The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) continues to cast a long shadow over Ripple’s operations. As a crucial deadline looms on January 15, this case has already reshaped the crypto landscape in ways that are hard to quantify. Let’s dive into the latest updates and what’s at stake for Ripple and the broader cryptocurrency market.

Ripple’s Early Days and the SEC Lawsuit’s Impact

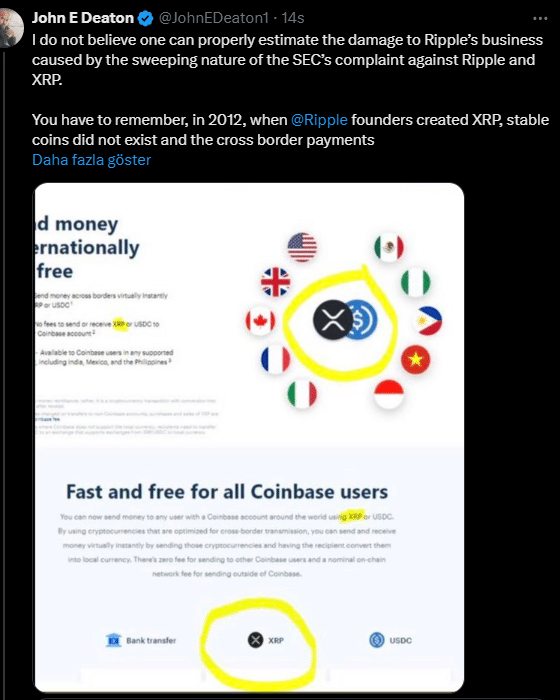

Attorney and XRP advocate John Deaton has highlighted how the SEC’s lawsuit has severely affected Ripple’s business. Back in 2012, Ripple’s founders launched XRP in a market devoid of stablecoins and primed for cross-border payment innovations. Ripple’s decision to focus on cross-border payments over smart contracts was seen as logical, given the lack of competition in this niche.

By 2019, Ripple’s efforts bore fruit. Major platforms like Coinbase listed XRP, while MoneyGram adopted it for fast and cost-effective international transfers. However, just 18 months later, the SEC filed a lawsuit alleging that XRP, regardless of how it was acquired, constituted an unregistered security. This lawsuit led to Coinbase delisting XRP and MoneyGram pivoting to XLM for its payment solutions.

XRP vs. XLM: Legal Distinctions?

The SEC’s case raised a critical question: Is there a legal difference between using XRP and XLM for payments? Interestingly, XLM’s creator, Jed McCaleb, is also a co-founder of Ripple. Deaton argues that the SEC’s actions against Ripple were overly broad and riddled with conflicts of interest, pointing out that some individuals behind the lawsuit later worked for Ripple’s competitors.

Key Developments Leading Up to January 15

Ripple’s legal journey has seen pivotal moments, including a significant ruling on July 13, 2023, when Judge Analisa Torres declared XRP not to be a security. However, the SEC appealed parts of this decision on October 17, 2023, keeping the case alive. The next major milestone is January 15, 2025, when the SEC is required to submit its opening brief, ensuring the case remains in the public eye.

Final Thoughts

The Ripple-SEC case has had far-reaching implications for both Ripple and the crypto industry at large. With the January 15 deadline approaching, the stakes couldn’t be higher. The outcome could redefine how digital assets are classified and regulated in the U.S., setting a precedent for years to come. For readers of The Bit Journal, staying informed about this case is crucial for understanding the evolving regulatory landscape.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!