The announcement followed Moo Deng’s rise to fame that even inspired a Solana-based meme coin, MOODENG. Meanwhile, Ethereum traders recently made some impressive profits, and one trader earned $1.1M from a leveraged short. Analysts also predict that ETH could outperform Bitcoin in early 2025. Ethereum ETFs, like BlackRock’s ETHA, are already gaining momentum by attracting millions in inflows, contrasting with Bitcoin ETFs.

Vitalik Buterin Adopts Viral Pygmy Hippo Moo Deng

Vitalik Buterin, the co-founder of Ethereum, captured the internet’s attention by adopting Moo Deng, a pygmy hippopotamus that became a viral sensation earlier this year. The announcement was made by Thailand’s Khao Kheow Open Zoo on Dec. 26 through a post on X which revealed that Buterin contributed 10,000,000 Thai Baht (or $292,000) to support Moo Deng and her family as part of the Wildlife Sponsorship Program. The zoo is extremely grateful that Buterin will be supporting Moo Deng over the next two years.

Moo Deng rose to fame in September of 2024 thanks to her playful personality and the widely shared videos posted by the zoo, which captivated audiences worldwide. After the adoption announcement, Buterin indicated that his support could extend further, and revealed plans to allocate 88 ETH, which is equivalent to over $290,000, to assist Moo Deng and her companions. Buterin’s philanthropy in 2024 also included a $180,000 Ethereum donation to the biotech charity Kanro, which came from meme coins that were sent to his wallet.

The viral phenomenon of Moo Deng extended beyond just the confines of social media, and even inspired the creation of a Solana-based meme coin named MOODENG. Early investors reaped impressive profits from the token, and one trader transformed a $1,300 investment into $3.4 million. However, the token’s success was short-lived as its value plummeted by about 58% from its peak price of $0.62 in mid-November 2024.

Data from Solana’s meme coin launchpad, Pump.fun, revealed that more than 99% of traders suffered losses or gained less than $1,000. Out of 8.5 million wallets, only 50 earned up to $1,000, while five wallets achieved profits between $1,000 and $10,000. Just one wallet managed to exceed $10,000 in earnings. Despite the financial turbulence, Moo Deng is still a symbol of joy and community engagement, now with the added support of one of cryptocurrency’s most influential figures.

Trader Nets $1.1M on Ether Short

MOODENG was not the only token that traders lucked out on. A crypto trader recently made more than $1.1 million in profit in just two days by strategically shorting Ethereum (ETH) during the current market correction.

By using a 50x leveraged short position, the trader borrowed 19,186 Ether, worth more than $64.5 million, when its price was $3,428. This position was opened on Dec. 24, and also earned the trader over $680,000 in funding fees. According to blockchain data from Hypurrscan, the short position carries a liquidation price above $4,750.

On-chain intelligence firm Lookonchain revealed that the trader faced a $1.2 million loss on the first day. However, the market’s subsequent downturn flipped the position into a highly profitable trade. While leveraged trading can amplify returns, it still carries some serious risks. These risks took center stage in January of 2024 during an incident where a trader lost over $161,000 after being liquidated on a leveraged position.

The past year has seen other traders make extraordinary profits in the volatile crypto market. Bitcoin’s historic climb past $100,000 on Dec. 5 was especially a boon for many, while meme coin traders also saw good returns. One such trader turned a $27 investment into $52 million over 600 days by capitalizing on PEPE’s meteoric rise. Another trader in May achieved a $46 million profit from a $3,000 investment in PEPE.

Ether Poised for Breakout

Traders can make even more money off ETH as the altcoin is showing potential for a breakout against Bitcoin in January 2025. TradingView data revealed that the ETH/BTC ratio strands close to 0.0356, and MN Capital founder Michael van de Poppe suggested it could surpass 0.04 in January. The last time the ratio hit 0.04 was on Dec. 8, when ETH reached $4,018.

Van de Poppe expects increased inflows into Ether in the coming month, while Bitcoin may experience outflows that could potentially consolidate its price. This shift could trigger an “altcoin run,” which happens when alternative tokens like Ethereum gain more market momentum. Already, key Ethereum ecosystem tokens like Shiba Inu (SHIB) and Mantle recorded impressive price increases recently.

Bitcoin, meanwhile, continues to trade below the $100,000 mark. Despite reaching the six-figure milestone on Dec. 5, its current performance contrasts with the enthusiasm building around Ethereum and altcoins.

Analysts also predict that spot Ether exchange-traded funds (ETFs) could outperform Bitcoin ETFs in 2025. Nate Geraci, the president of ETF Store, shared that inflows into ETH ETFs are aligning with those of gold ETFs and may accelerate even more in the near future. Pseudonymous trader Brent compared Ether’s current state to a “ball forcibly held underwater,” which means that the altcoin has the potential for explosive growth.

Into The Cryptoverse founder Benjamin Cowen noticed earlier in December that the ETH/BTC ratio’s decline is either over or nearing its conclusion, which also sets the stage for potential growth over the next 6 to 12 months.

Ethereum ETF Gains Momentum While Bitcoin ETFs Face Outflows

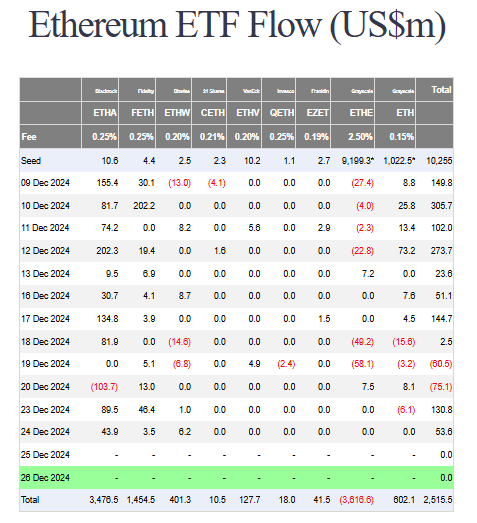

BlackRock’s Ethereum ETF, the iShares Ethereum Trust (ETHA), attracted almost $44 million in inflows on Christmas eve, bringing its total net assets to $3.65 billion, according to data from SoSoValue. In contrast, BlackRock’s iShares Bitcoin Trust (IBIT) faced outflows of $188 million, contributing to an overall $338 million bleed from Bitcoin ETFs on the same day.

Among the Bitcoin ETFs, Fidelity’s Wise Origin Bitcoin Fund (FBTC) and ARK’s 21Shares Bitcoin ETF (ARKB) recorded outflows of $83.16 million and $75 million, respectively. Bitwise’s Bitcoin ETF (BITB) stood out as the only product in the green, gaining $8.5 million in inflows. Bitwise’s Ethereum ETF also performed well after attracting roughly $6 million in inflows.

Ethereum ETF flow (Source: Farside Investors)

Despite the recent underperformance, BlackRock’s spot Bitcoin ETF is still a standout success thanks to it amassing close to $54 billion in net assets in less than a year. This achievement cements its position as one of the most successful cryptocurrency stories of the year. Industry experts, including Bitwise, predict that the total Bitcoin ETF inflows next year could surpass those of 2024.

Additionally, Bitcoin ETFs recently surpassed the estimated holdings of Bitcoin’s pseudonymous creator, Satoshi Nakamoto, though the exact number of coins owned by Nakamoto is still unknown.