10h15 ▪

3

min read ▪ by

Once full of ambitions to dethrone Ethereum, most blockchains today seem to be avoiding uncomfortable comparisons with the Web3 giant. However, two names still emerge in the arena: Ripple and Solana. And the latter is making waves in 2024 with stunning performances, both in total value locked and in crypto trading volumes. Let’s focus on the impressive numbers that reveal why Solana is shaking up the established order.

Solana vs Ethereum: a domination in numbers

With nearly 3.8 billion dollars traded within 24 hours on its DEX platforms, Solana far surpasses Ethereum (1.7 billion) and Base (1.2 billion) combined. The rising star of Web3 doesn’t do things by halves, although it worries its founders: its total value locked (TVL) has increased from 1.4 billion to 9.5 billion dollars in one year, which is a fivefold increase, according to DefiLlama.

Some key highlights:

- The DEX Raydium on Solana saw its monthly volumes reach 30 billion dollars, surpassing Uniswap in November;

- Memecoins represent up to 65% of Raydium’s monthly volume;

- In just 30 days, the Pump.fun platform generated 250 million dollars in volumes.

As highlighted by Aylo on X:

“Solana has regained a DEX volume greater than that of Ethereum and Base combined.”

A performance that reflects its central role in the memecoins sector and AI agent tokens.

Why crypto traders love Solana

The success of Solana can be explained by a well-oiled recipe: low fees, fast execution, and an active community. Traders looking for explosive profits flock to memecoins and AI-related tokens, two sectors where Solana excels.

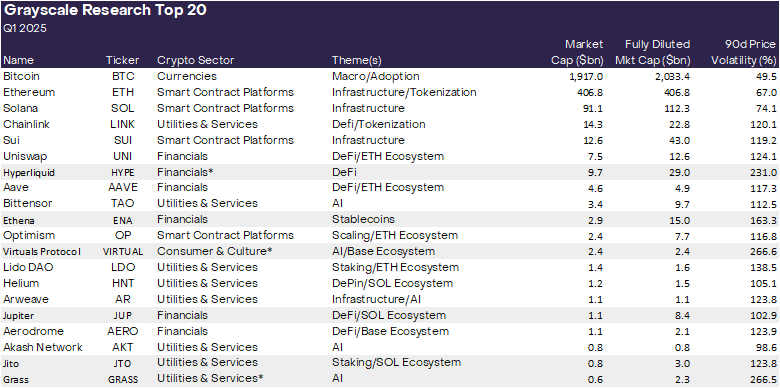

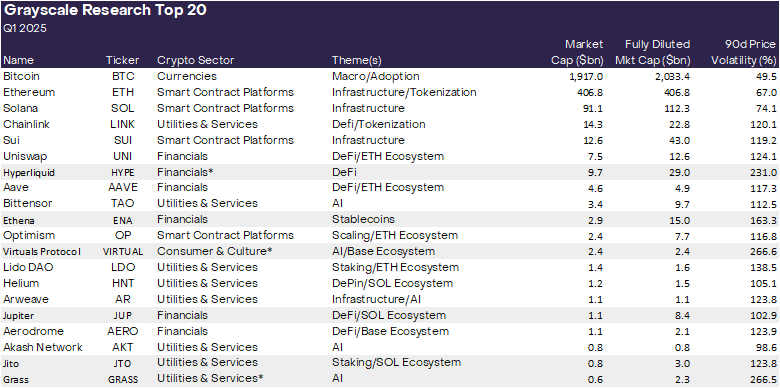

Grayscale Research notes that “speculations surrounding memecoins and AI agent tokens” attract new investors to the Solana ecosystem.

Raydium, with its 60% market share on Solana, embodies this dominance. Although competition with Ethereum remains fierce, Solana is leveraging its rise to attract investors weary of Ethereum’s limitations.

Moreover, its diverse ecosystem encourages innovation, whether in DeFi or beyond.

But Solana doesn’t just shine with its numbers: it innovates. With its unprecedented shield that will allow it to be untouchable against the quantum threat, this blockchain establishes itself as a key player in Web3, ready to challenge anyone who dares to step on its turf.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.