CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Ripple made a $50 million financial commitment to the U.S. Securities and Exchange Commission SEC to end their prolonged court battle. Following the settlement Ripple decided to remove its cross-appeal from the suit which put an end to the four-year-long legal battle. Part of the agreement stipulates that the SEC should seek court permission to lift the ban which stops Institutional organizations from trading XRP.

The court previous ruling favoring Ripple regarding its XRP retail sales had shifted the case to its current appeal phase. Ripple moves toward closing its legal battle because this action seeks to create stability in its commercial operations. Finally the process requires official court rules as well as SEC approval before conclusion.

This agreement has reduced Ripple’s penalty, which the SEC originally planned for $125 million while setting a precedent for the entire crypto industry. Ripple faces less legal uncertainty now, and it plans to concentrate on worldwide business development and strategic market investments. Through this resolution, the U.S. securities laws gain clarity on how to handle digital assets.

Ripple Finalizes Legal Dispute with the SEC

Ripple confirmed the lawsuit’s end after both parties agreed to withdraw their respective appeals from the court. Ripple’s Chief Legal Officer Stuart Alderoty stated that the matter is now fully resolved, pending standard court formalities. The SEC will retain $50 million from the escrow account, and the remaining amount will return to Ripple.

Judge Analisa Torres previously ruled that Ripple’s XRP sales on exchanges did not breach securities laws, but institutional sales did. The settlement acknowledges this mixed ruling while avoiding a prolonged appeal process. The SEC has now agreed to lift the injunction restricting XRP sales to institutional investors.

This outcome is seen as favorable for Ripple, which maintained throughout the case that XRP is not a security. The company now aims to grow its footprint in markets with clear regulatory frameworks. Ripple believes this development supports the larger goal of advancing the cryptocurrency ecosystem.

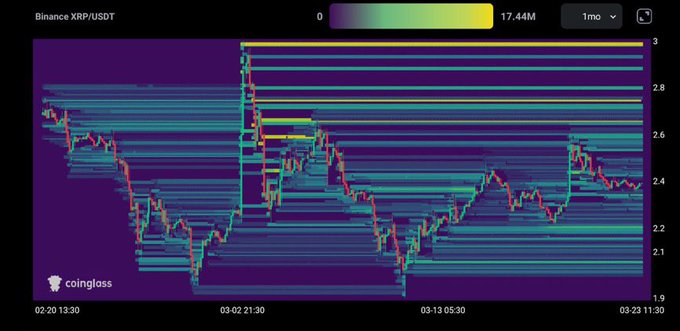

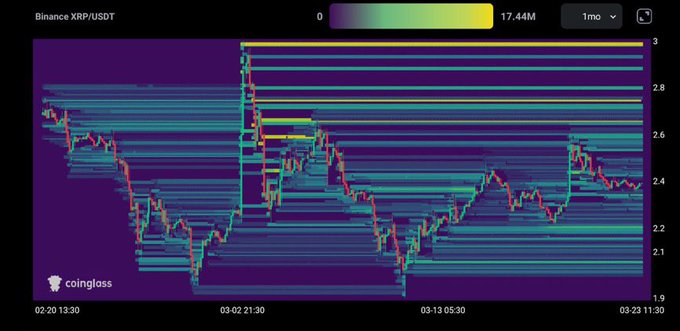

XRP Market Reacts to Positive Legal Development

XRP price maintains a trading price of $2.47 while reporting a 1.08% growth during the previous day. The settlement agreement produces positive market responses from investors because it decreases significant legal ambiguities in the space. At present, XRP maintains a market valuation of $142.87 billion and its 24-hour trading volume reaches $5.50 billion.

Market analysts note that XRP bears a crucial resistance threshold at $2.60 that may launch a new price break. According to market analysis, the token formed a well-defined bullish structure because it absorbed existing sell-order liquidity. After breaking through its current resistance of $2.60, XRP has the potential to rise to $2.9990 and $3.4000.

Prominent analysts such as Crypto Patel highlight $2.2220 as a significant bullish order block.

The level sees growing institutional interest that might function as the primary entry point for holding XRP for an extended period. The continued rally momentum makes XRP likely to achieve additional gains throughout the coming period.

FAQs

Why did Ripple agree to settle the case with the SEC?

Ripple chose to settle in order to end the prolonged legal battle and reduce the financial penalty.

What does the settlement mean for XRP’s institutional sales?

The SEC will request the court to lift the injunction, allowing Ripple to resume XRP institutional sales.

How does this impact Ripple’s future plans?

Ripple plans to focus on international growth and continue investing in crypto-related projects.

Is the legal case fully closed now?

Yes, the case will conclude officially after the SEC vote and final court procedures are completed.

How has XRP’s price reacted to the news?

XRP has seen a positive price movement, signaling increased investor confidence after the settlement announcement.

Glossary

SEC (U.S. Securities and Exchange Commission): The U.S. regulatory agency enforcing securities laws.

XRP: A digital currency created by Ripple Labs that is used for real-time cross-border transactions.

Institutional Sales: Token sales to investment firms, hedge funds, or accredited investors.

Injunction: A court order restricting a party’s specific actions, such as Ripple’s XRP sales.

Order Block (OB): A price level where institutions place large orders, often used in technical analysis.

Howey Test: A legal test used in the U.S. to determine whether a transaction qualifies as an investment contract.

Bullish Structure: A market pattern that signals potential upward price movement.

Liquidity Sweep: A market event where prices move to trigger stop-loss orders, often followed by a reversal.

Market Cap: The total value of a cryptocurrency, calculated by multiplying its price by circulating supply.

Appeal Phase: A stage in a legal process where a party requests a higher court to review a lower court’s decision.