The size and popularity of the Bitcoin options market have made it one of the best tools for gauging market sentiment and predicting volatility. Previous CryptoSlate analysis found that options wielded an outsized influence over Bitcoin’s price volatility and were responsible for most of the volatility we’ve seen this quarter.

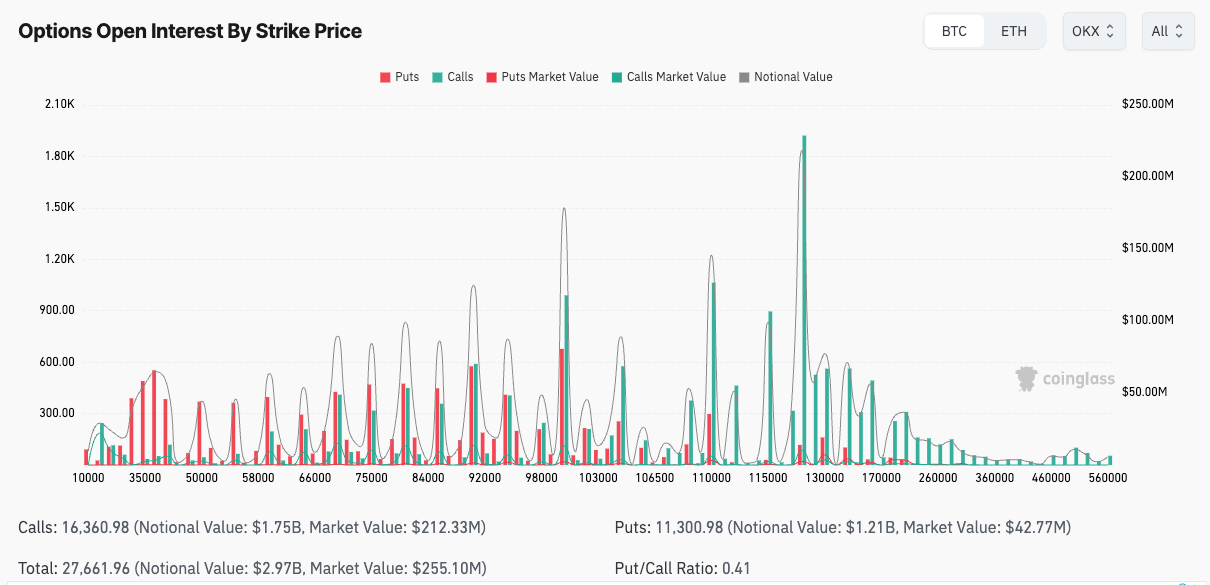

Options data has shown a significant concentration of open interest (OI) at the $120,000 strike price for contracts expiring at the end of the year. This particular strike price has garnered significant attention from traders, with over $640 million in OI on Deribit alone. This OI far surpasses the activity we’ve seen at neighboring strikes across most platforms. Such a heavy focus on a single strike price shows speculators are optimistic about a price increase but creates a possibility of high volatility in the coming weeks.

Open interest in strike prices far above the current spot price of Bitcoin can indicate that traders are willing to bet on extraordinary price movements. While Bitcoin’s price at press time remains significantly below the $120,000 level, fixed at around $107,000, the options delta can provide a clearer perspective on the probability of such bets materializing.

Delta, a key options metric, represents the sensitivity of an option’s price to changes in the underlying asset and can also serve as an approximation of the option’s probability of expiring in the money. For the $120,000 strike expiring on December 27, the delta sits at approximately 0.10, suggesting a 10% chance that Bitcoin will reach or exceed this price by year’s end, data from Kaiko showed.

As options are forward-looking, they provide insight into where traders believe the market could move and how volatile they expect it to be. A high concentration of open interest at a particular strike and substantial volume show which levels traders see as significant. In this case, the $120,000 strike emerges as a preferred point.

This is particularly significant because options activity often precedes spot market trends, as traders use options to hedge, speculate, or capitalize on expected volatility. High open interest on such a high strike price shows the market is preparing for a sharp price increase.

The size of Deribit’s OI shows the dominance of crypto-specific platforms in the Bitcoin options market. While CME, Binance, and OKX all offer options trading, Deribit remains the clear leader, particularly for high-strike calls.

On Deribit, open interest is highly concentrated not only at $120,000 but also at other key psychological levels, such as $100,000, $110,000, and $130,000. This clustering indicates that traders are hedging or speculating around key price thresholds, likely anticipating significant price action in the last few weeks of the year. When combined with low deltas, the data shows traders are betting on low-probability, high-reward outcomes.

The disparity between Deribit’s options data and the activity on platforms like CME reflects a clear divide between institutional and retail participation. While CME data reflects a more conservative positioning among institutional traders, the speculative activity on Deribit points to a higher appetite for risk among crypto-native participants. This shows the importance of monitoring multiple platforms when analyzing the options market. Deribit, as the leader in liquidity and open interest, often sets the tone for Bitcoin options trends, while traditional platforms provide a complementary view of institutional flows.

From a volatility perspective, options strike price data and open interest levels are equally important for understanding how the market is pricing risk. The concentration of activity at distant strikes suggests that traders expect Bitcoin’s price to exhibit high levels of volatility leading into the end of the year. Options, particularly out-of-the-money calls, often serve as inexpensive bets on extreme moves. Substantial OI at strikes far above the current spot price indicates that traders anticipate price swings large enough to justify these positions, even if the probability of success remains low.

The post Options traders bet big on Bitcoin reaching $120K despite low odds appeared first on CryptoSlate.