CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

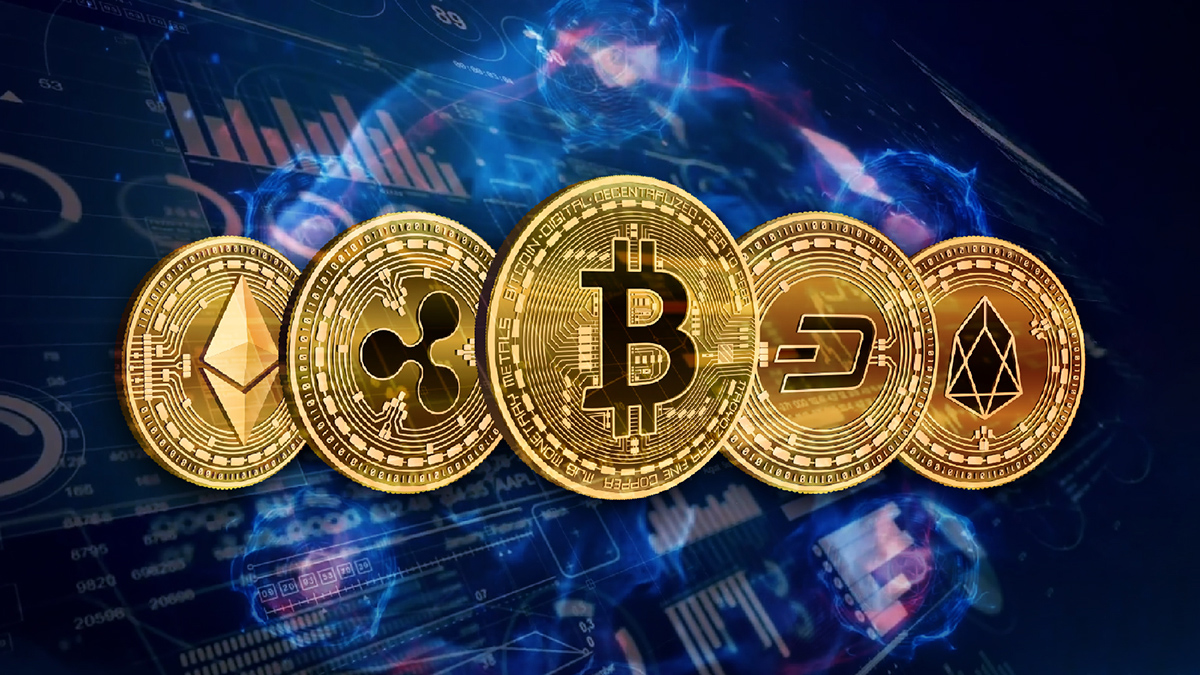

According to the source, the U.S. President Donald Trump has signed an executive order establishing a Strategic Bitcoin Reserve, signaling a historic shift in the government’s stance on Bitcoin. The move has been met with mixed reactions, fueling excitement among Bitcoin advocates while also triggering volatility in the crypto markets.

What Is the Strategic Bitcoin Reserve?

According to the executive order, the U.S. government will build its Bitcoin Reserve using BTC seized from criminal and civil forfeiture cases. This means no taxpayer money will be used to purchase Bitcoin, alleviating concerns about government intervention in the market.

A White House spokesperson explained, “The U.S. must embrace digital assets as part of its financial future. The Strategic Bitcoin Reserve ensures the country maintains a position in the evolving global economy.”

The order also includes the creation of a U.S. Digital Asset Stockpile, which will hold other cryptocurrencies such as Ethereum (ETH), Solana (SOL), Ripple (XRP), and Cardano (ADA).

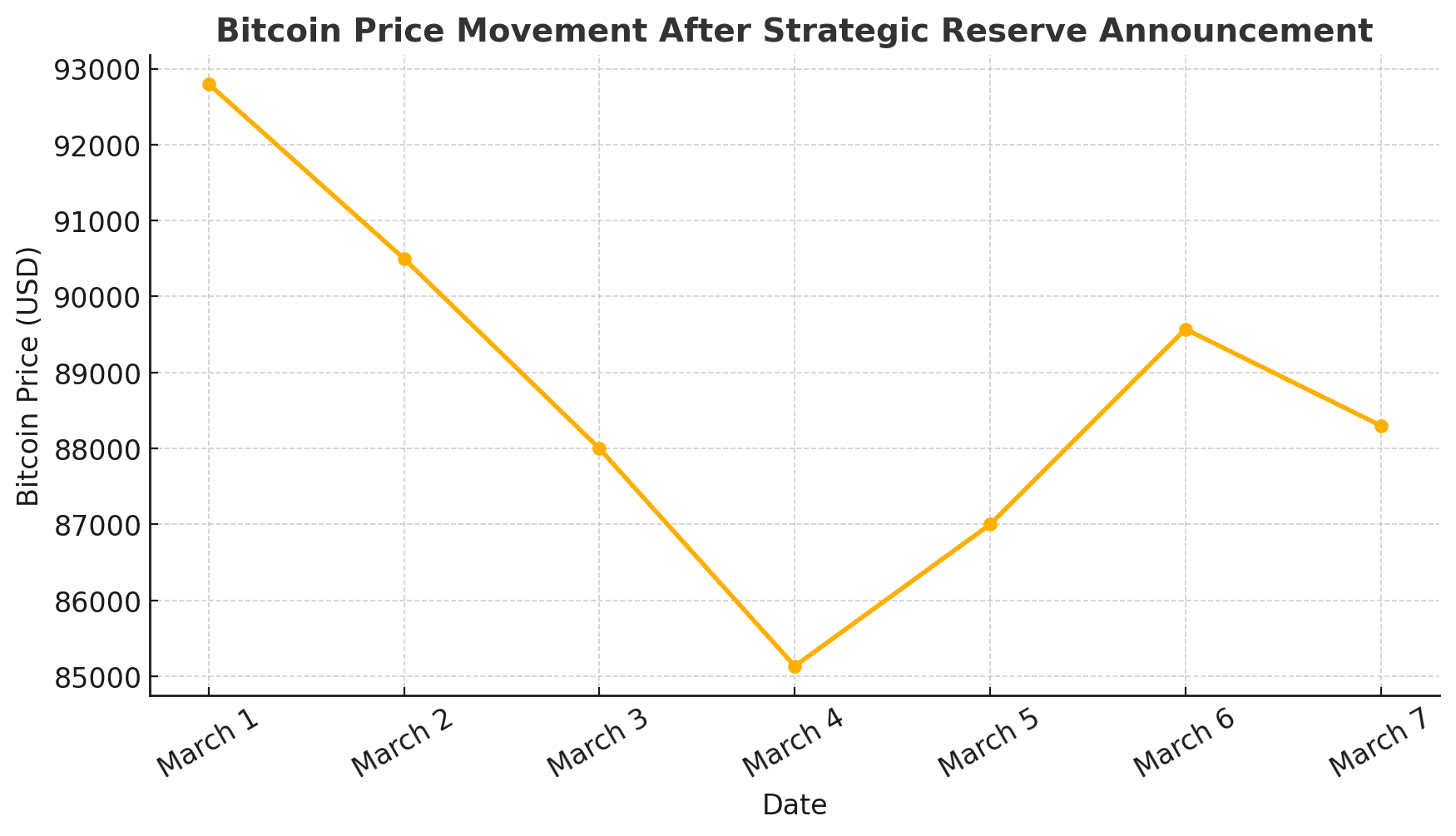

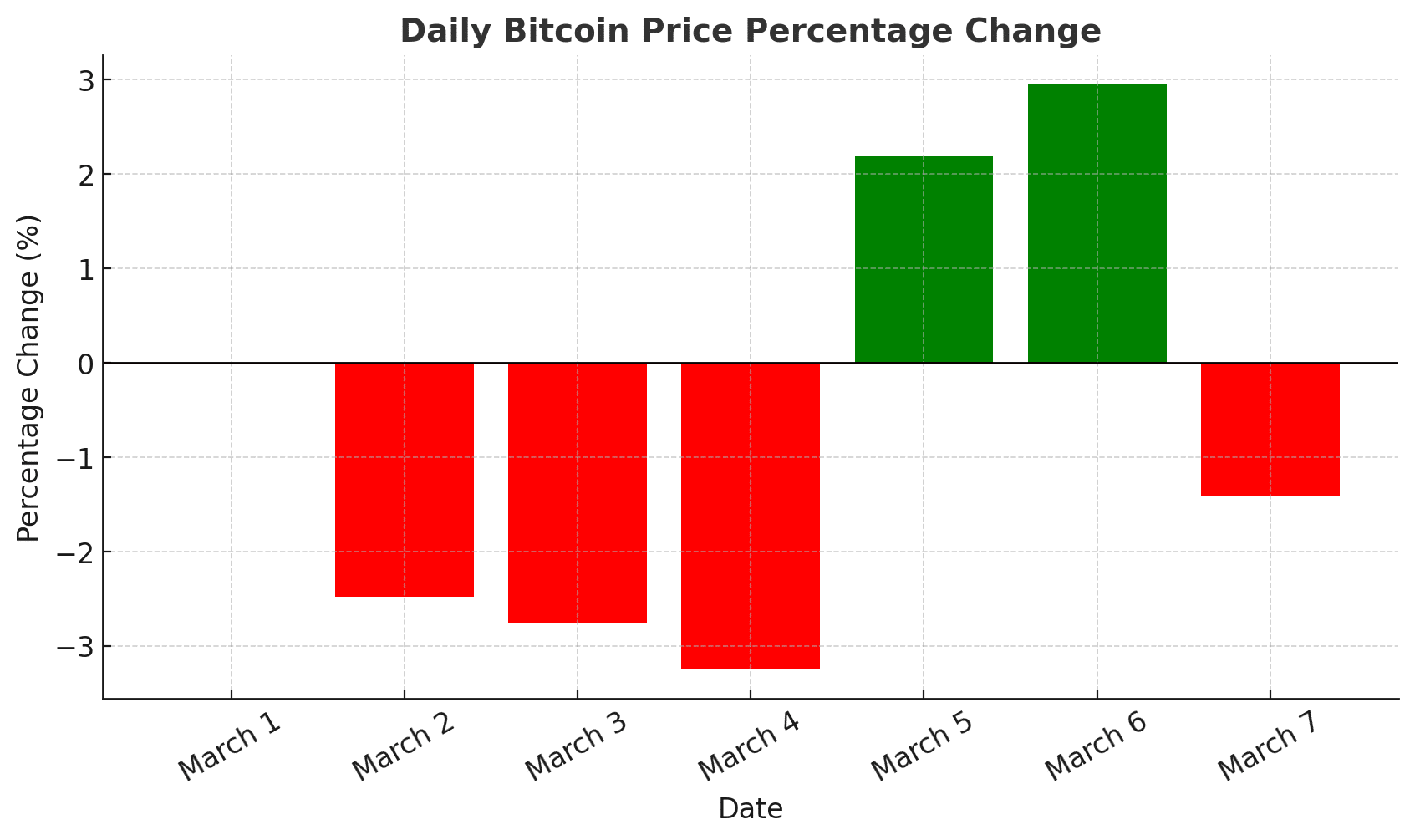

Despite this significant policy shift, Bitcoin’s price has plunged in recent days, leaving many investors questioning: Why is Bitcoin falling if the U.S. government is backing it?

Why Is Bitcoin Price Dropping?

Bitcoin’s price dropped below $90,000, marking a significant correction after reaching new all-time highs earlier this year. The decline is attributed to several key factors:

1. Macroeconomic Concerns

The broader economic landscape is rattling investors, particularly concerns over rising inflation, proposed tariffs, and geopolitical instability. Trump’s aggressive trade policies and potential tariffs have created uncertainty in global markets.

Steven Lubka, Managing Director at Swan Bitcoin, commented, “While the creation of a Bitcoin reserve is a long-term positive, macroeconomic factors are keeping investors cautious. The uncertainty in global markets is causing a short-term selloff.”

2. Security Breach at Bybit

A massive $1.5 billion hack targeting Bybit, one of the largest crypto exchanges, has spooked investors. Large-scale breaches often lead to panic selling and short-term price drops.

3. Record ETF Outflows

Bitcoin Exchange-Traded Funds (ETFs) have been experiencing record outflows, indicating that institutional investors are cashing out profits. Over $1 billion exited Bitcoin ETFs in the last two weeks, adding further selling pressure.

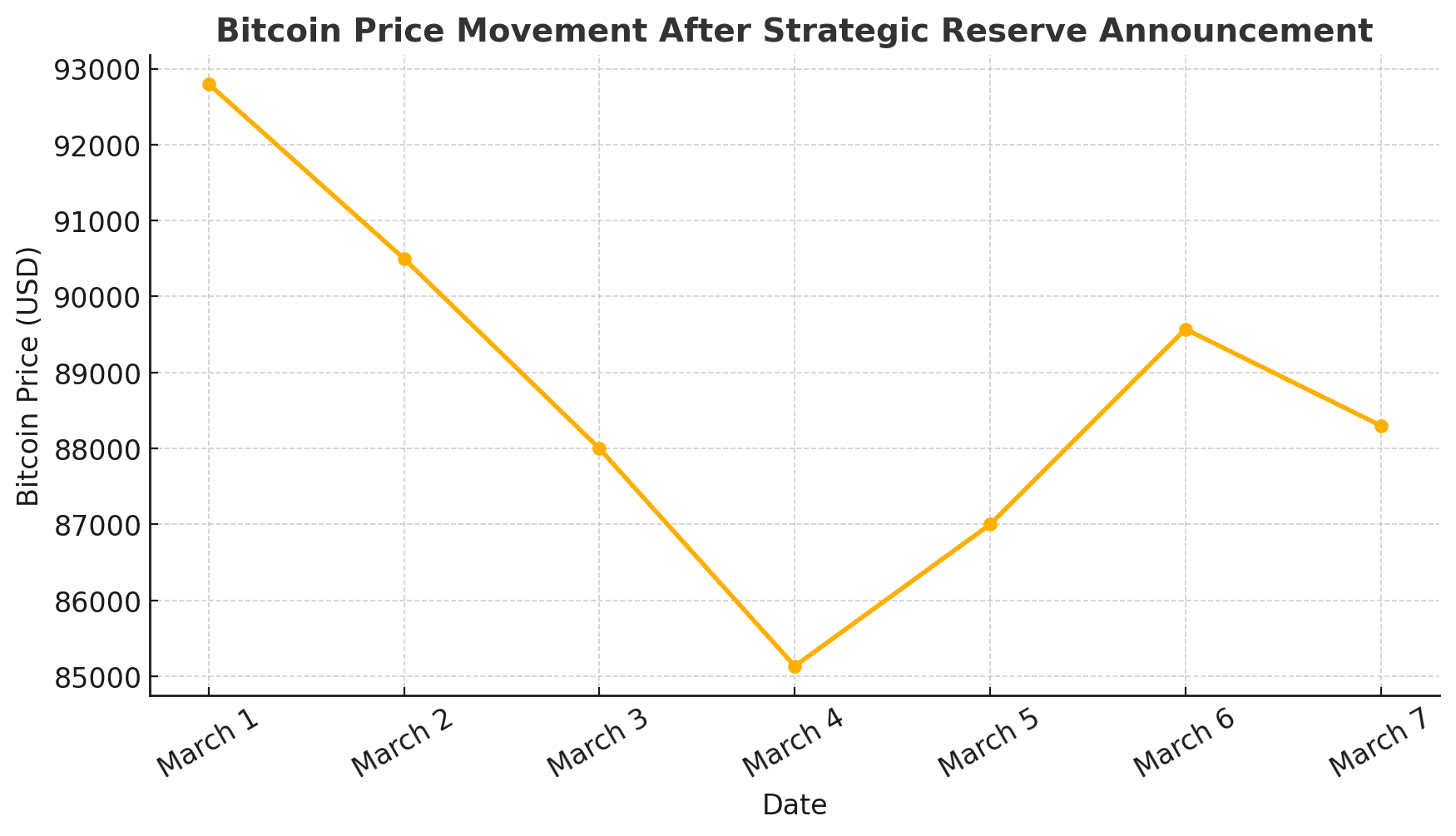

Bitcoin Price Table – Recent Declines

| Date | Bitcoin Price (USD) | Daily Change (%) |

|---|---|---|

| March 1 | $92,800 | – |

| March 2 | $90,500 | -2.48% |

| March 3 | $88,000 | -2.76% |

| March 4 | $85,135 | -3.25% |

| March 5 | $87,000 | +2.19% |

| March 6 | $89,570 | +2.95% |

| March 7 | $88,300 | -1.42% |

Will Bitcoin Recover? What Experts Say

Despite the short-term correction, many analysts believe that the long-term outlook for Bitcoin remains bullish.

-

Marcel Heinrichsmeier, a Crypto Assets Analyst at DZ Bank, stated,

“Bitcoin has faced similar pullbacks in the past. The long-term fundamentals remain strong, especially with institutional adoption rising.”

-

Edward Snowden, cybersecurity expert and Bitcoin advocate, tweeted,

“Governments stacking Bitcoin? If you’re not bullish, you’re not paying attention.”

