PEPE, the meme coin, is the third largest in the market and has had a significant price surge recently due to increased investment activities. The surge comes when other cryptocurrencies have also posted similar gains in the market. For example, Bitcoin rose to nearly $98,500, which created positive sentiment in the industry. The Crypto Fear & Greed Index, which determines the market sentiment, also rose as Bitcoin price surged and was almost at the greed level.

The total market capitalization of all the coins listed on the CoinGecko platform has recently hit the $3.60 trillion mark. All cryptocurrencies were on the rise and the same can be said for the PEPE coin. In the last 24-hour period alone, the volume of token trading rose to $2.2 billion; this shows that more and more investors are getting involved in the trading.

PEPE Futures Open Interest Increases

Besides the price jump, the PEPE’s future open interest has gradually increased. It went up for the third day in a row, now standing at $151 million. This is the highest level of future open interest for the token since December 30, 2023. The open interest has also gone up, which means that traders are placing their bets on further price shifts, which can only be seen as positive for the meme coin.

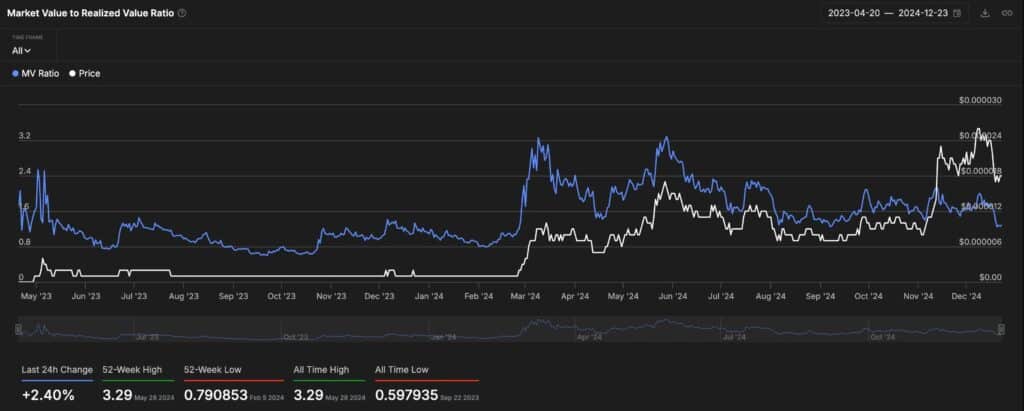

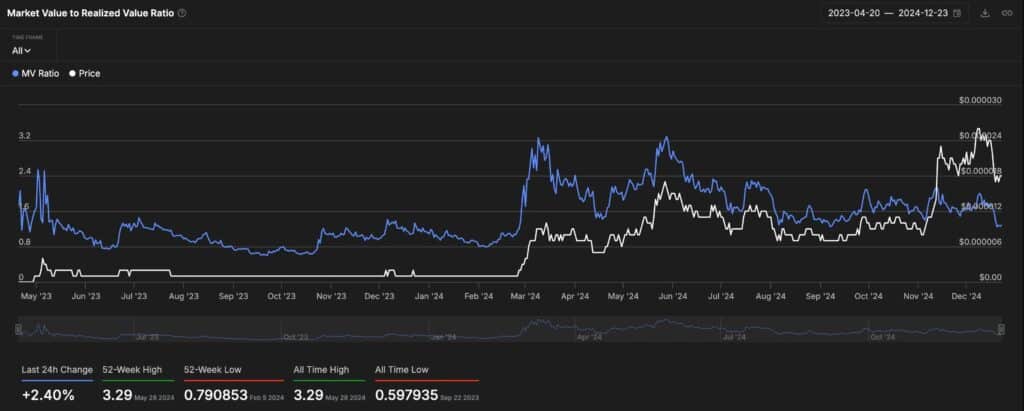

A major reason behind PEPE’s price surge is the MVRV ratio, which stands at its lowest since November 5, 2023, the date of its last major price drop. The MVRV-Z score, which is used to determine whether an asset is overvalued or undervalued, fell to 1.28. This means that the token could very well be oversold and ready for a jump. In the past, this indicator has dipped to similar levels, which has, in turn, led to some substantial price appreciation for tokens; for instance, the price spiked to an all-time high of $0.00002830 in November.

Nevertheless, there are some optimistic signals, but not all the parameters suggest further growth of PEPE. It appears that many speculators have left the market recently, and the data support this observation. In the past seven days, there has been a decline in active new and zero-balance addresses linked to tokens of more than 20%.

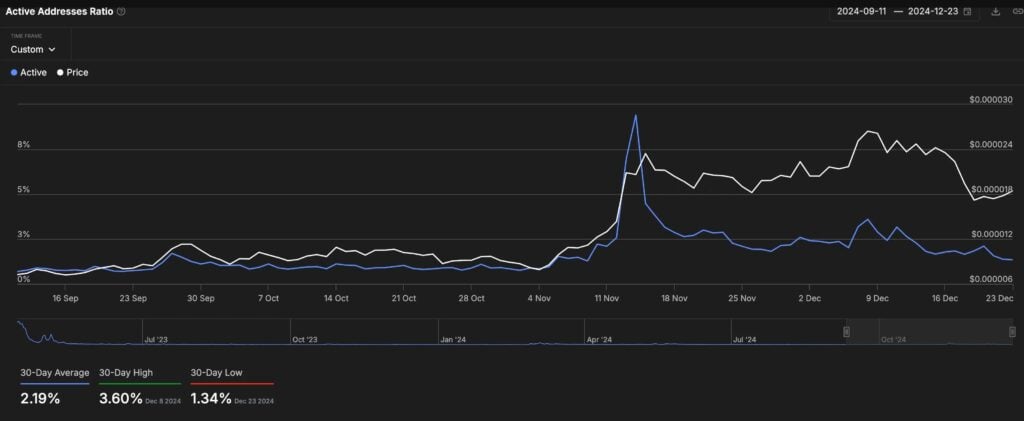

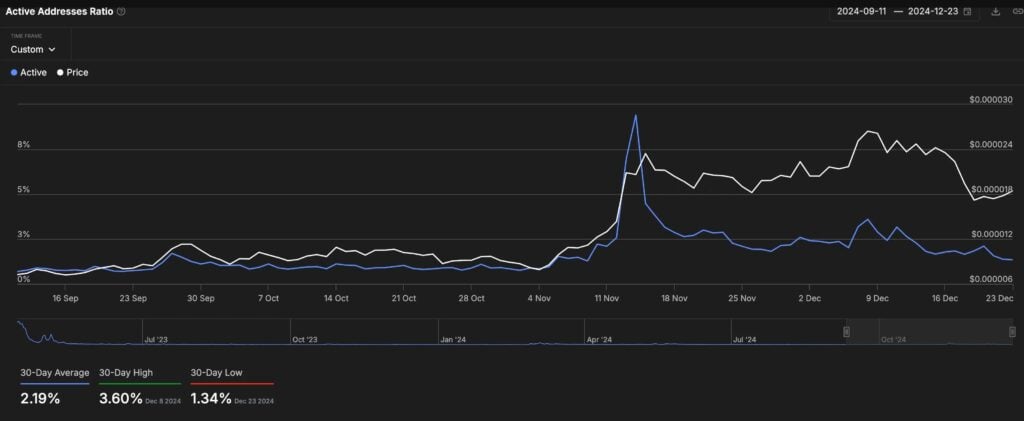

In addition, the active address ratio, which is considered as a precursor of price breakouts, has declined to 1.34%. This is the lowest level in a month and, hence, the interest in PEPE may start to decline. Previous coin price rises have taken place when this ratio was declining, so current appreciation might be more a factor of speculation than solid demand.

Risks of a Dead Cat Bounce

Looking at the technicals, the price of PEPE appears to be painted in the middle of the road. This month alone, the coin had risen to its highest point of $0.00002830 but then made a dramatic drop. The price fell below a crucial support level of $0.00001713, the higher part of the “cup and handle” formation from May to November.

Despite the fact that the PEPE price is still trading above the 100 DMA, the price is trying to break the 50 DMA. A break above the 50-day MA could open up further upside, but as always, there are risks involved. There are those who think that the recent PEPE rise might be a so-called “dead cat bounce”, when the price rises briefly before continuing its decline. Furthermore, the deterioration of the bearish flag pattern on the chart indicates that PEPE is vulnerable to more price drops if the market takes a turn.

To keep the bearish outlook invalidated and confirm a bull break out, PEPE must close and remain above $0.000025. This would suggest that investors are fully back in the coin and that the meme coin is set to rise even further. However, until such time as this change takes place, it is wise for those thinking of buying or investing in PEPE to exercise a degree of caution.

Conclusion

Even though PEPE has made significant progress in the last few days, it is still hard to predict its future. The data reveal possibilities for further growth; nevertheless, the possibilities of reversing or maintaining the negative trend are rather high. Traders should focus on price movements of the coin as well as the general market environment.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What is driving PEPE’s recent price surge?

The surge in the price of tokens is attributed to high levels of investment and the general rise of the crypto market, including Bitcoin at $98,500.

How does the MVRV ratio impact PEPE’s price potential?

The MVRV ratio shows that the tokens could be oversold and may rise like previous hikes or at least hold steady.

Are there any warning signs for PEPE’s future price movement?

Yes, the decrease in active addresses and a falling active address ratio may be indicative of lesser investor interest and possible static prices in future.

What level must PEPE break to confirm sustained bullish momentum?

For the price to indicate a sustained and solid bullish trend, the token has to break and trade above $0.000025.