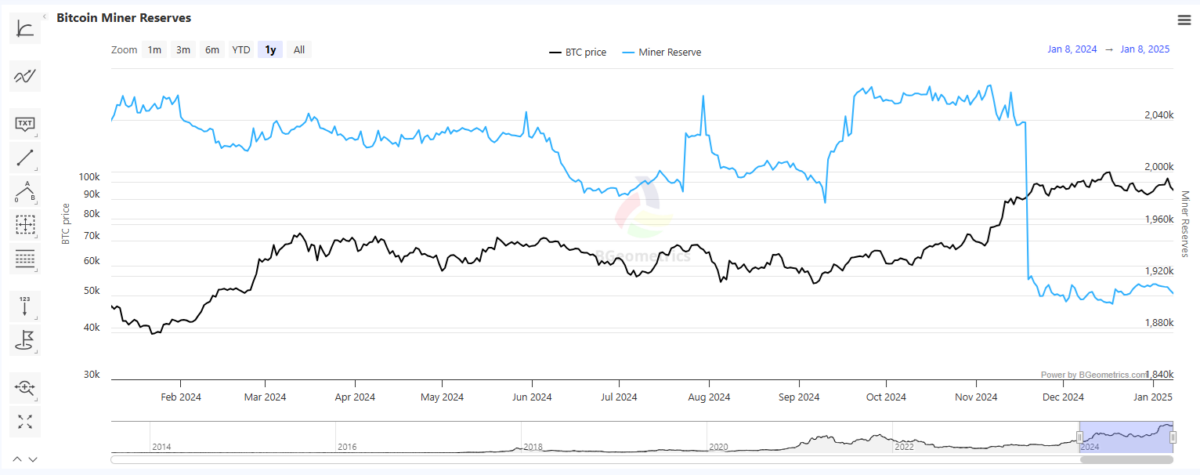

Miners are one of the most closely watched Bitcoin (BTC) holders because many consider their behavior as signals for long-term price action. Miners now retain around 1.9M BTC, not counting expanded treasuries, with sales occurring more sparingly.

Miners are no longer selling their Bitcoin (BTC) holdings at usual rates, retaining between 1.8 and 1.9M coins across the board. Outflows to exchanges are at the lowest levels since April, shifting the balance of new supply to mining companies.

The shift was noticed at the end of 2024. Miner flows to exchanges have been a long-term indicator of market sentiment.

Mining firms holding on for favorable conditions

Some of the BTC block producers can still sell their coins on OTC markets. Most, however, are hoping for higher market prices while retaining the coins produced at a lower cost basis. Miners can also plan their activity to avoid panic-selling or capitulation. Additionally, some large-scale corporate mining firms receive payments from third parties and do not always depend on selling their BTC for electricity or equipment.

As a result, miners’ realized price when selling is above $47,000 per BTC, compared to $41,000 for all other sellers. At that price, most mining operators realize profits of over 100%, especially if they sell coins mined during previous halving periods.

Average BTC mining costs are recalculated at over $89,000, rising along with the market. However, miners retain coins that have been mined at costs as low as $23,000 or even lower for older companies. Miners may also be a source of coin availability, especially in the case of diminished exchange reserves.

Miners have also survived a larger number of cycles and have learned not to capitulate or sell their coins too fast. Previously, some of the funds were selling regularly to cover costs, but the past year shifted sentiment, turning miners into partial long-term whales.

Over the past two years, mining firms have continued to expand their hashrate, while their reserves reached a temporary top at 2.02M coins. Since then, some of the companies have been taking profits, mostly to finance new investments. The miner reserves are lower than the reported 2.95M BTC in corporate treasuries, though some of those coins may overlap as belonging to long-term miners.

Of those reserves, the top US-based mining firms hold over 73,000 BTC. As activity shifted to powerful US-based farms, up to 40% of newly mined BTC may be held in the wallets of those top mining companies. Those new BTC may be even more valuable for OTC purchases and long-term holding, as they have not been linked to illegal activities.

Despite previous fears, miners are showing no signs of capitulation, instead focusing on retaining access to electricity and expanding their new mining facilities. Bitcoin hashrate remains near its historical peak, with short-term fluctuations as some of the pools come offline during less favorable mining conditions.

Miners may offset selling from other investors

Miners holding on to their coins could also potentially offset the selling from ETFs and other professional whales. BlackRock recently broke its holding streak, even though it still holds 557.39K BTC. The ETF issuer sold 1,320 BTC, which may still be easily absorbed by the market. However, they are sending a signal of shifting sentiments.

ETFs as a whole hold 1.1M BTC, which may be sold more rapidly and without a plan. Miners, on the other hand, mostly sell based on predictable electricity costs or long-term investment plans.

BlackRock’s sales happened on a day that BTC continued to feel price pressure, settling under $94,000. Soon after absorbing some selling, BTC recovered to $95,073.80, showing its ability to bounce with short-term volatility.

Smaller drawdowns are no longer causing the same panic, even for newer buyers who acquired BTC at a lower cost basis. Even short-term buyers show strong support above prices of $87,000.

For BTC, spot selling may not be the biggest threat, compared to the derivative market. In the short term, attacks against leveraged positions may sway the price. Options expiry periods also cause short-term volatility.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan