CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

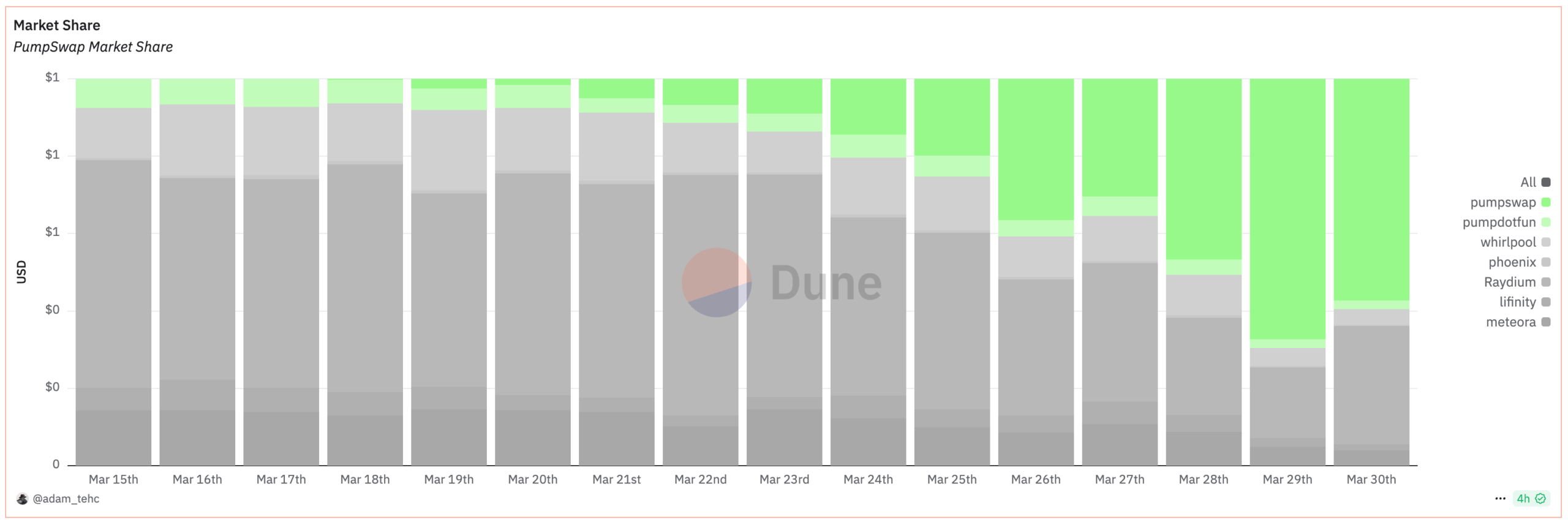

- PumpSwap hit $10B volume in 10 days, disrupting Solana DEX leaders like Raydium by retaining memecoin trading internally.

- Dominating 67.4% of Solana DEX volume, PumpSwap overshadowed Raydium (18.2%), signaling rapid market share redistribution post-launch.

PumpSwap, a new decentralized exchange created by Pump.fun, has crossed $10 billion in total trading volume just ten days after its official launch. This performance has reshaped activity across the Solana decentralized exchange (DEX) sector, directly impacting the share held by established platforms like Raydium, Meteora, and Whirlpool.

The platform went live on March 20, offering users an option to trade memecoins directly through PumpSwap instead of migrating to other exchanges. Previously, most memecoins deployed through Pump.fun would eventually move to Raydium, one of Solana’s largest DEXs by trading volume. But PumpSwap’s debut has shifted that behavior.

According to data compiled by Dune Analytics, PumpSwap handled 67.4% of all volume among Solana-based DEXs on a recent Saturday. In comparison, Raydium processed 18.2%, while no other DEX captured more than 5%. For context, Raydium had previously led the market, handling roughly one-quarter of all DEX transactions on Solana as recently as January.

In just ten days, PumpSwap has generated more than $20 million in protocol fees. From that, liquidity providers earned over $5 million, showing that early activity has not only been high but also financially productive for participants. Moreover, nearly 700,000 wallets have connected to the protocol so far, reflecting broad engagement from individual traders.

While PumpSwap’s growth is evident, volume on Pump.fun itself has begun to slow down. This drop coincides with a broader cooldown in memecoin trading across various platforms. As the trend softens, interest in speculative launches may decline, but the infrastructure built around them continues to expand. Pump.fun has hinted at a potential native token, though no timeline has been officially confirmed.

Meanwhile, Raydium is preparing to launch a competing memecoin platform called LaunchLab. The project appears to be a direct response to Pump.fun’s model. As memecoin interest drove much of the recent Solana activity, exchanges are now adjusting their offerings to compete for this specific segment.

PumpSwap’s entry into the market has reallocated user attention and liquidity in a short period. The performance data shows a redistribution of traffic, particularly away from older exchanges. The team’s strategy—to keep memecoins within its own infrastructure—has, for now, reduced reliance on third-party DEXs.

It remains to be seen whether PumpSwap can maintain this level of volume, especially if memecoin trading drops further. However, the early statistics show that control over trading pipelines can drive large shifts in market positioning. In this case, the decision to integrate a direct trading feature appears to have given Pump.fun a temporary lead in liquidity capture.