Market sentiment suggests that Bitcoin could rebound as macroeconomic fears settle and long-term holders accumulate.

Final Thoughts: A Turning Point for Bitcoin?

The establishment of a Strategic Bitcoin Reserve is a historic moment for Bitcoin’s integration into government policy. However, short-term market turbulence has overshadowed the announcement, leading to a selloff driven by macroeconomic uncertainty, security breaches, and ETF outflows.

In the long run, many analysts believe this move could solidify Bitcoin Reserve’s status as a global reserve asset, paving the way for wider adoption. For now, traders and investors will be closely watching price action and macroeconomic signals in the coming weeks.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the Strategic Bitcoin Reserve?

The Strategic Bitcoin Reserve is a U.S. government initiative to hold Bitcoin seized in criminal cases, securing the country’s digital asset future.

Why did Bitcoin’s price drop after the announcement?

Bitcoin’s price fell due to a mix of macroeconomic concerns, a major exchange hack, and institutional investors taking profits.

Will the U.S. government buy Bitcoin with taxpayer money?

No, the government will only use seized Bitcoin from criminal and civil cases, meaning taxpayer funds won’t be used.

What impact will this have on Bitcoin’s future?

In the long term, the move legitimizes Bitcoin Reserve as a strategic asset, but in the short term, it adds uncertainty and price fluctuations.

Glossary

- Bitcoin (BTC) – The world’s largest decentralized digital currency, often seen as digital gold.

- Ethereum (ETH) – A smart contract platform that enables decentralized applications.

- Ripple (XRP) – A digital payment protocol for fast, low-cost cross-border transactions.

- Solana (SOL) – A high-performance blockchain designed for scalability.

- Exchange-Traded Fund (ETF) – A regulated investment vehicle that tracks Bitcoin’s price.

- Macroeconomic Factors – Economic trends such as inflation, trade policies, and interest rates that impact financial markets.

Sources