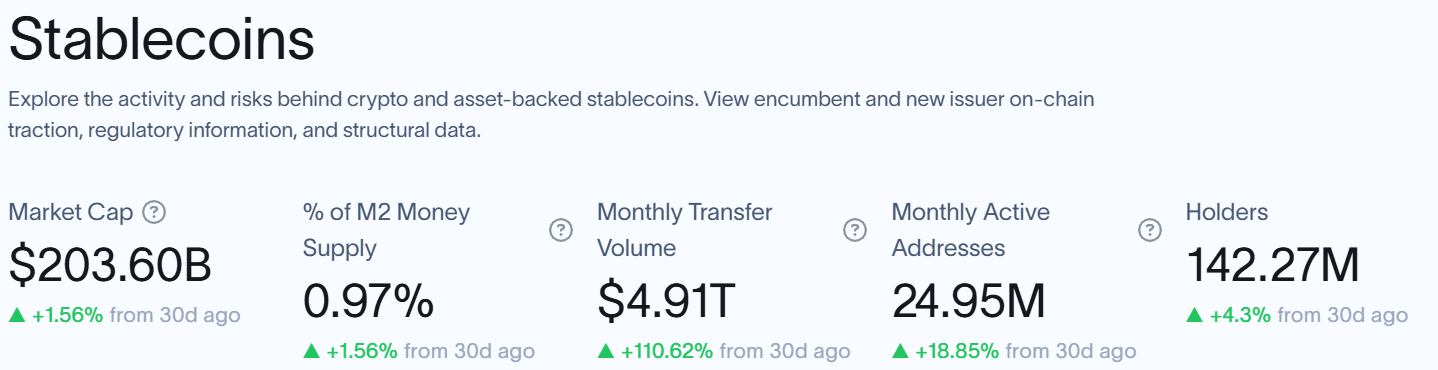

One of the main goals of PHPX is to transform cross-border payments and financial inclusion. Meanwhile, Agora completed its first OTC transaction with AUSD, which was a huge step into the institutional market. Ethena’s USDe, which is now ranked as the third-largest stablecoin, recently gained a lot of traction in DeFi with its attractive yields and integrations into platforms like Compound Finance. The stablecoin market is currently valued at close to $203 billion, and projections suggest it could realistically reach $300 billion in 2025.

Philippine Banks to Launch PHPX Stablecoin

Several banks in the Philippines are collaborating to create PHPX, a peso-backed stablecoin with the goal of improving cross-border payments and financial inclusion. The PHPX stablecoin is scheduled for launch between May and July, and is being developed by Singapore-based startup Just Finance.

A stablecoin is a type of cryptocurrency that is designed to maintain a stable value by being pegged to a reserve asset, like a fiat currency such as the peso, or other assets like gold. This stability makes stablecoins ideal for use in everyday transactions and cross-border payments.

PHPX will operate on the Hedera decentralized ledger technology (DLT) network. Some of the key participants in the project include UnionBank of the Philippines, Rizal Commercial Banking, Cantilan Bank, and Rural Bank of Guinobatan. All will play a role in the token’s governance.

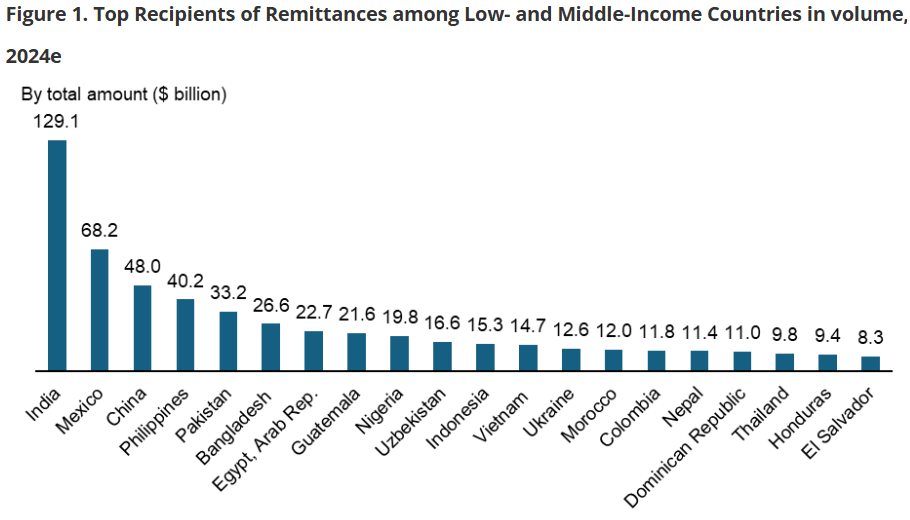

PHPX is designed to transform cross-border remittances, which is an essential economic component in the Philippines as $40 billion was sent by overseas workers in 2024 alone. UnionBank’s fintech arm, UBX, previously operated PHX, a quasi-stablecoin for closed-loop payments. UBX CEO John Januszczak believes it is important to create a publicly exchangeable token to support broader use cases beyond just domestic transactions. The PHPX stablecoin will hopefully streamline cross-border transfers by enabling real-time payments and offering solutions like paying tuition fees directly from abroad.

(Source: World Bank)

The initiative also includes plans for a multicurrency stablecoin exchange that will facilitate swaps between PHPX and stablecoins in US dollars, Singapore dollars, and Japanese yen. Liquidity providers and other qualified investors may be incorporated to meet market demand, potentially expanding PHPX’s use to domestic retail and point-of-sale transactions.

Hedera’s permissioned network ensures that the stablecoin is compliant with Basel Committee crypto-asset requirements, while interactions will align with EU’s Markets in Crypto-Assets Regulation standards or similar frameworks.

Agora’s AUSD Completes First OTC Trade

Stablecoin developments are also happening in other parts of the world. Asset manager Galaxy and stablecoin issuer Agora recently announced the completion of the first over-the-counter transaction involving AUSD, Agora’s stablecoin, which was its first transition from a proof-of-concept to real-world application.

Agora’s CEO, Nick van Eck, believes this milestone is a step toward establishing AUSD in the competitive stablecoin market, which is currently dominated by Circle’s USD Coin (USDC) and Tether’s USDT. Other newer entrants like Ethena’s USDe have also turned some heads recently.

The stablecoin market experienced a lot of growth, especially after President-elect Donald Trump openly committed to making the United States a global leader in crypto. The market caps of the top three stablecoins—USDT, USDC, and Dai—grew by more than $25 billion in 2024, driven by increased demand during the fourth quarter.

Stablecoins play a pivotal role in decentralized finance (DeFi) by serving as critical on-ramps to the ecosystem. Ethena’s USDe stablecoin gained traction in the DeFi space after reaching a market cap of $6 billion in December, which allowed it to surpass Dai. Analysts attribute its success to attractive staking yields, which averaged 17.5% annually in 2024, and its integration into DeFi protocols.

AUSD features (Source: Agora)

Agora positions AUSD as a builder-focused stablecoin that is aimed at traders and developers, leveraging gas-optimized smart contracts and offering full collateral backing. With reserves held by a leading asset manager and regular audits, Agora is targeting the institutional stablecoin market. Overall, Agora plans to establish AUSD as a cornerstone in the industry.

Compound Adds USDe and mETH to Lending Platform

Compound Finance recently integrated Ethena’s USDe and Mantle’s liquid staking token (LST) mETH as lending collateral on its decentralized lending and borrowing platform. The decision was finalized through a token holder vote on Jan. 8, and certainly proves the growing adoption of yield-bearing stablecoins and Ethereum-based LSTs in DeFi. With $2.7 billion in total value locked (TVL), Compound is one of the Ethereum network’s leading DeFi protocols.

Compound TVL (SourceL DeFiLlama)

The integration also reflects broader trends in DeFi, where TVL surged to over $118 billion as of Jan. 10. This is a 150+% year-to-date increase. The growth is fueled in part by the popularity of LSTs and liquid restaking tokens (LRTs) like Mantle’s mETH and cmETH. Restaking involves leveraging already-staked tokens to secure additional protocols, and has enhanced yield opportunities. Mantle’s mETH currently generates an annual yield of about 2.86%, while its cmETH token amplifies returns with restaking rewards.

The adoption of Ethena’s USDe stablecoin reinforced DeFi’s expansion. Since its February 2024 launch, USDe has become the third-largest stablecoin by market cap. It has also attracted a lot of interest from users seeking double-digit yields, with its staked version, sUSDe, currently yielding 11.25% annual returns.

Circle Donates 1 Million USDC to Trump Inauguration

Circle, the issuer of USDC, donated 1 million USDC to President-elect Donald Trump’s Inauguration Committee. Circle CEO Jeremy Allaire described the acceptance of the donation as a reflection of the asset class’s growing maturity.

USDC holds a market cap of close to $45 billion, and is part of a broader stablecoin market that is worth almost $203 billion, according to data from RWA.xyz. Trump’s inauguration is slated for Jan. 20, and it caused a lot of optimism in the crypto industry due to expectations for pro-crypto legislation and regulatory reform under his administration.

Stablecoin stats (Source: RWA.xyz)

In recent years, stablecoins attracted the attention of US lawmakers for their potential to support the economy. In April of 2024, Senators Kirsten Gillibrand and Cynthia Lummis introduced the Lummis-Gillibrand Payment Stablecoin Act, which places a lot of emphasis on the need for a regulatory framework to preserve the US dollar’s global dominance.

Former House Speaker Paul Ryan also advocated for stablecoins in a June op-ed, and he specifically mentioned their ability to address the national debt crisis by driving demand for US government debt through overcollateralized issuers holding $120 billion in short-term securities. Later in October, Senator Bill Hagerty introduced the Clarity for Payment Stablecoins Act, which proposed state-level regulation for issuers with less than $10 billion in market cap.

Looking ahead, industry leaders and venture capitalists see great growth potential in the stablecoin market. Guy Young, the founder of Ethena, predicts the sector will reach a $300 billion market capitalization by 2025. This growth will likely be driven by established players like Tether and Circle. Deng Chao, CEO of HashKey Capital, believes stablecoins are a primary focus for venture capital in emerging markets because of their proven utility in providing financial services to unbanked populations globally.