CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Tandem may invest in project tokens, but Offchain Labs stresses no guarantees for funding or engineering support.

- The program prioritizes “fair launches,” rejecting models that prioritize short-term gains over community-driven growth.

- Ethereum’s L2 expansion risks fragmentation and revenue loss, with Standard Chartered downgrading its ETH forecast to $4,000 by 2025.

Offchain Labs, the team behind Ethereum’s layer-2 network Arbitrum, has partnered with the Arbitrum Foundation to create Onchain Labs, a program aimed at accelerating the growth of decentralized applications (DApps) on the platform.

Announced on March 17, the initiative will focus on supporting projects described as “experimental and forward-thinking” offering guidance on product design and market strategies. Offchain Labs clarified that the program will not provide technical or operational resources, though its venture arm, Tandem, may invest in project tokens.

Introducing Onchain Labs, in partnership with @arbitrum.

While we continue to innovate scaling infra, today we also look to empower the Arbitrum app layer.

pic.twitter.com/acIr4Ii9wD

— Offchain Labs (@OffchainLabs) March 17, 2025

The company stated that Arbitrum has become one of the “most efficient networks” in the blockchain sector but now seeks to broaden its application offerings.

“We aim to work with developers from early stages to build user experiences that set industry standards,” Offchain Labs noted.

It also emphasized that only projects committed to “fair launches” will receive support, criticizing models that prioritize short-term gains over community benefit.

“Success should be shared across all participants,” the firm added.

Ethereum’s Layer-2 Growth Sparks Concerns Over Fragmentation

The rise of layer-2 (L2) networks like Arbitrum and Base has led to debates about Ethereum’s future. Over 70 L2s now operate, according to L2Beat, raising worries about compatibility and infrastructure complexity. Vitali Dervoed of Composability Labs warned that this trend could weaken Ethereum’s cohesion.

“Too many L2s make it harder for systems to work together, creating long-term challenges,” he said.

Lower-cost L2s are also diverting revenue from Ethereum’s base layer. Standard Chartered recently reduced its 2025 Ethereum price forecast by 60%, citing L2 competition as a key factor. Analyst Geoff Kendrick highlighted that Base alone has shifted $50 billion from Ethereum’s market value.

“This trend reflects a broader shift in user activity,” he explained.

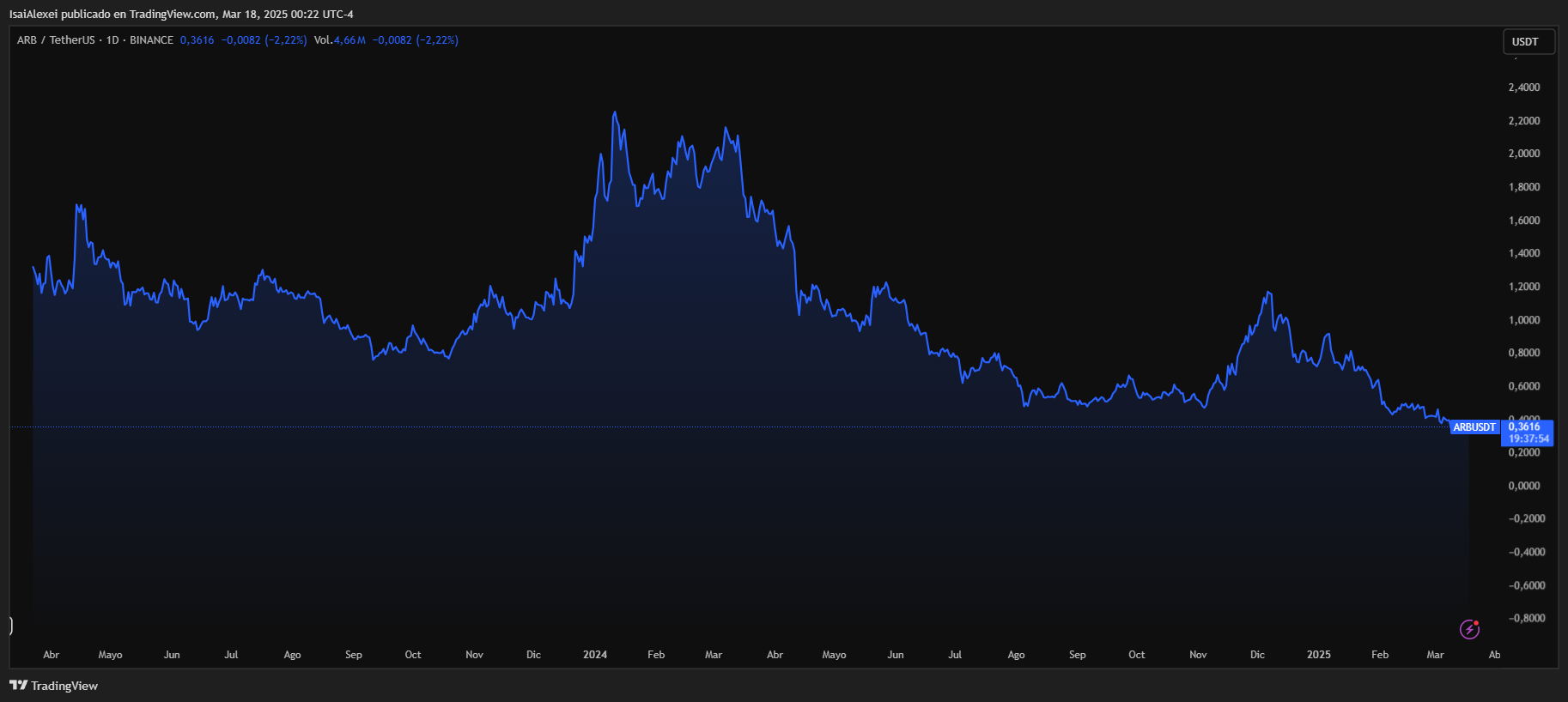

As of today, Arbitrum (ARB) is trading at $0.3621, reflecting a 2.08% decline in the past 24 hours.

Over the past week, ARB has gained 13.01%, but over the last month, it has dropped 24.06%. In the last six months, ARB has fallen 31.56%, and its year-to-date performance is down 49.86%, highlighting a prolonged downtrend.

Arbitrum reached its all-time high of $1.82 but has since declined significantly. Currently, technical indicators suggest a neutral trend, with mixed signals from moving averages and oscillators. If ARB can sustain momentum, resistance levels to watch are $0.38-$0.40, while key support remains around $0.35-$0.32.

Recent news, such as ARB’s upcoming listing on Arkham Exchange (March 18) and Gemini (March 15), may influence short-term price action. However, traders should exercise caution as volatility remains high, and the market continues to show bearish pressure.